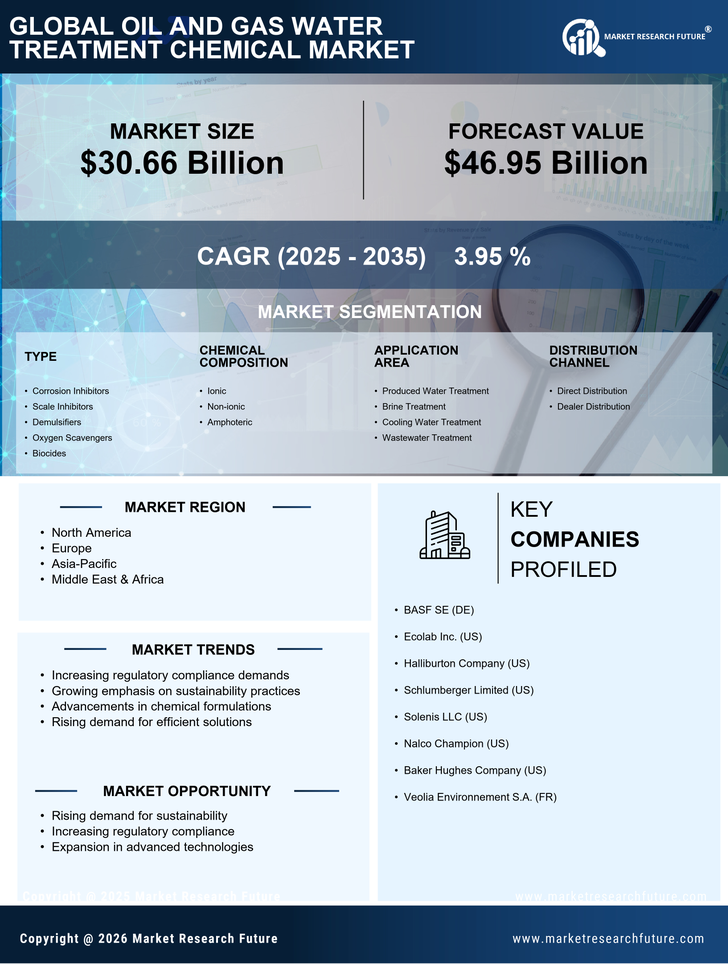

Growing Focus on Sustainable Practices

The Oil And Gas Water Treatment Chemical Market is increasingly influenced by a growing focus on sustainability and corporate social responsibility. Companies are recognizing the importance of adopting sustainable practices in their operations, particularly in water management. This shift is driving the demand for environmentally friendly treatment chemicals that minimize ecological impact. As stakeholders, including investors and consumers, place greater emphasis on sustainability, oil and gas companies are compelled to align their practices with these expectations. The market is witnessing a trend towards the development of biodegradable and non-toxic treatment chemicals, which not only meet regulatory requirements but also enhance the overall sustainability profile of operations. This evolving landscape indicates a promising future for the Oil And Gas Water Treatment Chemical Market as it adapts to the demands of a more environmentally conscious market.

Increased Investment in Oil and Gas Exploration

The Oil And Gas Water Treatment Chemical Market is experiencing growth due to increased investments in oil and gas exploration activities. As exploration efforts expand into more challenging environments, the need for effective water treatment solutions becomes paramount. Companies are investing heavily in technologies that can manage produced water efficiently, which in turn drives the demand for specialized treatment chemicals. Recent reports indicate that exploration and production spending is expected to rise, further fueling the need for advanced water treatment solutions. This trend suggests that the market for water treatment chemicals will continue to expand as companies seek to optimize their operations and comply with environmental regulations, thereby reinforcing the importance of the Oil And Gas Water Treatment Chemical Market.

Regulatory Compliance and Environmental Standards

The Oil And Gas Water Treatment Chemical Market is increasingly influenced by stringent regulatory frameworks aimed at minimizing environmental impact. Governments and regulatory bodies are enforcing laws that mandate the treatment of wastewater before discharge. This has led to a surge in demand for effective water treatment chemicals that comply with these regulations. For instance, the implementation of the Clean Water Act in various regions necessitates the use of advanced treatment solutions, thereby driving market growth. Companies are compelled to invest in innovative chemical solutions that not only meet compliance standards but also enhance operational efficiency. As a result, the market is witnessing a shift towards eco-friendly chemicals that align with sustainability goals, indicating a robust growth trajectory in the Oil And Gas Water Treatment Chemical Market.

Technological Innovations in Chemical Formulations

Technological advancements play a pivotal role in shaping the Oil And Gas Water Treatment Chemical Market. The introduction of novel chemical formulations and treatment technologies has revolutionized the efficiency of water treatment processes. Innovations such as nanotechnology and advanced polymer chemistry are enabling the development of more effective treatment chemicals that can address complex water quality challenges. These advancements not only improve the performance of treatment chemicals but also reduce the overall environmental footprint of oil and gas operations. As companies seek to enhance their treatment capabilities, the market is likely to witness a surge in demand for cutting-edge chemical solutions that leverage these technological innovations, indicating a dynamic evolution within the Oil And Gas Water Treatment Chemical Market.

Rising Water Scarcity and Demand for Efficient Treatment

The Oil And Gas Water Treatment Chemical Market is significantly impacted by the escalating water scarcity issues faced in many regions. As freshwater resources become increasingly limited, the oil and gas sector is under pressure to optimize water usage and treatment processes. This has led to a heightened demand for advanced water treatment chemicals that can effectively treat produced water and facilitate reuse. According to recent estimates, The Oil And Gas Water Treatment Chemical is projected to grow at a compound annual growth rate of over 5% in the coming years. This trend suggests that companies are prioritizing the development of innovative chemical solutions that enhance water recovery and recycling, thereby addressing both operational needs and environmental concerns within the Oil And Gas Water Treatment Chemical Market.