Market Trends

Introduction

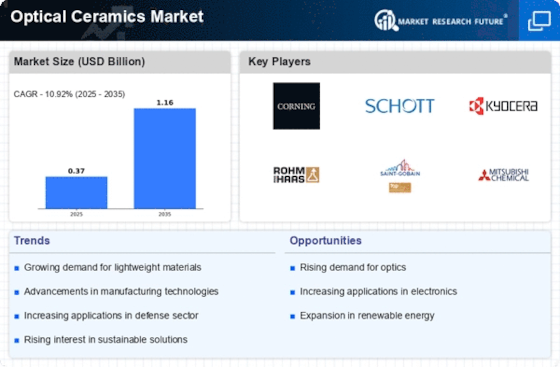

As we enter 2024, the Optical Ceramics market is poised for significant evolution, driven by a confluence of macro factors including rapid technological advancements, increasing regulatory pressures, and shifting consumer behaviors. Innovations in materials science are enhancing the performance and applications of optical ceramics, particularly in sectors such as telecommunications, defense, and consumer electronics. Concurrently, regulatory frameworks are becoming more stringent, necessitating compliance with environmental and safety standards, which in turn influences manufacturing processes and product development. Additionally, changing consumer preferences towards high-performance and sustainable materials are reshaping market dynamics. For stakeholders, understanding these trends is crucial, as they not only dictate competitive positioning but also inform strategic decisions in product development and market entry.

Top Trends

-

Increased Demand for High-Performance Optical Components

The demand for high-performance optical components is surging, driven by advancements in telecommunications and consumer electronics. Companies like General Electric are investing in R&D to enhance optical ceramics' performance, leading to a 15% increase in production capacity. This trend is expected to push manufacturers to innovate, resulting in more efficient and durable optical products. -

Sustainability Initiatives in Manufacturing

Sustainability is becoming a priority, with companies adopting eco-friendly practices in optical ceramics production. For instance, Saint-Gobain has implemented a recycling program that has reduced waste by 20%. This shift not only meets regulatory requirements but also appeals to environmentally conscious consumers, potentially influencing purchasing decisions in the market. -

Integration of Smart Technologies

The integration of smart technologies into optical ceramics is on the rise, with applications in augmented reality and smart glasses. Murata Manufacturing is leading this trend by developing lightweight, high-transmittance ceramics. This innovation is expected to enhance user experience and open new market segments, particularly in consumer electronics. -

Expansion in Aerospace and Defense Applications

Optical ceramics are increasingly being utilized in aerospace and defense sectors for their durability and performance. Companies like II-VI Optical Systems are supplying advanced materials for military applications, which has led to a 10% increase in contracts. This trend is likely to expand as defense budgets grow, creating new opportunities for manufacturers. -

Emergence of Customized Optical Solutions

Customization in optical ceramics is gaining traction, with firms offering tailored solutions to meet specific client needs. CeraNova has reported a 30% increase in custom orders, reflecting a shift towards personalized products. This trend is expected to drive competition and innovation, as companies strive to differentiate their offerings. -

Advancements in Manufacturing Techniques

Innovative manufacturing techniques, such as additive manufacturing, are transforming the production of optical ceramics. CoorsTek has adopted 3D printing methods, resulting in reduced lead times and costs. This trend is likely to enhance operational efficiency and enable rapid prototyping, fostering a more agile market environment. -

Growth in Medical Applications

The use of optical ceramics in medical devices is expanding, particularly in imaging and diagnostic equipment. Schott AG has developed specialized ceramics for endoscopic applications, contributing to a 25% increase in market penetration. This trend is expected to continue as healthcare technology advances, creating new revenue streams for manufacturers. -

Global Supply Chain Optimization

Optimizing global supply chains is becoming critical for optical ceramics manufacturers to mitigate risks and reduce costs. Companies like Koninklijke Philips N.V. are investing in supply chain technologies, leading to a 15% improvement in logistics efficiency. This trend is likely to enhance competitiveness and resilience in the market. -

Regulatory Compliance and Quality Standards

Stringent regulatory compliance and quality standards are shaping the optical ceramics market, with companies needing to adhere to international guidelines. For example, compliance with ISO standards has become essential for market entry. This trend is expected to drive investment in quality assurance processes, impacting operational costs and product pricing. -

Collaboration and Partnerships for Innovation

Collaboration among industry players is fostering innovation in optical ceramics. Partnerships between companies like Brightcrystals Technology and research institutions have led to breakthroughs in material properties. This trend is likely to accelerate technological advancements and enhance product offerings, positioning companies for future growth.

Conclusion: Navigating the Optical Ceramics Landscape

The Optical Ceramics market in 2024 is characterized by intense competitive dynamics and significant fragmentation, with both legacy and emerging players vying for market share. Regional trends indicate a growing demand in Asia-Pacific and North America, prompting vendors to adapt their strategies accordingly. Legacy players are leveraging established brand equity and manufacturing expertise, while emerging companies are focusing on innovation and agility to capture niche segments. Key capabilities such as AI integration, automation in production processes, sustainability initiatives, and operational flexibility will be critical in determining market leadership. Vendors must prioritize these capabilities to enhance their competitive positioning and respond effectively to evolving customer demands.

Leave a Comment