Regulatory Pressures

Regulatory pressures are increasingly influencing the Online Payment Fraud Detection Market. Governments and regulatory bodies are implementing stringent regulations to protect consumers and ensure the security of online transactions. Compliance with these regulations is essential for businesses to avoid hefty fines and reputational damage. For instance, regulations such as the Payment Card Industry Data Security Standard (PCI DSS) mandate that organizations implement robust security measures to safeguard payment data. As a result, companies are compelled to invest in advanced fraud detection solutions to meet compliance requirements. This trend is expected to drive growth in the Online Payment Fraud Detection Market, as organizations prioritize compliance and security in their payment processes. The ongoing evolution of regulatory frameworks will likely continue to shape the market landscape.

Advancements in Technology

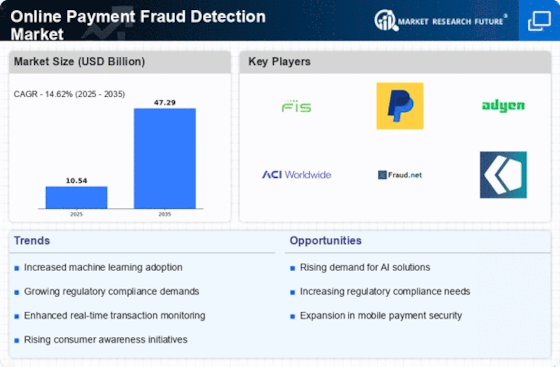

Technological advancements play a crucial role in shaping the Online Payment Fraud Detection Market. Innovations in artificial intelligence and machine learning have enabled the development of sophisticated fraud detection algorithms that can analyze vast amounts of transaction data in real-time. These technologies enhance the ability to identify and mitigate fraudulent activities before they result in significant financial losses. The market is projected to grow as businesses adopt these advanced solutions to stay ahead of potential threats. Furthermore, the integration of biometric authentication methods, such as fingerprint and facial recognition, is gaining traction, providing an additional layer of security. As technology continues to evolve, the Online Payment Fraud Detection Market is likely to expand, driven by the need for more effective and efficient fraud prevention measures.

Rising Cybersecurity Threats

The increasing prevalence of cybersecurity threats is a significant driver for the Online Payment Fraud Detection Market. As cybercriminals become more sophisticated, the risk of online payment fraud escalates, prompting businesses to enhance their security measures. Reports indicate that cyberattacks targeting payment systems have surged, with financial losses reaching billions annually. This alarming trend has led organizations to recognize the necessity of investing in effective fraud detection solutions to safeguard their assets and customer information. The Online Payment Fraud Detection Market is thus experiencing robust growth as companies seek to mitigate risks associated with online transactions. The urgency to address these threats is likely to propel further advancements in fraud detection technologies, ensuring that businesses remain resilient against evolving cyber threats.

Increase in Online Transactions

The rise in online transactions is a primary driver for the Online Payment Fraud Detection Market. As consumers increasingly prefer digital payment methods, the volume of online transactions has surged. According to recent data, e-commerce sales have reached unprecedented levels, with estimates suggesting a growth rate of over 15% annually. This surge in transactions creates a fertile ground for fraudulent activities, prompting businesses to invest in robust fraud detection solutions. The Online Payment Fraud Detection Market is thus witnessing heightened demand as organizations seek to protect their revenue and maintain customer trust. The need for effective fraud detection mechanisms is further underscored by the increasing sophistication of cybercriminals, who continuously evolve their tactics to exploit vulnerabilities in online payment systems.

Consumer Awareness and Demand for Security

Consumer awareness regarding online security is a pivotal driver for the Online Payment Fraud Detection Market. As individuals become more informed about the risks associated with online transactions, they increasingly demand secure payment options. This heightened awareness has led consumers to favor businesses that prioritize security measures, influencing companies to adopt advanced fraud detection solutions. Market data suggests that a significant percentage of consumers are willing to abandon a transaction if they perceive security risks, underscoring the importance of trust in online payments. Consequently, businesses are compelled to invest in the Online Payment Fraud Detection Market to meet consumer expectations and maintain competitive advantage. The growing demand for secure payment methods is likely to continue shaping the market, as organizations strive to enhance their security protocols and build consumer confidence.