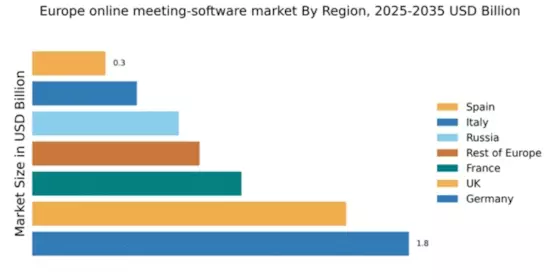

Germany : Strong Demand and Infrastructure Growth

Germany holds a commanding market share of 1.8 in the online meeting software sector, driven by robust demand for remote collaboration tools. Key growth drivers include a strong emphasis on digital transformation, government initiatives promoting remote work, and a well-developed IT infrastructure. The increasing adoption of cloud-based solutions and regulatory support for data protection further enhance market dynamics, making it a fertile ground for innovation and investment.

UK : Innovation and User-Centric Solutions

Key markets include London, Manchester, and Birmingham, where major players like Microsoft and Zoom have established a strong presence. The competitive landscape is vibrant, with numerous startups and established firms vying for market share. The business environment is conducive to innovation, particularly in sectors like education and finance, where online meetings are increasingly integrated into daily operations.

France : Growth Driven by Innovation and Demand

Paris, Lyon, and Marseille are key markets where major players like Cisco and Microsoft are actively competing. The competitive landscape is marked by a mix of established firms and innovative startups, creating a dynamic business environment. Sectors such as education, healthcare, and corporate services are increasingly relying on online meeting solutions, further driving market growth.

Russia : Market Potential in Digital Solutions

Moscow and St. Petersburg are pivotal markets where major players like Zoom and TeamViewer are gaining traction. The competitive landscape is evolving, with both local and international firms vying for market share. The business environment is complex, influenced by regulatory policies and local preferences, particularly in sectors like education and government services, which are increasingly adopting online meeting solutions.

Italy : Digital Transformation in Focus

Key markets include Milan, Rome, and Turin, where major players like Microsoft and Cisco are establishing a strong foothold. The competitive landscape features a mix of established companies and emerging startups, fostering a dynamic business environment. Sectors such as finance, education, and healthcare are increasingly integrating online meeting solutions into their operations, further propelling market growth.

Spain : Focus on User Experience and Security

Madrid and Barcelona are key markets where major players like Zoom and Microsoft are actively competing. The competitive landscape is characterized by a mix of local and international firms, creating a vibrant business environment. Sectors such as tourism, education, and corporate services are increasingly adopting online meeting solutions, further driving market growth and innovation.

Rest of Europe : Regional Growth and Innovation Trends

Key markets include the Nordic countries and Eastern Europe, where major players like Cisco and LogMeIn are establishing a presence. The competitive landscape varies significantly across regions, influenced by local preferences and regulatory environments. Sectors such as education, healthcare, and corporate services are increasingly integrating online meeting solutions, driving market growth and innovation.