Focus on Cost Efficiency

Cost efficiency remains a pivotal concern for businesses in South America, driving the online meeting-software market. Organizations are increasingly recognizing the financial benefits of virtual meetings over traditional face-to-face interactions. By reducing travel expenses and minimizing time away from work, companies can allocate resources more effectively. In 2025, it is estimated that businesses could save up to $500 million collectively by adopting online meeting solutions. This financial incentive is compelling, particularly for small and medium-sized enterprises (SMEs) that are looking to optimize their operational costs. As a result, the online meeting-software market is likely to see a surge in adoption as firms prioritize budget-friendly communication alternatives.

Growing Remote Workforce

The rise of remote work in South America has catalyzed the demand for online meeting-software market solutions. As organizations adapt to flexible work arrangements, the need for effective communication tools has surged. In 2025, it is estimated that around 30% of the workforce in major South American economies will be working remotely, necessitating reliable platforms for collaboration. This shift not only enhances productivity but also fosters a culture of inclusivity, allowing teams to connect seamlessly regardless of their physical location. Consequently, the online meeting-software market is experiencing robust growth, with projections indicating a compound annual growth rate (CAGR) of approximately 15% over the next five years. Companies are increasingly investing in these technologies to maintain operational efficiency and employee engagement.

Technological Advancements

The online meeting-software market in South America is significantly influenced by rapid technological advancements. Innovations in artificial intelligence (AI) and machine learning are enhancing user experiences, making virtual meetings more interactive and efficient. Features such as real-time language translation and automated transcription are becoming standard, catering to diverse linguistic backgrounds in the region. Furthermore, the integration of augmented reality (AR) and virtual reality (VR) into meeting platforms is expected to revolutionize how businesses conduct virtual interactions. As of 2025, it is projected that 40% of companies in South America will adopt these advanced features, thereby increasing the overall market value. This trend indicates a shift towards more immersive and engaging online meeting experiences, positioning the industry for sustained growth.

Increased Internet Penetration

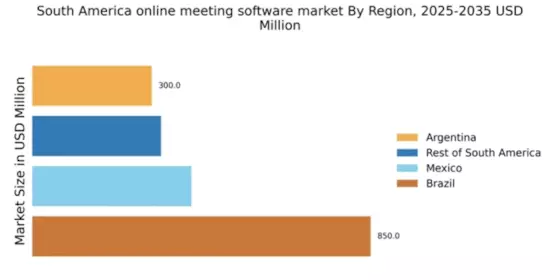

The expansion of internet access across South America is a crucial driver for the online meeting-software market. With internet penetration rates reaching approximately 75% in urban areas, more individuals and businesses are able to utilize online meeting tools. This accessibility is particularly vital in countries like Brazil and Argentina, where digital transformation initiatives are underway. As connectivity improves, the demand for reliable and user-friendly meeting software is likely to rise. In 2025, it is anticipated that the number of users engaging in online meetings will increase by 25%, further propelling market growth. The online meeting-software market is thus positioned to benefit from this trend, as more organizations seek to leverage technology for effective communication.

Rising Demand for Collaboration Tools

The online meeting-software market is experiencing a notable increase in demand for collaboration tools in South America. As businesses strive for enhanced teamwork and project management, the need for integrated solutions that facilitate real-time collaboration is becoming paramount. In 2025, it is projected that 60% of organizations will prioritize the implementation of collaborative software to improve workflow efficiency. This trend is particularly evident in sectors such as education and technology, where teams require seamless communication channels. The online meeting-software market is thus poised for growth, as companies seek to adopt platforms that not only support meetings but also enhance overall collaboration and productivity.