Research Methodology on Ocean Bound Plastics Market

The research methodology used for this report on the market for ocean-bound plastics is derived from a systematic approach to analyzing the global market size and its potential future growth. The primary data regarding market size and growth rate are collected from secondary sources such as newspaper articles, industry journals, reports, blogs and whitepapers, books, press releases and annual reports. Moreover, the primary data is collected from industry experts and opinion holders, such as key opinion leaders, investment bankers and brokerage firms and industry players.

Market Size Estimation

For the estimation of the total market size, the following parameters are taken into consideration:

- The global ocean-bound plastic market size, in terms of revenue, for the period between 2024 and 2032 is calculated by estimating the revenue of major players in the market, considering the historical data from 2018 to 2022.

- The segmental market size is calculated using the bottom-up approach, wherein the smallest and the largest segments are estimated by considering the growth rates across different applications and regions.

- The year-on-year growth rate of the global ocean-bound plastic market is studied to understand the growth trajectory in the market.

- The global ocean-bound plastic market volume is estimated by incorporating the revenue of each segment across all regions.

- The growth rate of the ocean-bound plastics market is estimated while considering the historical growth rate of different applications and regions.

Data Triangulation

Data triangulation is used to ensure the accuracy and robustness of the estimated market size. This used a combination of techniques, such as Porter’s Five Forces analysis for the industry and SWOT analysis for the product. The data is triangulated by the use of various approaches and sources, such as primary interviews, observation, and secondary research.

Market Forecasting

The segmental growth rate is identified using a weighted average approach, wherein the market size of each segment is multiplied by its respective market share, thus obtaining the weighted average growth rate for the segment. The global market size and the growth rate of the global ocean-bound plastics market for the period between 2023 and 2030 are determined based on the estimated CAGR of each segment over the respective forecast period.

Assumptions

In this process, the following assumptions were made:

The market size calculation is based on the global production of ocean-bound plastics and their usage.

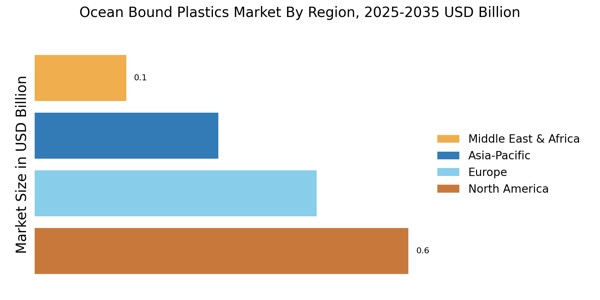

The high availability of ocean-bound plastics in Europe, North America and the Asia-Pacific region, is expected to dominate the market during the forecast period.

The increase in the number of organizations and companies that are investing in ocean-bound plastic solutions is expected to drive the growth of the market.

A stable political and economic environment is expected to drive the growth of the market.

The market will remain competitive in terms of product innovation and pricing.