Emergence of Edge Computing

The rise of edge computing is reshaping the landscape of the internet of-things-testing market. By processing data closer to the source, edge computing reduces latency and enhances the performance of IoT applications. As of 2025, it is estimated that over 40% of IoT data will be processed at the edge, necessitating new testing methodologies to evaluate the performance and reliability of edge-enabled devices. This shift presents both challenges and opportunities for the internet of-things-testing market, as companies must adapt their testing strategies to accommodate the unique characteristics of edge computing environments. The demand for specialized testing services in this area is expected to grow, reflecting the broader trend towards decentralized computing.

Increased Regulatory Scrutiny

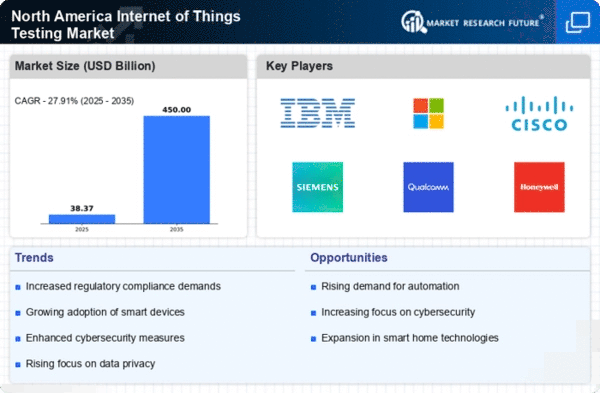

Regulatory bodies in North America are intensifying their scrutiny of IoT devices, which is driving demand for testing services in the internet of-things-testing market. Compliance with standards such as the Federal Communications Commission (FCC) regulations and the National Institute of Standards and Technology (NIST) guidelines is becoming increasingly critical for manufacturers. In 2025, it is anticipated that over 70% of IoT devices will require some form of regulatory compliance testing before market entry. This trend compels companies to invest in robust testing frameworks to ensure adherence to these regulations, thereby enhancing the credibility and safety of their products. The internet of-things-testing market is thus experiencing growth as organizations prioritize compliance to mitigate risks associated with non-compliance.

Growing Cybersecurity Concerns

As the number of connected devices increases, so do the cybersecurity threats associated with them. The internet of-things-testing market is being driven by the urgent need for enhanced security testing protocols. In 2025, it is projected that cyberattacks targeting IoT devices will rise by 30%, prompting manufacturers to prioritize security in their testing processes. This heightened focus on cybersecurity necessitates the development of specialized testing services that can identify vulnerabilities and ensure robust protection against potential threats. The internet of-things-testing market is thus likely to expand as organizations seek to fortify their devices against an increasingly hostile cyber landscape.

Rising Demand for Smart Devices

The proliferation of smart devices in North America is a primary driver for the internet of-things-testing market. As consumers increasingly adopt smart home technologies, wearables, and connected appliances, the need for rigorous testing becomes paramount. In 2025, the smart home market alone is projected to reach approximately $80 billion, indicating a robust growth trajectory. This surge necessitates comprehensive testing solutions to ensure device interoperability, security, and performance. Consequently, companies are investing heavily in testing services to meet consumer expectations and regulatory requirements. The internet of-things-testing market is thus positioned to benefit from this rising demand, as manufacturers seek to validate their products against a backdrop of diverse and evolving consumer needs.

Advancements in Connectivity Technologies

The evolution of connectivity technologies, such as 5G and Wi-Fi 6, is significantly impacting the internet of-things-testing market. These advancements enable faster data transmission and improved device communication, which are critical for the functionality of IoT devices. As of 2025, it is estimated that 5G networks will cover over 50% of the North American population, facilitating the deployment of more sophisticated IoT applications. This rapid expansion creates a pressing need for testing services that can evaluate the performance and reliability of devices operating on these new networks. The internet of-things-testing market must adapt to these technological changes, ensuring that testing methodologies evolve in tandem with connectivity advancements.