Rising Geriatric Population

The increasing geriatric population is a significant factor contributing to the growth of the Opioid Induced Constipation Drug Market. Older adults are more likely to be prescribed opioids for chronic pain conditions, which subsequently raises the risk of developing opioid-induced constipation.

Data suggests that the elderly population is projected to reach 1.5 billion by 2050, indicating a substantial market for OIC treatments. As this demographic continues to expand, the demand for effective management of OIC will likely increase, prompting pharmaceutical companies to focus on developing targeted therapies. This demographic shift underscores the importance of addressing OIC in the context of aging populations, thereby driving the Opioid Induced Constipation Drug Market.

Increasing Prevalence of Opioid Use

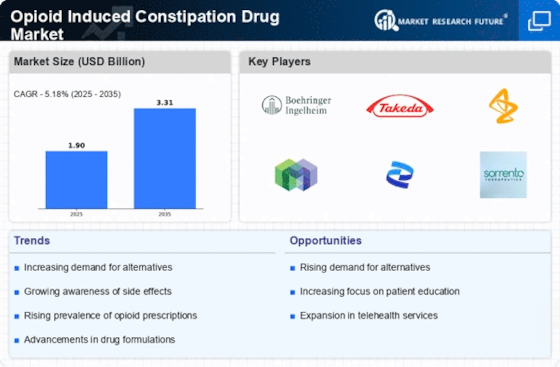

The rising prevalence of opioid prescriptions for chronic pain management is a primary driver of the Opioid Induced Constipation Drug Market. As healthcare providers increasingly rely on opioids to treat various conditions, the incidence of opioid-induced constipation (OIC) has escalated. Reports indicate that approximately 40% of patients on chronic opioid therapy experience OIC, leading to a growing need for effective treatment options.

This trend suggests that as the number of opioid prescriptions continues to rise, so too will the demand for drugs specifically targeting OIC. Consequently, pharmaceutical companies are likely to invest in research and development to create innovative solutions, thereby expanding the Opioid Induced Constipation Drug Market.

Regulatory Support for OIC Treatments

Regulatory bodies are increasingly recognizing the need for effective treatments for opioid-induced constipation, which serves as a significant driver for the Opioid Induced Constipation Drug Market. Recent guidelines from health authorities emphasize the importance of addressing OIC as a critical aspect of opioid therapy management.

This regulatory support not only encourages the development of new drugs but also facilitates faster approval processes for existing treatments. As a result, pharmaceutical companies are motivated to enhance their product offerings, leading to a more competitive landscape within the Opioid Induced Constipation Drug Market. The potential for increased market access and reimbursement options further bolsters the attractiveness of investing in OIC therapies.

Growing Awareness Among Healthcare Professionals

There is a notable increase in awareness among healthcare professionals regarding the implications of opioid-induced constipation, which is driving the Opioid Induced Constipation Drug Market. Educational initiatives and training programs are being implemented to inform clinicians about the prevalence and management of OIC. This heightened awareness is likely to result in more proactive screening and treatment of OIC in patients receiving opioid therapy.

As healthcare providers become more knowledgeable about the available treatment options, the demand for effective OIC drugs is expected to rise. This trend indicates a shift towards a more comprehensive approach to pain management, thereby enhancing the growth potential of the Opioid Induced Constipation Drug Market.

Technological Advancements in Drug Delivery Systems

Technological advancements in drug delivery systems are poised to transform the Opioid Induced Constipation Drug Market. Innovations such as sustained-release formulations and targeted delivery mechanisms are enhancing the efficacy and patient compliance of OIC treatments. These advancements not only improve the therapeutic outcomes but also reduce the side effects associated with traditional opioid therapies.

As pharmaceutical companies leverage these technologies to develop more effective OIC drugs, the market is likely to witness an influx of novel products. This trend indicates a shift towards more sophisticated treatment options, which could significantly enhance the overall landscape of the Opioid Induced Constipation Drug Market.