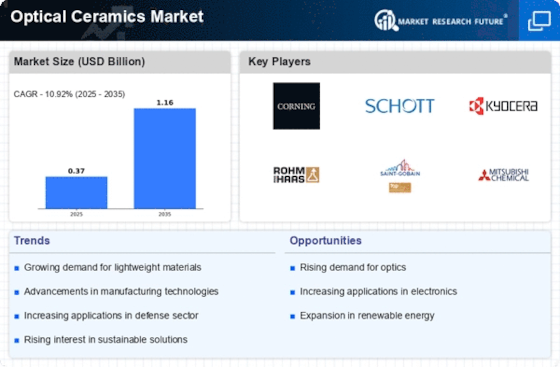

Market Share

Introduction: Navigating the Competitive Landscape of Optical Ceramics

The optical ceramics market is witnessing a transformative shift driven by rapid technology adoption and evolving consumer expectations, compelling industry players to recalibrate their strategies. Key participants, including OEMs, IT integrators, and specialized startups, are fiercely competing for market leadership by leveraging advanced technologies such as AI-based analytics and IoT integration. These innovations not only enhance product performance but also streamline manufacturing processes, creating significant competitive advantages. Furthermore, the rise of green infrastructure initiatives is prompting vendors to adopt sustainable practices, thereby appealing to environmentally conscious consumers. As regional markets, particularly in Asia-Pacific and North America, exhibit robust growth potential, strategic deployment trends are increasingly focused on localized production and supply chain optimization. This dynamic environment necessitates that C-level executives and strategic planners remain agile, continuously assessing the impact of regulatory shifts and technological advancements on their market positioning.

Competitive Positioning

Full-Suite Integrators

These vendors offer comprehensive solutions across the optical ceramics spectrum, integrating various technologies and services.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Saint-Gobain | Diverse product portfolio and global reach | Optical ceramics and materials | Global |

| General Electric | Strong innovation and R&D capabilities | Advanced optical materials | North America, Europe |

| Koninklijke Philips N.V. | Focus on health and well-being applications | Optical components for healthcare | Europe, Asia |

Specialized Technology Vendors

These companies focus on niche technologies and specialized applications within the optical ceramics market.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Surmet Corporation | Expertise in advanced ceramics and coatings | Optical ceramics for defense and aerospace | North America |

| CeramTec | High-performance ceramic solutions | Industrial and technical ceramics | Global |

| CILAS Arianegroup | Innovative laser and optics solutions | Optical ceramics for laser applications | Europe |

Infrastructure & Equipment Providers

These vendors supply the necessary infrastructure and equipment to support the production and application of optical ceramics.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| CoorsTek Inc. | Leading manufacturer of engineered ceramics | Ceramic materials and components | North America, Asia |

| Murata Manufacturing Co. Ltd | Strong focus on electronic components | Ceramics for electronic applications | Asia, Global |

| Schott AG | Expertise in glass and glass-ceramics | Optical glass and ceramics | Global |

| Kyocera Corporation | Diverse technology applications | Ceramics for electronics and optics | Asia, North America |

| Brightcrystals Technology Inc. | Focus on high-quality optical materials | Optical ceramics for display technologies | China, Asia |

| Shanghai SICCAS | Strong local manufacturing capabilities | Optical ceramics for various applications | China |

| Konoshima Chemicals Co. Ltd | Specialization in fine ceramics | Optical ceramics for industrial use | Japan, Asia |

Research & Development Leaders

These vendors are recognized for their significant contributions to R&D in optical ceramics, driving innovation and new applications.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| II-VI Optical Systems Inc. | Strong focus on optical systems and components | Optical ceramics for telecommunications | North America, Global |

Emerging Players & Regional Champions

- CeramTec (Germany): Specializes in high-performance optical ceramics for laser applications, recently secured a contract with a leading aerospace company for advanced optical components, challenging established vendors by offering customized solutions with shorter lead times.

