Expansion of Diagnostic Applications

The lab on-a-chip-device market is witnessing an expansion in diagnostic applications, driven by the need for rapid and accurate testing solutions. These devices are increasingly utilized in various fields, including infectious disease detection, cancer diagnostics, and genetic testing. The ability to conduct multiple tests simultaneously on a single chip is particularly appealing to healthcare providers, as it reduces time and costs associated with traditional laboratory testing. The market for diagnostic applications is expected to account for over 60% of the total lab on-a-chip-device market by 2026, indicating a strong shift towards integrated diagnostic solutions that enhance patient care and streamline clinical workflows.

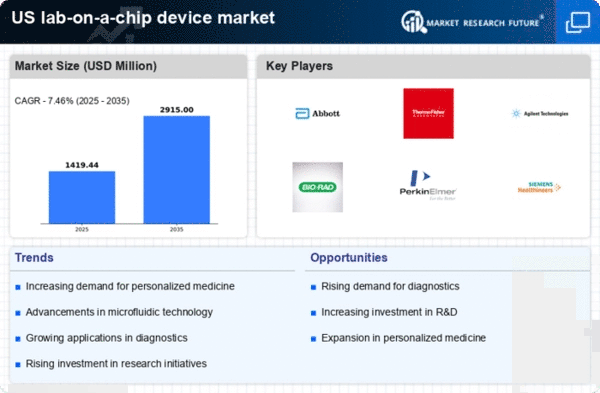

Rising Demand for Personalized Medicine

The lab on-a-chip-device market is experiencing a notable surge in demand for personalized medicine. This trend is driven by the increasing recognition of the need for tailored therapeutic approaches that cater to individual patient profiles. As healthcare providers seek to enhance treatment efficacy, lab on-a-chip devices offer rapid and precise diagnostic capabilities, enabling the customization of therapies. The market is projected to grow at a CAGR of approximately 15% over the next five years, reflecting the growing integration of these devices in clinical settings. Furthermore, advancements in microfluidics technology are facilitating the development of more sophisticated lab on-a-chip devices, which are essential for the implementation of personalized medicine strategies.

Advancements in Microfluidics Technology

Advancements in microfluidics technology are playing a pivotal role in shaping the lab on-a-chip-device market. Innovations in this field are enabling the miniaturization of laboratory processes, allowing for the integration of multiple functions onto a single chip. This not only enhances the efficiency of testing but also reduces costs associated with traditional laboratory setups. The US market is witnessing a surge in the development of microfluidic devices, with applications ranging from drug discovery to environmental monitoring. As these technologies continue to evolve, they are expected to drive the growth of the lab on-a-chip-device market, potentially leading to new applications and improved performance metrics.

Increased Focus on Point-of-Care Testing

The lab on-a-chip-device market is significantly influenced by the growing emphasis on point-of-care testing (POCT). Healthcare providers are increasingly adopting POCT solutions to facilitate immediate decision-making and improve patient outcomes. Lab on-a-chip devices enable rapid testing at the site of care, reducing the need for centralized laboratory facilities. This shift is particularly relevant in emergency and rural healthcare settings, where timely diagnostics are crucial. The POCT segment is projected to grow at a CAGR of around 18% through 2027, reflecting the increasing demand for accessible and efficient testing solutions that lab on-a-chip devices provide.

Growing Investment in Research and Development

Investment in research and development (R&D) within the lab on-a-chip-device market is on the rise, as stakeholders recognize the potential of these technologies in various applications. Increased funding from both public and private sectors is fostering innovation, leading to the development of advanced lab on-a-chip devices that can perform complex analyses with minimal sample volumes. In the US, R&D expenditures in the healthcare sector have reached approximately $200 billion annually, with a significant portion allocated to microfluidics and lab on-a-chip technologies. This influx of capital is likely to accelerate the pace of technological advancements, thereby enhancing the capabilities and applications of lab on-a-chip devices across diagnostics and therapeutics.