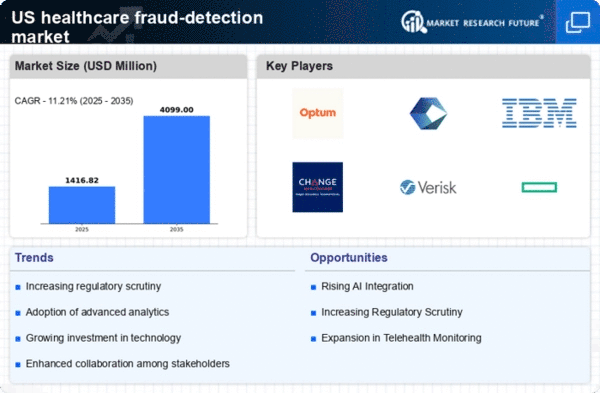

The healthcare fraud-detection market is currently characterized by a dynamic competitive landscape, driven by the increasing need for advanced analytics and compliance solutions. Key players such as Optum (US), Cognizant (US), and IBM (US) are strategically positioned to leverage their technological capabilities and extensive data resources. Optum (US) focuses on integrating artificial intelligence (AI) into its fraud detection systems, enhancing predictive analytics to identify fraudulent activities more effectively. Cognizant (US) emphasizes partnerships with healthcare providers to develop tailored solutions that address specific fraud risks, while IBM (US) invests heavily in blockchain technology to ensure data integrity and transparency in transactions. Collectively, these strategies foster a competitive environment that prioritizes innovation and technological advancement. In terms of business tactics, companies are increasingly localizing their operations and optimizing supply chains to enhance responsiveness to market demands. The market structure appears moderately fragmented, with several players vying for market share, yet the influence of major companies remains substantial. This competitive structure allows for a diverse range of solutions, catering to various segments within the healthcare sector, while also fostering collaboration among key players to address common challenges. In October 2025, Optum (US) announced a partnership with a leading health insurance provider to implement a new AI-driven fraud detection system. This strategic move is significant as it not only expands Optum's market reach but also enhances its capabilities in real-time fraud detection, potentially reducing losses for insurers and improving patient trust. The collaboration underscores the importance of integrating advanced technologies into existing frameworks to combat fraud effectively. In September 2025, Cognizant (US) launched a comprehensive fraud detection platform that utilizes machine learning algorithms to analyze claims data. This initiative is crucial as it positions Cognizant at the forefront of technological innovation in the market, allowing for more accurate identification of fraudulent claims. The platform's ability to adapt and learn from new data sets could significantly enhance its effectiveness over time, thereby attracting more clients seeking robust fraud prevention solutions. In August 2025, IBM (US) unveiled a blockchain-based solution aimed at improving transparency in healthcare transactions. This development is particularly relevant as it addresses the growing concerns regarding data security and integrity in the healthcare sector. By leveraging blockchain technology, IBM (US) not only enhances its fraud detection capabilities but also sets a precedent for other companies to follow, potentially reshaping industry standards. As of November 2025, current trends in the healthcare fraud-detection market indicate a strong shift towards digitalization, AI integration, and sustainability. Strategic alliances among companies are increasingly shaping the competitive landscape, fostering innovation and collaboration. Looking ahead, it appears that competitive differentiation will evolve from traditional price-based strategies to a focus on technological innovation, reliability in supply chains, and the ability to provide comprehensive, data-driven solutions. This shift may redefine how companies position themselves in the market, emphasizing the importance of adaptability and forward-thinking in a rapidly changing environment.