Regulatory Support for Waste Management

The used cooking-oil market in North America benefits from increasing regulatory support aimed at waste management and environmental sustainability. Governments are implementing stricter regulations on waste disposal, which encourages the recycling of used cooking oil. This regulatory framework not only promotes responsible waste management but also incentivizes businesses to participate in the collection and processing of used cooking oil. For instance, various states have introduced programs that provide financial assistance to companies that recycle used cooking oil, thereby enhancing the market's growth potential. The market is projected to expand as more businesses comply with these regulations, leading to an increase in the supply of used cooking oil for biodiesel production and other applications.

Growing Awareness of Environmental Impact

There is a notable increase in public awareness regarding the environmental impact of waste cooking oil, which is driving the used cooking-oil market in North America. Consumers and businesses alike are becoming more conscious of their ecological footprint, leading to a shift towards sustainable practices. This heightened awareness is fostering a demand for recycled products, including biodiesel derived from used cooking oil. According to recent studies, approximately 70% of consumers express a preference for products made from recycled materials, which is likely to boost the market for used cooking oil. As environmental concerns continue to rise, the industry is expected to see a significant uptick in demand for sustainable alternatives.

Rising Demand for Renewable Energy Sources

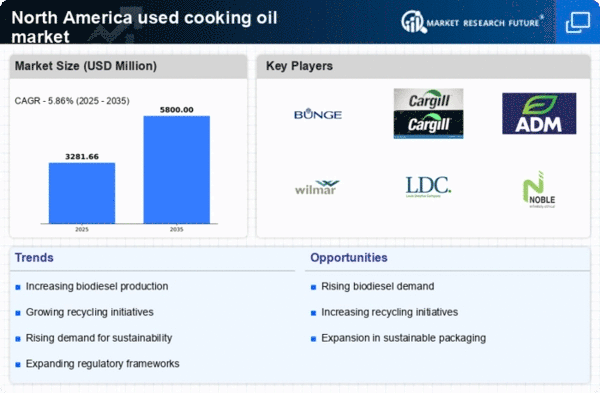

The increasing demand for renewable energy sources is a significant driver for the used cooking-oil market in North America. As governments and organizations strive to meet renewable energy targets, the need for biodiesel, which can be produced from used cooking oil, is on the rise. The U.S. Energy Information Administration reports that biodiesel production has grown by over 20% in recent years, indicating a robust market for used cooking oil as a feedstock. This trend is expected to continue as more states implement policies promoting renewable energy, thereby creating a favorable environment for the used cooking-oil market to thrive.

Technological Advancements in Oil Recycling

The used cooking-oil market is experiencing a transformation due to technological advancements in oil recycling processes. Innovations in filtration and purification technologies are enhancing the efficiency of converting used cooking oil into biodiesel and other valuable products. These advancements not only improve the quality of the end products but also reduce operational costs for recycling facilities. For example, new methods can increase oil recovery rates by up to 30%, making the recycling process more economically viable. As these technologies become more widely adopted, the market is likely to expand, attracting more players and increasing competition within the industry.

Economic Incentives for Recycling Initiatives

Economic incentives play a crucial role in shaping the used cooking-oil market in North America. Various state and federal programs offer financial benefits to businesses that engage in recycling initiatives, including the collection and processing of used cooking oil. These incentives can take the form of tax credits, grants, or subsidies, which lower the financial barriers for companies looking to enter the market. As a result, more businesses are likely to invest in recycling operations, leading to an increase in the availability of used cooking oil for biodiesel production. This trend not only supports the growth of the market but also contributes to a circular economy.