Increasing Healthcare Expenditure

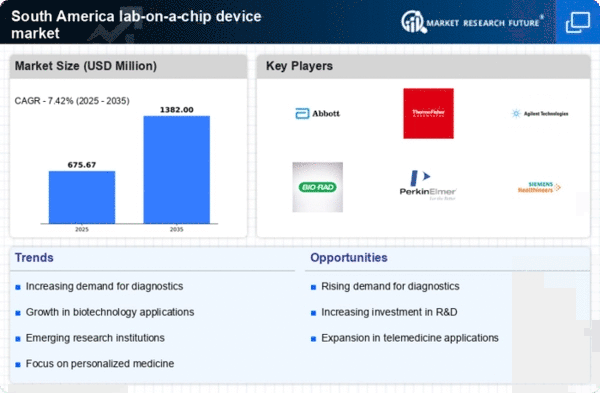

The lab on-a-chip device market in South America will benefit from rising healthcare expenditure across various countries in the region. Governments and private sectors are investing more in healthcare infrastructure, which is projected to grow at a CAGR of 5.5% from 2025 to 2030. This increase in funding facilitates the adoption of advanced diagnostic technologies, including lab on-a-chip devices. As healthcare systems strive to improve patient outcomes and reduce costs, the integration of these devices into clinical settings appears to be a priority. Furthermore, the growing prevalence of chronic diseases necessitates efficient diagnostic solutions, thereby driving demand for lab on-a-chip devices. The focus on personalized medicine and rapid diagnostics is expected to further enhance the market landscape, making it a pivotal component of the healthcare ecosystem in South America.

Rising Incidence of Infectious Diseases

The lab on-a-chip device market in South America is growing due to the rising incidence of infectious diseases. The region has witnessed an increase in cases of diseases such as dengue, Zika virus, and tuberculosis, which necessitate rapid and accurate diagnostic tools. The World Health Organization indicates that the burden of infectious diseases in South America remains high, prompting healthcare providers to seek innovative solutions. Lab on-a-chip devices offer the potential for quick diagnostics, enabling timely treatment and containment of outbreaks. This urgency for effective disease management is likely to drive investments in lab on-a-chip technologies, as they provide a compact and efficient means of testing. The ability to conduct multiple tests simultaneously on a single chip could significantly enhance the response to public health challenges, thereby solidifying the role of lab on-a-chip devices in the healthcare landscape.

Advancements in Research and Development

The lab on-a-chip device market in South America will grow due to advancements in research and development. Academic institutions and private companies are increasingly focusing on innovative technologies that enhance the capabilities of lab on-a-chip devices. This trend is reflected in the rising number of patents filed in the region, indicating a robust pipeline of new technologies. Collaborations between universities and industry players are fostering an environment conducive to innovation, which is expected to drive the market forward. The emphasis on developing cost-effective and efficient diagnostic solutions is likely to attract investment, further propelling the lab on-a-chip-device market. As research continues to evolve, the potential applications of these devices in various fields, including environmental monitoring and food safety, may also expand, creating new opportunities for growth.

Growing Demand for Personalized Medicine

The lab on-a-chip device market in South America is influenced by the growing demand for personalized medicine. As healthcare shifts towards tailored treatment approaches, the need for precise diagnostics becomes paramount. Lab on-a-chip devices facilitate the analysis of individual patient profiles, allowing for customized therapeutic strategies. This trend is supported by a projected growth rate of 7% in the personalized medicine sector over the next five years. The ability to conduct rapid and accurate tests on a micro-scale aligns with the objectives of personalized healthcare, making lab on-a-chip devices essential tools in this transformation. Furthermore, as patients and healthcare providers seek more effective treatment options, the integration of these devices into clinical workflows is likely to expand, enhancing their adoption in South America.

Regulatory Support for Innovative Technologies

The lab on-a-chip device market in South America benefits from regulatory support aimed at fostering innovation in healthcare technologies. Regulatory bodies are increasingly recognizing the importance of rapid diagnostic tools and are streamlining approval processes for lab on-a-chip devices. This supportive regulatory environment is likely to encourage manufacturers to invest in the development of new products. The potential for quicker market entry could enhance competition and drive down costs, making these devices more accessible to healthcare providers. Additionally, initiatives aimed at promoting research and development in the medical technology sector are expected to further stimulate growth. As regulations evolve to accommodate new technologies, the lab on-a-chip-device market is likely to see an influx of innovative solutions that address the specific needs of the South American healthcare landscape.