Increased Focus on Cost Efficiency

Cost efficiency emerges as a significant driver in the online meeting-software market in North America. Organizations are increasingly scrutinizing their operational expenses, leading to a preference for software solutions that offer value without compromising quality. A recent survey revealed that 55% of businesses prioritize cost-effective meeting solutions, prompting software providers to develop competitive pricing models. This trend encourages the emergence of subscription-based services, which allow companies to scale their usage according to their needs. As a result, the online meeting-software market is likely to witness a shift towards more affordable options, enabling a broader range of organizations to access essential communication tools. This focus on cost efficiency may also stimulate innovation, as providers seek to deliver high-quality services at lower price points.

Growing Importance of User Experience

User experience (UX) has become a pivotal factor influencing the online meeting-software market in North America. As users demand intuitive interfaces and seamless navigation, software developers are increasingly prioritizing UX design in their offerings. Research indicates that 75% of users are more likely to continue using a platform that provides a positive experience. This trend compels companies to invest in user-centric design principles, ensuring that their software is accessible and easy to use. The online meeting-software market thus faces pressure to enhance UX, as organizations recognize that a superior experience can lead to higher engagement and productivity. Consequently, software providers that successfully address UX concerns may gain a competitive edge in a crowded marketplace.

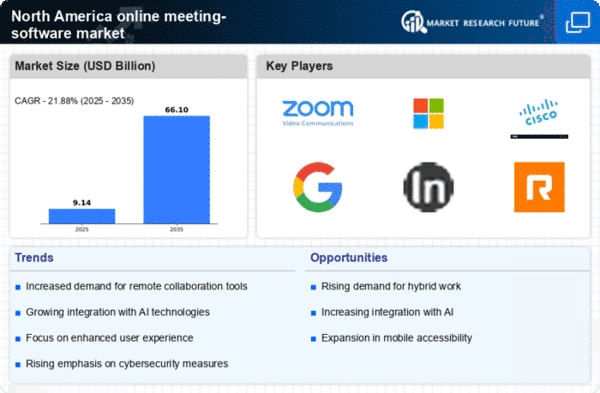

Rising Demand for Remote Collaboration

The online meeting-software market in North America experiences a notable surge in demand for remote collaboration tools. As organizations increasingly adopt hybrid work models, the need for effective communication solutions becomes paramount. According to recent data, approximately 70% of companies in North America have implemented remote work policies, driving the adoption of online meeting software. This shift necessitates platforms that facilitate seamless interactions among team members, regardless of their physical location. Consequently, software providers are compelled to enhance their offerings, ensuring they meet the evolving needs of businesses. The online meeting-software market is thus positioned for growth, as companies seek to optimize productivity and maintain connectivity in a dispersed work environment.

Regulatory Compliance and Data Privacy Concerns

Regulatory compliance and data privacy concerns significantly impact the online meeting-software market in North America. With increasing scrutiny on data protection laws, organizations are compelled to adopt software solutions that adhere to stringent compliance standards. Approximately 65% of businesses report that compliance with regulations such as GDPR and CCPA is a top priority when selecting meeting software. This trend drives software providers to implement robust security measures and transparent data handling practices. As a result, the online meeting-software market is likely to see a rise in demand for solutions that not only facilitate communication but also ensure the protection of sensitive information. Companies that prioritize compliance may enhance their reputation and build trust with users, further driving market growth.

Technological Advancements in Software Features

Technological advancements play a crucial role in shaping the online meeting-software market in North America. Innovations such as high-definition video conferencing, real-time collaboration tools, and integrated project management features are becoming standard expectations among users. Data indicates that 60% of users prioritize software that offers advanced functionalities, which enhances their meeting experiences. As competition intensifies, software developers are likely to invest in research and development to introduce cutting-edge features that cater to user preferences. This trend not only improves user satisfaction but also drives market growth, as organizations are more inclined to adopt solutions that offer superior capabilities. The online meeting-software market thus benefits from continuous technological evolution, which aligns with the demands of modern workplaces.