Rising Healthcare Costs

The escalating costs associated with healthcare in the US are driving the medical payment-fraud-detection market. As expenditures on healthcare services continue to rise, estimated to reach $6 trillion by 2027, the financial burden on both providers and patients intensifies. This situation creates an environment ripe for fraudulent activities, prompting healthcare organizations to invest in advanced fraud detection systems. The medical payment-fraud-detection market is thus experiencing increased demand as stakeholders seek to mitigate losses attributed to fraudulent claims, which are estimated to account for approximately 10% of total healthcare spending. Consequently, the need for effective fraud detection solutions becomes paramount, as organizations aim to protect their financial resources and ensure the integrity of healthcare services.

Technological Advancements

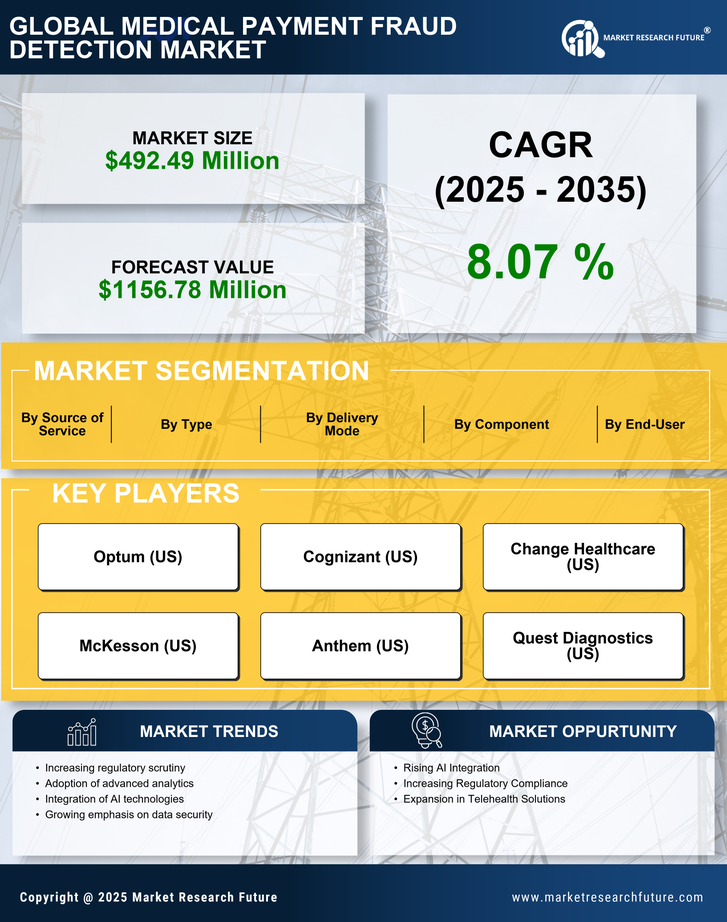

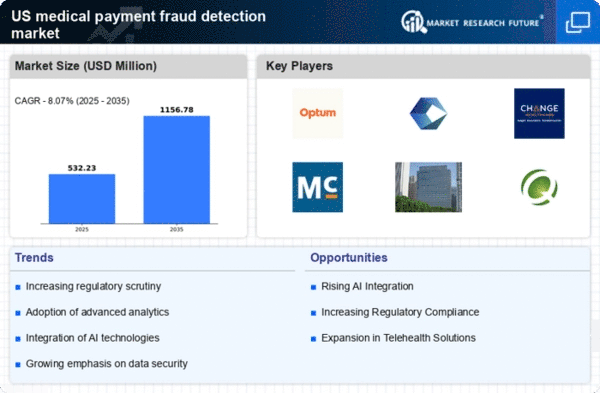

Rapid advancements in technology are significantly influencing the medical payment-fraud-detection market. Innovations such as machine learning, big data analytics, and blockchain are being integrated into fraud detection systems, enhancing their effectiveness. For instance, machine learning algorithms can analyze vast datasets to identify patterns indicative of fraudulent behavior, potentially reducing false positives by up to 30%. As healthcare providers increasingly adopt these technologies, the market is expected to grow, with projections indicating a compound annual growth rate (CAGR) of 20% over the next five years. This technological evolution not only improves detection capabilities but also streamlines the claims process, thereby fostering a more efficient healthcare system.

Increased Regulatory Scrutiny

heightened regulatory scrutiny within the healthcare sector is propelling the medical payment-fraud-detection market. Regulatory bodies are implementing stricter compliance measures to combat fraud, waste, and abuse in healthcare spending. For example, the Centers for Medicare & Medicaid Services (CMS) has introduced initiatives aimed at reducing improper payments, which have historically reached billions of dollars annually. As a result, healthcare organizations are compelled to adopt robust fraud detection mechanisms to comply with these regulations. This trend is likely to drive market growth, as organizations invest in solutions that not only meet regulatory requirements but also enhance their operational efficiency and protect against financial losses.

Shift Towards Value-Based Care

The transition from fee-for-service to value-based care models is influencing the medical payment-fraud-detection market. In value-based care, providers are incentivized to deliver high-quality services rather than volume, which can inadvertently create opportunities for fraud. As healthcare organizations adapt to this new model, they are increasingly focused on implementing effective fraud detection systems to ensure compliance and protect their revenue streams. This shift is expected to drive market growth, as organizations seek to align their operations with value-based care principles while minimizing the risk of fraudulent claims. The emphasis on quality over quantity necessitates robust fraud detection mechanisms to maintain financial viability.

Growing Awareness of Fraudulent Activities

There is a growing awareness among healthcare stakeholders regarding the prevalence of fraudulent activities, which is significantly impacting the medical payment-fraud-detection market. As healthcare fraud becomes more visible, with high-profile cases garnering media attention, organizations are increasingly prioritizing fraud prevention strategies. This heightened awareness is leading to greater investments in fraud detection technologies and training programs for staff. The market is expected to benefit from this trend, as organizations recognize the importance of safeguarding their financial assets and maintaining trust with patients and payers. The proactive approach to fraud detection is likely to enhance the overall integrity of the healthcare system.