Rise of Digitalization

Digitalization is reshaping the Oil & Gas Automation Market, as companies leverage digital tools to enhance operational efficiency and decision-making processes. The implementation of digital twins, cloud computing, and big data analytics allows for real-time monitoring and management of assets, leading to improved productivity. According to recent estimates, the digital transformation in the oil and gas sector could yield savings of up to 20% in operational costs. Moreover, the integration of digital platforms facilitates better collaboration among teams, enabling faster response times to market changes. As the industry continues to embrace digital solutions, the potential for innovation and efficiency gains appears boundless, positioning digitalization as a key driver of growth in the automation market.

Emphasis on Sustainability

Sustainability has emerged as a pivotal driver in the Oil & Gas Automation Market, as companies increasingly prioritize environmentally friendly practices. The shift towards sustainable operations is not merely a trend but a necessity, driven by regulatory pressures and societal expectations. Automation technologies facilitate this transition by optimizing resource usage and minimizing waste. For example, automated systems can monitor emissions in real-time, ensuring compliance with environmental standards. The market for sustainable technologies in oil and gas is expected to grow significantly, with investments in renewable energy sources and carbon capture technologies gaining traction. This focus on sustainability not only enhances corporate reputation but also aligns with the global push towards reducing carbon footprints, making it a crucial factor in the industry's future.

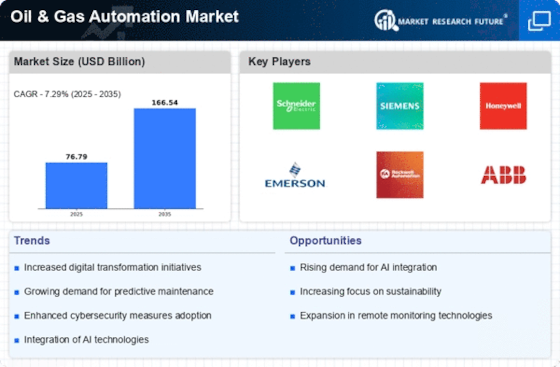

Integration of Advanced Technologies

The Oil & Gas Automation Market is witnessing a robust integration of advanced technologies such as artificial intelligence, machine learning, and the Internet of Things. These technologies enhance operational efficiency and safety, allowing companies to optimize production processes and reduce downtime. For instance, predictive maintenance powered by AI can significantly lower operational costs by anticipating equipment failures before they occur. The market for AI in oil and gas is projected to reach approximately 3.81 billion USD by 2025, indicating a strong trend towards automation. Furthermore, the adoption of smart sensors and real-time data analytics is transforming traditional practices, enabling companies to make informed decisions swiftly. This technological evolution not only streamlines operations but also contributes to improved environmental compliance, a critical aspect in today's regulatory landscape.

Regulatory Compliance and Safety Standards

Regulatory compliance and safety standards are increasingly influencing the Oil & Gas Automation Market, as companies navigate a complex landscape of environmental and safety regulations. Automation technologies are essential in ensuring compliance with these stringent standards, as they provide real-time monitoring and reporting capabilities. For instance, automated systems can track emissions and safety metrics, facilitating adherence to regulations and reducing the risk of penalties. The market for compliance-related automation solutions is expected to grow, driven by the need for transparency and accountability in operations. Furthermore, the integration of safety automation systems can significantly reduce workplace accidents, enhancing overall safety performance. As regulatory pressures mount, the focus on compliance and safety will likely drive further investments in automation technologies.

Increasing Demand for Operational Efficiency

The quest for operational efficiency is a primary driver in the Oil & Gas Automation Market, as companies strive to enhance productivity while reducing costs. Automation technologies play a crucial role in streamlining processes, minimizing human error, and optimizing resource allocation. The implementation of automated drilling systems and remote monitoring solutions has been shown to increase production rates significantly. Reports indicate that companies adopting automation can achieve up to a 30% increase in efficiency. This relentless pursuit of efficiency not only improves profit margins but also allows companies to remain competitive in a volatile market. As the industry faces fluctuating oil prices, the emphasis on operational efficiency is likely to intensify, further propelling the adoption of automation technologies.