Increasing Exploration Activities

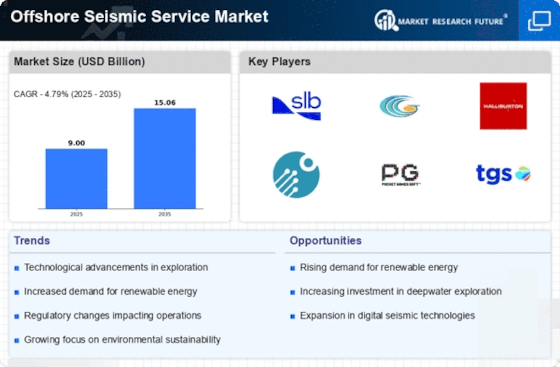

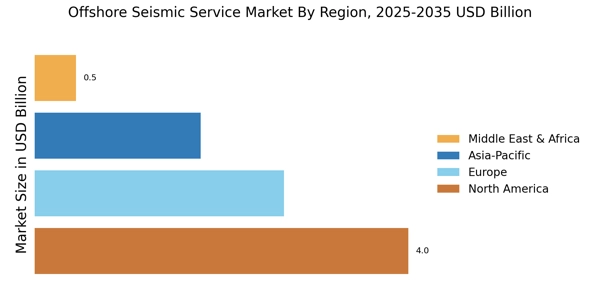

The Offshore Seismic Service Market is witnessing an increase in exploration activities, particularly in untapped regions. As energy demands rise, companies are investing in seismic surveys to identify new oil and gas reserves. According to recent estimates, the offshore exploration sector is projected to grow at a compound annual growth rate of approximately 5% over the next few years. This growth is fueled by the need for energy security and the desire to discover new resources. Consequently, the demand for offshore seismic services is expected to rise, as these services are essential for successful exploration and resource identification.

Rising Investments in Renewable Energy

The Offshore Seismic Service Market is also being shaped by rising investments in renewable energy sources. As the world shifts towards sustainable energy solutions, offshore wind and tidal energy projects are gaining momentum. Seismic services play a crucial role in assessing the geological suitability of sites for these renewable projects. The offshore wind sector alone is expected to attract billions in investments, creating a parallel demand for seismic services to ensure site viability. This trend indicates a diversification of the Offshore Seismic Service Market, as it expands beyond traditional oil and gas exploration into renewable energy assessments.

Geopolitical Factors and Energy Security

The Offshore Seismic Service Market is increasingly affected by geopolitical factors and the quest for energy security. Nations are prioritizing energy independence, leading to heightened exploration activities in offshore regions. This geopolitical landscape drives investments in seismic services, as countries seek to assess their offshore resources comprehensively. The potential for conflicts over maritime boundaries and resources may further intensify the need for accurate seismic data. As nations navigate these complexities, the Offshore Seismic Service Market is likely to experience growth, driven by the imperative to secure energy resources.

Regulatory Compliance and Safety Standards

The Offshore Seismic Service Market is significantly influenced by regulatory compliance and safety standards. Governments and regulatory bodies are increasingly enforcing stringent safety measures to protect marine environments and ensure the safety of seismic operations. Compliance with these regulations often necessitates the use of advanced seismic technologies and methodologies, which can increase operational costs. However, companies that adhere to these standards may gain a competitive edge, as they are perceived as responsible and reliable. This trend is likely to drive demand for offshore seismic services, as firms seek to align with evolving regulatory frameworks.

Technological Innovations in Seismic Equipment

The Offshore Seismic Service Market is experiencing a surge in technological innovations, particularly in seismic equipment. Advanced technologies such as 4D seismic imaging and real-time data processing are enhancing the accuracy and efficiency of seismic surveys. These innovations allow for better subsurface mapping, which is crucial for oil and gas exploration. The integration of artificial intelligence and machine learning into seismic data analysis is also gaining traction, potentially reducing operational costs and time. As companies seek to optimize their exploration efforts, the demand for cutting-edge seismic technology is likely to grow, driving the Offshore Seismic Service Market forward.