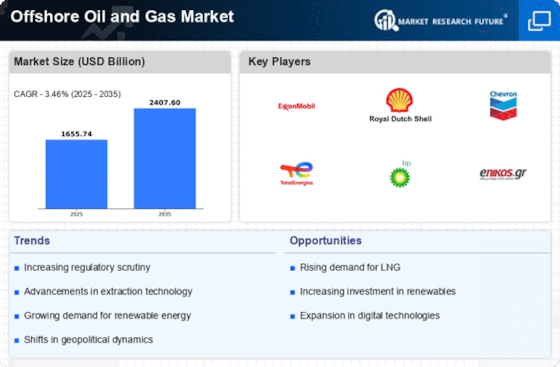

The Offshore Oil and Gas Market is currently characterized by a complex interplay of competitive dynamics, driven by factors such as technological advancements, regulatory changes, and a growing emphasis on sustainability. Major players like ExxonMobil (US), Royal Dutch Shell (GB), and TotalEnergies (FR) are strategically positioning themselves to leverage these trends. ExxonMobil (US) has been focusing on enhancing its operational efficiency through digital transformation initiatives, while Royal Dutch Shell (GB) is increasingly investing in renewable energy projects to diversify its portfolio. TotalEnergies (FR) appears to be concentrating on expanding its footprint in emerging markets, thereby shaping a competitive environment that is both innovative and adaptive to changing consumer demands.

In terms of business tactics, companies are localizing their operations and optimizing supply chains to enhance resilience and responsiveness. The market structure is moderately fragmented, with a mix of established players and emerging companies vying for market share. This fragmentation allows for a variety of competitive strategies, as key players leverage their strengths to influence market dynamics collectively.

In August 2025, Chevron (US) announced a significant partnership with a leading technology firm to develop AI-driven solutions aimed at optimizing offshore drilling operations. This strategic move is likely to enhance Chevron's operational efficiency and reduce costs, positioning the company favorably in a competitive landscape that increasingly values technological integration. Furthermore, this partnership underscores the growing trend of digitalization within the industry, as companies seek to harness data analytics for improved decision-making.

In September 2025, BP (GB) unveiled its ambitious plan to achieve net-zero emissions by 2030, which includes a substantial investment in carbon capture and storage technologies. This initiative not only reflects BP's commitment to sustainability but also positions the company as a leader in the transition towards greener energy solutions. The strategic importance of this move lies in its potential to attract environmentally conscious investors and customers, thereby enhancing BP's competitive edge in a market that is progressively prioritizing sustainability.

In October 2025, Eni (IT) launched a new offshore project in the Mediterranean, focusing on natural gas extraction. This project is significant as it aligns with the European Union's energy diversification goals, potentially reducing reliance on external energy sources. Eni's proactive approach in this venture indicates a strategic alignment with regional energy policies, which may enhance its market position and foster long-term growth.

As of October 2025, the Offshore Oil and Gas Market is witnessing a shift towards digitalization, sustainability, and AI integration, which are defining current competitive trends. Strategic alliances are increasingly shaping the landscape, enabling companies to pool resources and expertise to tackle complex challenges. Looking ahead, competitive differentiation is likely to evolve from traditional price-based competition to a focus on innovation, technology, and supply chain reliability, as companies strive to meet the demands of a rapidly changing market.

Leave a Comment