Market Trends

Key Emerging Trends in the Oil Gas Upstream Projects Market

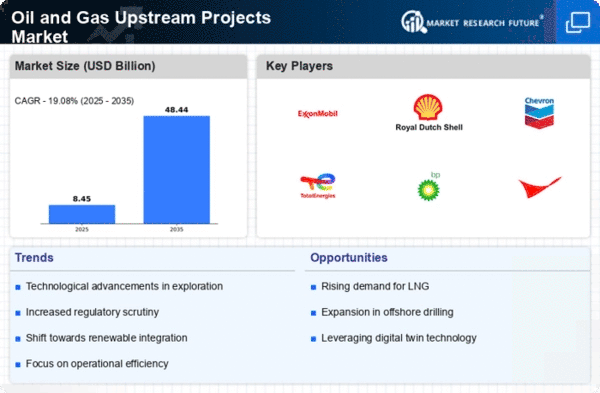

Some notable trends are taking place in the oil and gas upstream projects market driven by geopolitical changes, technology developments, as well as a drastic transformation brought about by buoyant global energy dynamics. One important development is the increasing emphasis on digitalization and cutting-edge technology in upstream businesses. There are emerging cases of companies using artificial intelligence, data analytics and IoT solutions to boost exploration activities. This trend serves as an illustration of the industry’s focus on reengineering processes, improving efficiency while minimizing costs spent and achieving maximum recovery levels for hydrocarbons via emerging digital technologies. Changes in geopolitical dynamics and market conditions are also fuelling the upstream projects oil & gas trends. Volatility of oil prices, geopolitical tensions, and the effects as well influence decisions relevant to investment that are also projected time line. Facing uncertainties, companies are turning to more flexible adaptive strategies such as short-cycle projects; modular designs through improved risk management. This trend emphasizes the need for agility and resilience in oil and gas production. Trends in the oil and gas upstream projects market are affected by energy transition from dirty to cleaner forms of energy. Companies are gradually integrating renewable energy in their business activities, studying potential CCS applications, and using the ESG goals. This trend represents efforts of the industry to respond to increasing high-pressure on responsible and sustainable energy practices, which is indication that measures taken in upstream activities reduction were adhered. The developments in the technology aspects relating to exploration and reservoir management are defining trends within the oil and gas upstream projects market. Technological innovations like cutting-edge seismic imaging, effective EOR methods and reservoir simulation technologies are making it easier to investigate subsurface rock formations as well as enhance the yield of production. This is an indication of the persistence quest by the industry into fully realizing potential in hydrocarbon reservoir and also ensures extended productivity of oil fields. One of the prominent trends affecting upstream projects market is emergence of unconventional resources such as shale and tight oils oil, and gas. The development of technical innovations in the fields of horizontal drilling and hydraulic fracturing has revolutionised oil extraction through making possible to access unconventional reserves. This trend has changed the dynamics of global energy resources including alternative means being used to supplement demand for unconventional power sources. It is now evident that the industry of late has focused and continues to provide attention on are focuses in developing, as well as optimizing unconventional projects. In the oil and gas upstream projects market, operational efficiency combined with cost optimization is a main trend.

Leave a Comment