Rising Global Energy Demand

The Oil Refining Market is significantly influenced by the rising global energy demand, which is projected to increase steadily in the coming years. As economies expand and populations grow, the need for energy, particularly in developing regions, is expected to escalate. According to estimates, global energy consumption could rise by over 25% by 2040, necessitating a corresponding increase in refined oil products. This growing demand is likely to compel refiners to enhance their production capacities and invest in infrastructure improvements. Consequently, the Oil Refining Market may experience shifts in supply chain dynamics, as refiners seek to meet the evolving energy needs of diverse markets.

Increasing Demand for Petrochemicals

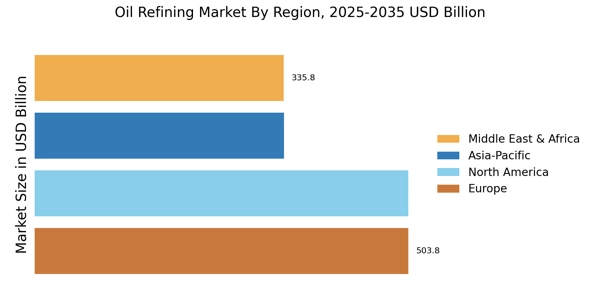

The Oil Refining Market is experiencing a notable surge in demand for petrochemicals, driven by their extensive applications in various sectors such as plastics, textiles, and pharmaceuticals. As industries continue to expand, the need for refined products is projected to grow. In 2025, The Oil Refining Market is expected to reach approximately 600 billion USD, indicating a robust growth trajectory. This increasing demand for petrochemicals is likely to compel refiners to enhance their production capabilities, thereby influencing the overall dynamics of the Oil Refining Market. Furthermore, the integration of advanced refining technologies may facilitate the efficient conversion of crude oil into high-value petrochemical products, potentially reshaping market strategies.

Geopolitical Factors Impacting Oil Supply

The Oil Refining Market is acutely sensitive to geopolitical factors that can disrupt oil supply chains. Events such as conflicts, trade disputes, and sanctions can lead to fluctuations in crude oil prices and availability. For instance, tensions in oil-producing regions can result in supply shortages, prompting refiners to seek alternative sources or adjust their operational strategies. In 2025, it is anticipated that refiners will need to navigate an increasingly complex geopolitical landscape, which may influence their procurement strategies and pricing models. This volatility could drive refiners to enhance their risk management practices, ensuring resilience in the face of potential supply disruptions.

Regulatory Pressure for Emission Reductions

The Oil Refining Market is currently navigating a landscape marked by stringent regulatory frameworks aimed at reducing greenhouse gas emissions. Governments worldwide are implementing policies that mandate lower sulfur content in fuels and promote cleaner refining processes. For instance, regulations such as the European Union's Fuel Quality Directive are pushing refiners to adopt advanced technologies that minimize environmental impact. This regulatory pressure is likely to drive investments in cleaner technologies, which could reshape operational practices within the Oil Refining Market. As refiners adapt to these regulations, they may also explore alternative feedstocks, further diversifying their product offerings and enhancing sustainability.

Technological Advancements in Refining Processes

Technological innovations are playing a pivotal role in transforming the Oil Refining Market. The adoption of advanced refining technologies, such as hydrocracking and catalytic reforming, is enhancing the efficiency and yield of refined products. In 2025, it is anticipated that refiners will increasingly invest in digital technologies, including artificial intelligence and machine learning, to optimize operations and reduce costs. These advancements not only improve the quality of refined products but also enable refiners to respond more effectively to market fluctuations. As a result, the Oil Refining Market is likely to witness a shift towards more agile and responsive operational models, which could enhance competitiveness.