Advancements in Diagnostic Technologies

Technological innovations are playing a pivotal role in shaping the Office-based Lab Market. The introduction of advanced diagnostic tools and equipment has significantly improved the accuracy and speed of laboratory tests. Innovations such as point-of-care testing devices and automated laboratory systems are becoming increasingly prevalent in office-based labs. These advancements not only enhance the quality of care but also reduce operational costs, making it more feasible for healthcare providers to establish and maintain office-based labs. Market data indicates that the demand for advanced diagnostic technologies is expected to rise, with a projected increase in the adoption of these tools by healthcare facilities, thereby driving the growth of the office-based lab sector.

Increased Focus on Preventive Healthcare

The Office-based Lab Market is witnessing a shift towards preventive healthcare, which is influencing the demand for laboratory services. As healthcare providers emphasize early detection and prevention of diseases, the need for routine diagnostic testing is becoming more pronounced. Office-based labs are well-positioned to meet this demand, as they can offer timely and accessible testing services that facilitate preventive care. Market analysis suggests that the preventive healthcare market is expanding, with a growing number of patients seeking regular screenings and check-ups. This trend is likely to drive the growth of office-based labs, as they play a crucial role in supporting preventive health initiatives and improving patient outcomes.

Regulatory Support for Office-based Labs

The Office-based Lab Market is benefiting from favorable regulatory frameworks that support the establishment and operation of office-based labs. Governments and regulatory bodies are increasingly recognizing the value of decentralizing laboratory services to improve healthcare access and efficiency. This regulatory support often includes streamlined licensing processes and reimbursement policies that incentivize healthcare providers to invest in office-based labs. As a result, more practitioners are likely to consider setting up their own labs, which could lead to a proliferation of office-based lab facilities. The positive regulatory environment is expected to contribute to the overall growth of the office-based lab market, as it encourages innovation and investment in this sector.

Integration of Health Information Technology

The integration of health information technology is transforming the Office-based Lab Market by enhancing data management and patient care coordination. Electronic health records (EHR) and laboratory information systems (LIS) are increasingly being adopted in office-based labs, allowing for seamless data sharing and improved workflow efficiency. This technological integration not only streamlines laboratory operations but also enhances communication between healthcare providers and patients. As the demand for integrated healthcare solutions continues to rise, office-based labs that leverage health information technology are likely to gain a competitive advantage. The ongoing evolution of health IT is expected to further propel the growth of the office-based lab market, as it supports better decision-making and patient management.

Rising Demand for Convenient Healthcare Services

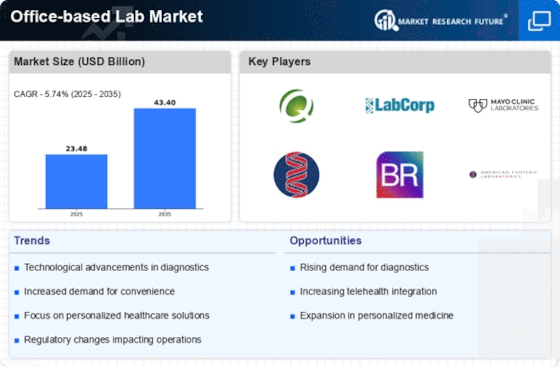

The Office-based Lab Market is experiencing a notable increase in demand for convenient healthcare services. Patients are increasingly seeking accessible and efficient healthcare solutions that minimize travel and wait times. This trend is driven by a growing preference for outpatient care, which allows patients to receive diagnostic services in a familiar environment. According to recent data, the outpatient lab services market is projected to grow at a compound annual growth rate of approximately 6.5% over the next several years. This shift towards convenience is likely to propel the expansion of office-based labs, as they offer a streamlined approach to diagnostics and treatment, thereby enhancing patient satisfaction and engagement.