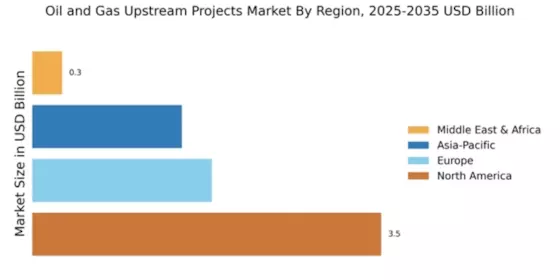

North America : Leading Global Market

North America continues to lead the Oil Gas Upstream Projects Market, holding a significant market share of 3.5 in 2024. The region's growth is driven by technological advancements, increased exploration activities, and favorable regulatory frameworks. The demand for energy, coupled with the push for sustainable practices, has catalyzed investments in innovative extraction methods and infrastructure development. Regulatory support for energy independence further enhances market dynamics.

The competitive landscape is characterized by major players such as ExxonMobil, Chevron, and ConocoPhillips, which dominate the market. The U.S. remains a key player, with Texas and North Dakota leading in production. The presence of established companies fosters innovation and efficiency, while new entrants are also emerging, contributing to a dynamic market environment. The region's focus on reducing carbon emissions is shaping future projects, ensuring sustainability in operations.

Europe : Regulatory Frameworks in Focus

Europe's Oil Gas Upstream Projects Market is valued at 1.8, reflecting a steady growth trajectory. The region is increasingly focusing on regulatory frameworks that promote sustainability and energy transition. The European Union's Green Deal and various national policies are driving investments in cleaner technologies and renewable energy integration. This regulatory push is expected to reshape the market, encouraging innovation and efficiency in oil and gas extraction processes.

Leading countries such as Norway, the UK, and the Netherlands are at the forefront of this transformation, with major players like BP and TotalEnergies actively participating. The competitive landscape is evolving, with a mix of traditional oil companies and new entrants focusing on sustainable practices. The emphasis on reducing carbon footprints and enhancing energy security is shaping future projects, ensuring that Europe remains a significant player in the global market.

Asia-Pacific : Emerging Market Potential

The Asia-Pacific region, with a market size of 1.5, is witnessing a surge in oil and gas upstream investments. This growth is driven by increasing energy demand, particularly in countries like China and India, where industrialization and urbanization are accelerating. Regulatory reforms aimed at attracting foreign investments and enhancing local production capabilities are also contributing to market expansion. The region's focus on energy security and diversification of energy sources is further catalyzing growth in upstream projects.

Key players in the region include major companies like Eni and Equinor, which are actively exploring opportunities in emerging markets. Countries such as Australia and Indonesia are becoming increasingly important in the competitive landscape, with significant investments in exploration and production. The presence of both established and new players is fostering innovation, ensuring that the Asia-Pacific region remains a vital component of The Oil Gas Upstream Projects.

Middle East and Africa : Resource-Rich Opportunities

The Middle East and Africa region, with a market size of 0.3, presents unique opportunities in the Oil Gas Upstream Projects Market. The region is rich in natural resources, and countries like Saudi Arabia and Nigeria are key players in global oil production. The demand for energy continues to rise, driven by population growth and industrial development. Regulatory frameworks are evolving to attract foreign investments, enhancing the region's appeal for upstream projects.

Leading countries in the region are focusing on maximizing production efficiency and sustainability. Major players such as Petrobras and Eni are investing in advanced technologies to improve extraction processes. The competitive landscape is characterized by a mix of state-owned enterprises and private companies, all vying for a share of the growing market. The region's strategic importance in global energy supply chains ensures its continued relevance in the oil and gas sector.