Focus on Cybersecurity

As the Oil Gas Terminal Automation Market evolves, the focus on cybersecurity has become increasingly critical. With the rise of interconnected systems, the vulnerability to cyber threats has escalated, prompting companies to invest heavily in robust cybersecurity measures. The market for cybersecurity solutions in the oil and gas sector is anticipated to reach USD 30 billion by 2026, reflecting a growing recognition of the need to protect sensitive data and infrastructure. This emphasis on cybersecurity not only safeguards operational integrity but also enhances stakeholder confidence. Companies are now prioritizing the implementation of advanced security protocols and regular audits to mitigate risks associated with cyberattacks, thereby ensuring the resilience of automated terminal operations.

Integration of Advanced Technologies

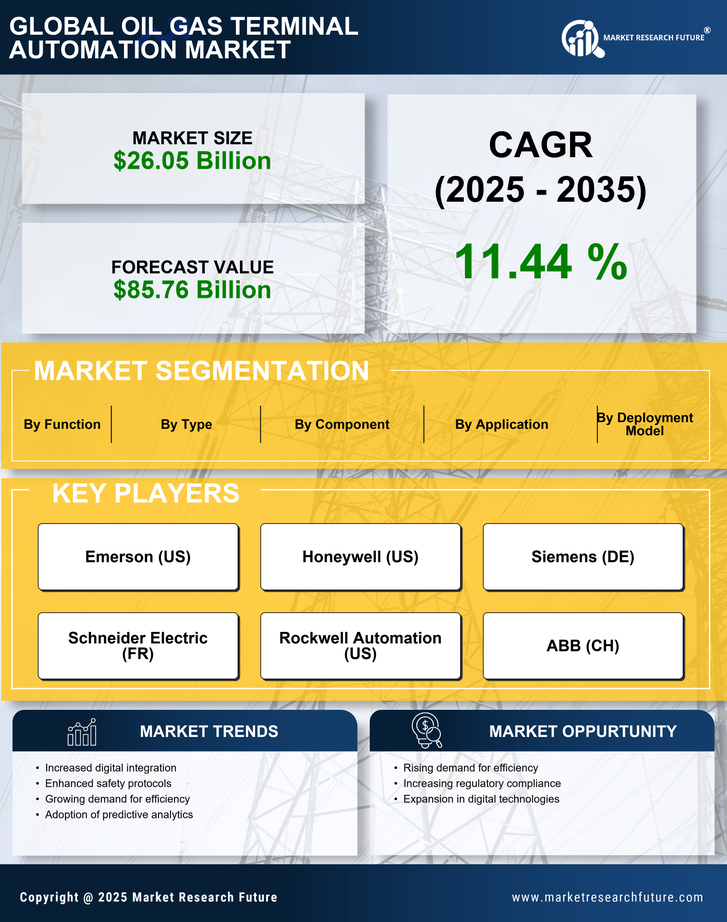

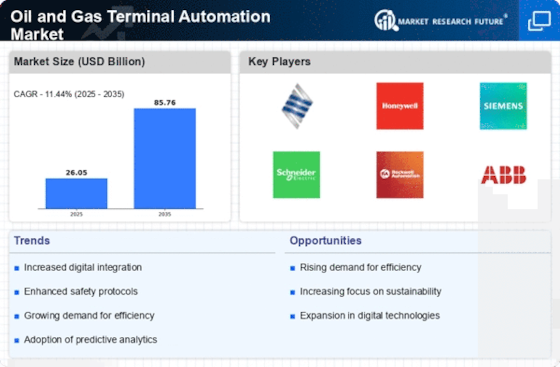

The Oil Gas Terminal Automation Market is experiencing a notable shift towards the integration of advanced technologies such as artificial intelligence, machine learning, and the Internet of Things. These technologies enhance operational efficiency, reduce human error, and improve decision-making processes. For instance, predictive maintenance powered by AI can significantly lower downtime, which is crucial in a sector where operational continuity is paramount. The market is projected to grow at a compound annual growth rate of approximately 6.5% over the next five years, driven by the need for enhanced automation solutions. Furthermore, the adoption of smart sensors and real-time data analytics is expected to revolutionize terminal operations, leading to more streamlined processes and cost savings.

Regulatory Compliance and Sustainability

The Oil Gas Terminal Automation Market is increasingly influenced by stringent regulatory compliance and sustainability initiatives. Governments worldwide are imposing regulations aimed at reducing carbon emissions and promoting environmentally friendly practices. This regulatory landscape compels companies to adopt automated solutions that not only comply with these regulations but also enhance operational efficiency. The market is expected to witness a surge in demand for automation technologies that facilitate compliance with environmental standards, such as emissions monitoring systems. As a result, investments in automation are projected to increase, with a focus on sustainable practices that align with global environmental goals. This trend indicates a shift towards greener operations, which could reshape the future of terminal automation.

Rising Demand for Operational Efficiency

The Oil Gas Terminal Automation Market is driven by the rising demand for operational efficiency among terminal operators. As competition intensifies, companies are seeking ways to optimize their operations and reduce costs. Automation technologies, such as advanced control systems and automated loading and unloading processes, are being adopted to enhance productivity and minimize human intervention. Reports suggest that automation can lead to a reduction in operational costs by up to 20%, making it an attractive investment for terminal operators. This focus on efficiency not only improves profit margins but also allows companies to respond more swiftly to market fluctuations, thereby enhancing their competitive edge in a rapidly evolving industry.

Increased Investment in Infrastructure Development

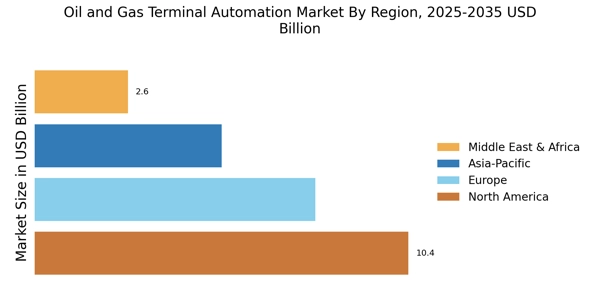

The Oil Gas Terminal Automation Market is witnessing increased investment in infrastructure development, driven by the need for modernization and expansion of existing facilities. Governments and private entities are allocating substantial funds to upgrade terminal infrastructure, which includes the implementation of automated systems for better management of resources. This trend is particularly evident in regions where oil and gas demand is projected to grow, necessitating enhanced terminal capabilities. The investment in automation technologies is expected to facilitate smoother operations, improve safety standards, and reduce turnaround times. As a result, the market is poised for growth, with infrastructure development playing a pivotal role in shaping the future of terminal automation.