Market Share

Oil Gas Upstream Projects Market Share Analysis

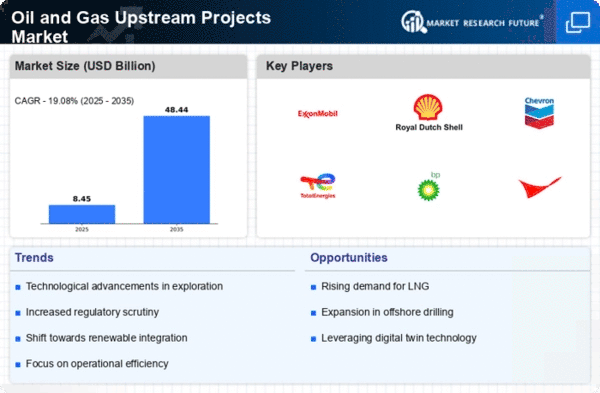

Due to the dynamic and competitive nature of the Oil & Gas Upstream Projects Market, having appropriate positioning strategies about market share is necessary for players to make progress in order that they can adjust quickly with industry trends while out maneuvering rivals. The innovation is a crux strategy, where firms spendthrift in the latest exploration and extraction technologies. Upstream projects can take pride in leading the way and being pioneers through developments such as seismic imaging, advanced drilling methods improved by using AI-powered reservoir modelling; thus allowing them to capture and sustain a significant market share. Formulation of strategic collaborations and partnerships determine the market share positioning in terms of Oil and Gas Upstream Projects Market. Staying in line with the like-minded fellow exploration and production companies, service providers or research institutions lets upstream projects share assets and competence. Working together in such collaborations does not only increase the project’s efficiency operations but makes it a stakeholder that serves as an essential source of growth to developmental innovation and innovativeness occurrences, thereby contributing significantly to market share within this sector. In the Oil and Gas Upstream Projects Market, adherence to a stringent environmental and safety policy is of strategic nature. The companies that align the sustainable practices, financial investment in technologies for emissions’ reduction and complete safety protocols compete well. Regulation compliance thus contributes directly to the operability of markets, as well as helps upstream business projects align with global sustainability goals in terms affecting market volumes and share. Strategies used by upstream projects for achieving optimal results in terms of market share positioning include portfolio diversification and optimization. Varied mix of explorations and production activities involving both conventional and unconventional sources and renewables also enables the companies to avoid risks, overcome obstacles while reaching more diverse energy requirements. Other than this, a perfect operations process and the efficiency of cost helps to be competitive as it optimizes overall market share. Strategic pricing is a key component of the market share positioning in the Oil and Gas Upstream Projects Market. The upstream projects should try and balance out the cost of production to competitors but also on operational costs such that they attract investment partners as well as stakeholders. Provision of chance for investors in form of competitive pricing structures having production sharing agreements or exploration incentives gives the projects a comparative edge hence securing larger market share. Other strategic pricing strategies can comprise cost models that are easy-to-understand and innovative funding alternatives, which appeals to various investors. Strategically, market share can be established by geographic expansion and diversified exploration areas in the Oil and Gas Upstream Project industry.

Leave a Comment