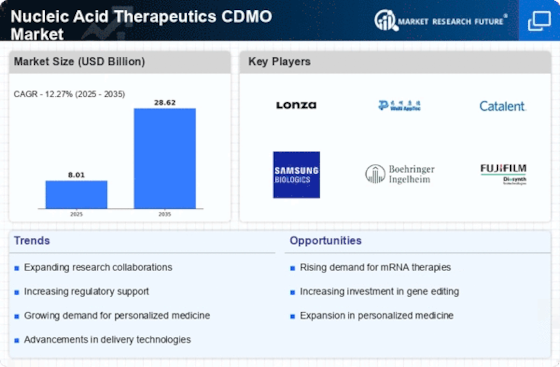

Growing Investment in Biotechnology

The Nucleic Acid Therapeutics CDMO Market is experiencing a surge in investment, particularly from venture capital and private equity firms. This influx of capital is primarily directed towards research and development of innovative nucleic acid-based therapies, such as RNA interference and CRISPR technologies. In recent years, the biotechnology sector has attracted substantial funding, with investments reaching billions of dollars annually. This financial support is crucial for contract development and manufacturing organizations (CDMOs) to enhance their capabilities and expand their service offerings. As a result, the Nucleic Acid Therapeutics CDMO Market is likely to witness accelerated growth, driven by the need for advanced manufacturing solutions that can meet the demands of emerging therapies.

Advancements in Delivery Technologies

The Nucleic Acid Therapeutics CDMO Market is witnessing transformative advancements in delivery technologies for nucleic acid therapeutics. Innovations in nanoparticle-based delivery systems, lipid nanoparticles, and viral vectors are enhancing the efficacy and safety of nucleic acid therapies. These advancements are crucial for overcoming the challenges associated with delivering nucleic acids to target cells effectively. As a result, CDMOs are increasingly investing in research and development to optimize these delivery mechanisms. The growing emphasis on improving delivery technologies is likely to propel the Nucleic Acid Therapeutics CDMO Market forward, as it enables the successful commercialization of novel therapies that require precise delivery to achieve therapeutic outcomes.

Rising Prevalence of Genetic Disorders

The Nucleic Acid Therapeutics CDMO Market is significantly influenced by the increasing prevalence of genetic disorders and chronic diseases. As the global population ages, the incidence of conditions such as cancer, cardiovascular diseases, and genetic disorders is on the rise. This trend has led to a heightened demand for innovative therapeutic solutions, including nucleic acid-based treatments. According to recent estimates, the market for gene therapies is projected to grow substantially, potentially reaching several billion dollars in the coming years. Consequently, CDMOs specializing in nucleic acid therapeutics are positioned to play a pivotal role in addressing these health challenges, thereby driving growth within the Nucleic Acid Therapeutics CDMO Market.

Collaboration Between Academia and Industry

The Nucleic Acid Therapeutics CDMO Market is benefiting from a growing trend of collaboration between academic institutions and industry players. These partnerships are fostering innovation and accelerating the development of nucleic acid-based therapies. Academic research often leads to groundbreaking discoveries, which, when combined with the manufacturing expertise of CDMOs, can result in the rapid translation of research into viable products. Such collaborations are increasingly common, as they leverage the strengths of both sectors to address complex challenges in nucleic acid therapeutics. This synergy is expected to enhance the capabilities of the Nucleic Acid Therapeutics CDMO Market, ultimately leading to the development of more effective and targeted therapies.

Regulatory Support for Nucleic Acid Therapies

The Nucleic Acid Therapeutics CDMO Market benefits from an increasingly favorable regulatory environment. Regulatory agencies are actively working to streamline the approval processes for nucleic acid-based therapies, recognizing their potential to address unmet medical needs. Initiatives aimed at expediting the review of innovative therapies have been implemented, which may lead to faster market entry for new products. For instance, the introduction of breakthrough therapy designations and fast track designations has encouraged the development of nucleic acid therapeutics. This supportive regulatory landscape is expected to bolster the Nucleic Acid Therapeutics CDMO Market, as it enables CDMOs to align their services with the evolving requirements of regulatory bodies.