- Nikon Corporation (Japan): Offers precision optical ceramics for imaging systems, recently implemented a partnership with a major electronics manufacturer to develop next-gen optical sensors, complementing established players by integrating advanced imaging technologies.

- Rohm Co., Ltd. (Japan): Focuses on optical ceramics for LED applications, recently launched a new line of high-efficiency optical materials, positioning itself as a challenger to traditional vendors by emphasizing sustainability and energy efficiency.

- Schott AG (Germany): Provides specialized optical ceramics for medical and industrial applications, recently expanded its production capabilities in Asia, enhancing its competitive edge against established players by increasing local supply chains.

Regional Trends: In 2024, there is a notable increase in the adoption of optical ceramics in Asia-Pacific, driven by the growing demand for advanced imaging and sensor technologies in electronics and automotive sectors. Additionally, there is a trend towards specialization in high-performance materials that cater to niche applications, such as aerospace and medical devices, reflecting a shift in focus from general-purpose ceramics to tailored solutions.

Collaborations & M&A Movements

- CeramTec and Schott AG entered into a partnership to develop advanced optical ceramics for high-performance laser applications, aiming to enhance their competitive positioning in the growing laser technology market.

- CoorsTek acquired the optical ceramics division of Corning Inc. in early 2024 to expand its product portfolio and strengthen its market share in the optical components sector.

- Kyocera and 3M collaborated to innovate new optical ceramic materials for use in consumer electronics, targeting the increasing demand for lightweight and durable components.

Competitive Summary Table

| Capability | Leading Players | Remarks |

|---|---|---|

| High-Temperature Stability | CeramTec, Kyocera | CeramTec has developed advanced formulations that enhance thermal stability, making their optical ceramics suitable for high-performance applications in aerospace. Kyocera's proprietary processing techniques allow for superior thermal shock resistance, as demonstrated in their recent product line for industrial lasers. |

| Optical Clarity | Schott AG, Corning | Schott AG's optical ceramics are renowned for their exceptional clarity and low absorption rates, which are critical for high-precision optics. Corning's innovative glass-ceramic materials have been successfully used in high-end consumer electronics, showcasing their optical clarity in real-world applications. |

| Customization and Flexibility | Rohm and Haas, Mitsubishi Materials | Rohm and Haas offers tailored solutions for specific customer needs, allowing for unique optical properties in their ceramics. Mitsubishi Materials has a strong reputation for flexibility in production, enabling rapid prototyping and customization for niche markets. |

| Sustainability | Saint-Gobain, Nippon Electric Glass | Saint-Gobain has implemented eco-friendly manufacturing processes that reduce waste and energy consumption, positioning them as a leader in sustainable optical ceramics. Nippon Electric Glass has introduced recycled materials in their production, enhancing their sustainability profile while maintaining performance. |

| Cost-Effectiveness | NGK Insulators, Hoya Corporation | NGK Insulators has optimized their production processes to lower costs without compromising quality, making their products attractive for budget-sensitive applications. Hoya Corporation's economies of scale allow them to offer competitive pricing while maintaining high standards in optical performance. |

Conclusion: Navigating the Optical Ceramics Landscape

The Optical Ceramics market in 2024 is characterized by intense competitive dynamics and significant fragmentation, with both legacy and emerging players vying for market share. Regional trends indicate a growing demand in Asia-Pacific and North America, prompting vendors to adapt their strategies accordingly. Legacy players are leveraging established brand equity and advanced manufacturing capabilities, while emerging companies are focusing on innovation and niche applications. To gain a competitive edge, vendors must prioritize capabilities such as AI integration for enhanced product development, automation for cost efficiency, sustainability practices to meet regulatory demands, and flexibility in production to respond to market shifts. As the landscape evolves, decision-makers must align their strategies with these capabilities to secure leadership positions in the Optical Ceramics market.

Leave a Comment