Growing Aging Population

The growing aging population in South America is a significant driver for the internet of-things-in-healthcare market. As the demographic landscape shifts, the demand for healthcare services tailored to older adults is increasing. By 2030, it is estimated that over 15% of the population in South America will be aged 65 and older. This demographic shift necessitates the implementation of IoT solutions to manage chronic conditions and enhance the quality of life for seniors. Technologies such as smart home devices and wearable health monitors are becoming vital in providing personalized care. Consequently, the internet of-things-in-healthcare market is expected to expand as healthcare providers seek innovative ways to cater to this growing segment.

Government Initiatives and Funding

Government initiatives and funding play a crucial role in propelling the internet of-things-in-healthcare market. In South America, various governments are increasingly investing in digital health technologies to improve healthcare delivery. For instance, initiatives aimed at enhancing telemedicine infrastructure and promoting the use of IoT devices in hospitals are gaining traction. Reports indicate that public funding for health technology in the region could reach $1 billion by 2026, significantly impacting the adoption of IoT solutions. These investments not only facilitate the integration of advanced technologies but also encourage private sector participation, thereby fostering innovation within the internet of-things-in-healthcare market.

Increased Focus on Healthcare Efficiency

An increased focus on healthcare efficiency is driving the internet of-things-in-healthcare market in South America. Healthcare organizations are under pressure to optimize operations and reduce costs while maintaining high-quality care. IoT technologies facilitate real-time data collection and analysis, enabling providers to streamline processes and improve resource allocation. For instance, hospitals utilizing IoT solutions can monitor equipment usage and patient flow, leading to enhanced operational efficiency. It is estimated that implementing IoT technologies could reduce operational costs by up to 20% in healthcare settings. This emphasis on efficiency is likely to propel the adoption of IoT solutions within the internet of-things-in-healthcare market.

Rising Demand for Remote Patient Monitoring

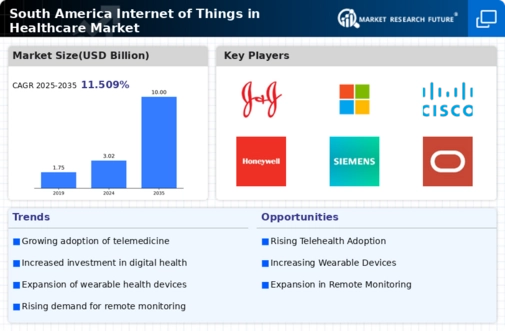

The increasing demand for remote patient monitoring is a pivotal driver in the internet of-things-in-healthcare market. As healthcare providers seek to enhance patient outcomes while reducing costs, remote monitoring solutions are becoming essential. In South America, the market for remote patient monitoring devices is projected to grow at a CAGR of approximately 25% from 2025 to 2030. This growth is fueled by the need for continuous health tracking, especially for chronic disease management. Patients benefit from real-time data sharing with healthcare professionals, which can lead to timely interventions. Consequently, the internet of-things-in-healthcare market is likely to expand as more healthcare facilities adopt these technologies to improve patient care and operational efficiency.

Rising Health Awareness and Preventive Care

Rising health awareness and a shift towards preventive care are emerging as key drivers in the internet of-things-in-healthcare market. South American consumers are increasingly prioritizing health and wellness, leading to a greater demand for preventive healthcare solutions. This trend is reflected in the growing popularity of health monitoring devices and applications that empower individuals to take charge of their health. The market for health and wellness IoT devices is projected to grow by 30% annually, as more people seek to monitor their health metrics proactively. This shift towards preventive care not only enhances individual health outcomes but also reduces the burden on healthcare systems, thereby fostering growth in the internet of-things-in-healthcare market.