Rising Health Awareness

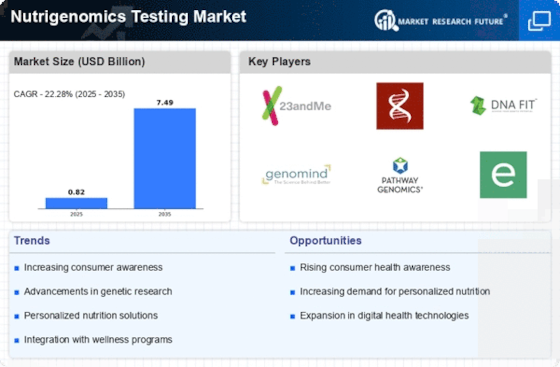

The increasing awareness regarding health and wellness among consumers appears to be a primary driver for the Nutrigenomics Testing Market. Individuals are becoming more conscious of the impact of diet on health, leading to a growing demand for personalized nutrition solutions. This trend is reflected in the market, where the demand for nutrigenomics testing services is projected to grow at a compound annual growth rate of approximately 10% over the next five years. As consumers seek tailored dietary recommendations based on their genetic makeup, the Nutrigenomics Testing Market is likely to expand significantly, catering to a more informed clientele.

Integration with Wellness Programs

The integration of nutrigenomics testing into wellness and preventive healthcare programs is emerging as a significant driver for the Nutrigenomics Testing Market. Healthcare providers are increasingly recognizing the value of personalized nutrition in disease prevention and management. This trend is evident as more healthcare facilities incorporate nutrigenomics testing into their services, thereby enhancing patient outcomes. The market is projected to see a rise in partnerships between nutrigenomics companies and healthcare providers, potentially increasing the market size by 15% in the coming years. Such collaborations are likely to solidify the role of nutrigenomics in holistic health strategies.

Regulatory Support and Standardization

Regulatory support and the push for standardization in the nutrigenomics testing sector are emerging as critical drivers for the Nutrigenomics Testing Market. Governments and health organizations are increasingly recognizing the importance of establishing guidelines and standards for genetic testing. This regulatory framework is expected to enhance consumer confidence and promote the adoption of nutrigenomics testing services. As regulatory bodies work towards creating a more structured environment, the market is likely to experience accelerated growth, with projections indicating a potential increase in market share by 20% over the next few years. Such developments are essential for the long-term sustainability of the Nutrigenomics Testing Market.

Advancements in Genetic Testing Technology

Technological innovations in genetic testing methodologies are propelling the Nutrigenomics Testing Market forward. The advent of next-generation sequencing and other advanced techniques has made genetic testing more accessible and affordable. These advancements not only enhance the accuracy of tests but also reduce turnaround times, thereby increasing consumer trust and adoption. As a result, the market is witnessing a surge in the number of companies offering nutrigenomics testing services, which is expected to reach a valuation of over 1 billion dollars by 2026. This technological evolution is crucial for the sustained growth of the Nutrigenomics Testing Market.

Growing Demand for Personalized Diet Plans

The demand for personalized diet plans based on genetic information is a notable driver for the Nutrigenomics Testing Market. Consumers are increasingly seeking tailored dietary solutions that align with their unique genetic profiles. This trend is supported by research indicating that personalized nutrition can lead to better health outcomes, including weight management and chronic disease prevention. As a result, the market for nutrigenomics testing is expected to grow, with estimates suggesting a market size of approximately 2 billion dollars by 2027. This growing consumer preference for individualized nutrition is likely to shape the future of the Nutrigenomics Testing Market.

Leave a Comment