Rising Demand for Smart Devices

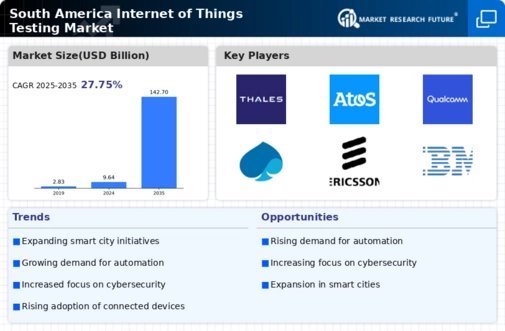

The proliferation of smart devices in South America is driving the internet of-things-testing market. As consumers increasingly adopt smart home technologies, wearables, and connected appliances, the need for rigorous testing becomes paramount. In 2025, the market for smart devices in the region is projected to reach approximately $15 billion, indicating a robust growth trajectory. This surge necessitates comprehensive testing solutions to ensure device reliability, security, and performance. Consequently, companies are investing in advanced testing methodologies to address the unique challenges posed by diverse device ecosystems. The internet of-things-testing market is thus positioned to benefit from this growing demand, as organizations seek to validate the functionality and interoperability of their products in a competitive landscape.

Consumer Awareness and Education

As consumer awareness regarding the benefits and risks of IoT devices grows, the internet of-things-testing market is experiencing a corresponding increase in demand for testing services. South American consumers are becoming more informed about the importance of security and performance in their connected devices. This heightened awareness is prompting manufacturers to prioritize testing to build trust and credibility in their products. In 2025, it is anticipated that consumer-driven testing requirements will influence over 30% of product development strategies in the region. Consequently, the internet of-things-testing market is adapting to these changing consumer expectations, leading to the development of more comprehensive testing protocols that address security vulnerabilities and performance issues.

Growth of Industrial IoT Applications

The expansion of industrial IoT applications in South America is a key driver for the internet of-things-testing market. Industries such as manufacturing, agriculture, and logistics are increasingly adopting IoT solutions to enhance operational efficiency and reduce costs. In 2025, the industrial IoT market in the region is projected to exceed $10 billion, highlighting the potential for growth. This trend necessitates robust testing frameworks to ensure the reliability and security of IoT systems deployed in critical environments. The internet of-things-testing market is thus likely to see increased investment in testing services tailored to industrial applications, as organizations seek to mitigate risks associated with system failures and data breaches.

Government Initiatives and Regulations

Government initiatives aimed at promoting digital transformation in South America are significantly impacting the internet of-things-testing market. Regulatory bodies are increasingly establishing standards and guidelines to ensure the safety and security of connected devices. For instance, the implementation of data protection laws and IoT-specific regulations is compelling manufacturers to prioritize testing and compliance. In 2025, it is estimated that compliance-related expenditures in the region will account for over 20% of total testing budgets. This regulatory environment fosters a greater emphasis on quality assurance and testing, driving demand for specialized services within the internet of-things-testing market. As a result, companies are compelled to enhance their testing capabilities to meet these evolving requirements.

Technological Advancements in Testing Tools

Technological advancements in testing tools and methodologies are significantly shaping the internet of-things-testing market in South America. The emergence of automated testing solutions, AI-driven analytics, and cloud-based testing platforms is enhancing the efficiency and effectiveness of testing processes. In 2025, it is projected that the adoption of automation in testing will increase by over 40%, streamlining workflows and reducing time-to-market for IoT products. These innovations enable organizations to conduct more thorough testing, ensuring that devices meet the necessary standards for performance and security. The internet of-things-testing market is thus likely to benefit from these advancements, as companies seek to leverage cutting-edge technologies to improve their testing capabilities.