Optical Ceramics Size

Market Size Snapshot

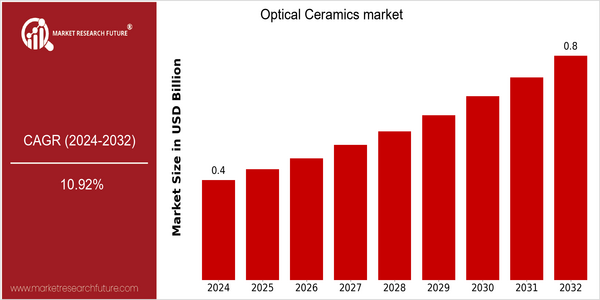

| Year | Value |

|---|---|

| 2024 | USD 0.37 Billion |

| 2032 | USD 0.85 Billion |

| CAGR (2024-2032) | 10.92 % |

Note – Market size depicts the revenue generated over the financial year

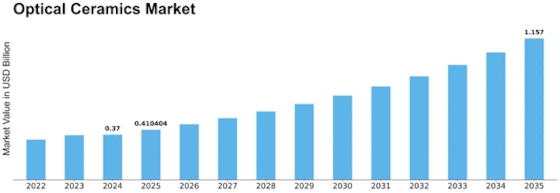

The global optical ceramics market is poised for significant growth, with a current market size of USD 0.37 billion in 2024 projected to expand to USD 0.85 billion by 2032. This growth trajectory reflects a robust compound annual growth rate (CAGR) of 10.92% over the forecast period. The increasing demand for high-performance optical materials in various applications, including telecommunications, consumer electronics, and defense, is a primary driver of this market expansion. As industries continue to seek advanced materials that offer superior optical properties and durability, optical ceramics are becoming increasingly essential.

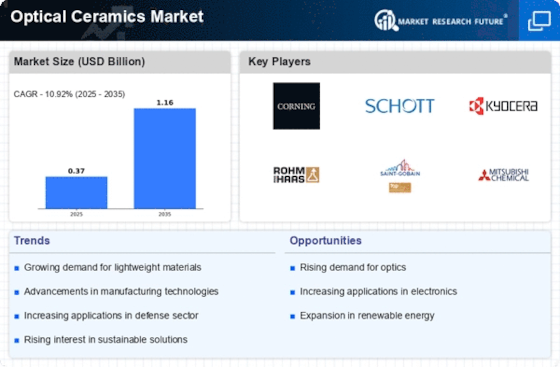

Technological advancements, particularly in manufacturing processes and material innovations, are further propelling the market forward. Companies are investing in research and development to enhance the performance characteristics of optical ceramics, such as transparency, thermal stability, and resistance to environmental factors. Key players in the market, including Corning Incorporated, Schott AG, and II-VI Incorporated, are actively pursuing strategic initiatives such as partnerships and product launches to strengthen their market position. For instance, recent collaborations aimed at developing next-generation optical components highlight the industry's commitment to innovation and meeting the evolving needs of end-users.

Regional Market Size

Regional Deep Dive

The Optical Ceramics market is experiencing significant growth across various regions, driven by advancements in technology and increasing demand for high-performance optical components. In North America, the market is characterized by a strong presence of key players and a focus on innovation, particularly in the aerospace and defense sectors. Europe showcases a robust market with a focus on research and development, while Asia-Pacific is rapidly emerging as a manufacturing hub due to its cost advantages and expanding electronics industry. The Middle East and Africa are witnessing gradual growth, influenced by investments in infrastructure and technology, while Latin America is beginning to explore opportunities in optical ceramics, albeit at a slower pace.

Europe

- The European Union has launched initiatives to promote sustainable manufacturing practices in the optical ceramics industry, encouraging companies to adopt eco-friendly materials and processes.

- Key players such as Schott AG and CeramTec GmbH are collaborating with research institutions to develop next-generation optical ceramics, focusing on applications in medical technology and automotive sectors.

Asia Pacific

- China's rapid industrialization and technological advancements have led to increased demand for optical ceramics in consumer electronics, with companies like Jinghua Optical and Hubei Yihua Chemical Group leading the charge.

- Japan's focus on precision manufacturing and innovation in optical technologies is fostering the development of high-quality optical ceramics, particularly for use in high-end imaging systems.

Latin America

- Brazil is beginning to see investments in the optical ceramics market, particularly in the telecommunications sector, as local companies seek to enhance their technological capabilities.

- Regulatory changes in Argentina are encouraging foreign investment in high-tech industries, including optical ceramics, which may lead to increased market activity in the region.

North America

- The U.S. Department of Defense has initiated several projects aimed at enhancing optical materials for military applications, which is driving innovation in the optical ceramics sector.

- Companies like Corning Incorporated and II-VI Incorporated are investing heavily in R&D to develop advanced optical ceramics for telecommunications and consumer electronics, reflecting a trend towards miniaturization and improved performance.

Middle East And Africa

- The UAE is investing in smart city projects that require advanced optical materials, creating opportunities for optical ceramics in urban infrastructure and smart technologies.

- South Africa's growing interest in renewable energy technologies is driving demand for optical ceramics in solar energy applications, supported by government initiatives to promote green energy.

Did You Know?

“Optical ceramics can withstand extreme temperatures and are often used in applications ranging from aerospace to medical devices, showcasing their versatility and importance in high-tech industries.” — Optical Society of America

Segmental Market Size

The Optical Ceramics segment plays a crucial role in the overall market, currently experiencing stable growth driven by advancements in material science and increasing demand for high-performance optical components. Key factors propelling this segment include the rising need for lightweight and durable materials in industries such as aerospace and defense, as well as the growing adoption of optical ceramics in consumer electronics for enhanced display technologies. Regulatory policies promoting energy efficiency and sustainability further bolster demand for these materials.

Currently, the adoption of optical ceramics is in the scaled deployment stage, with companies like Schott AG and II-VI Incorporated leading the way in production and innovation. Primary applications include high-energy laser systems, optical windows, and sensors, particularly in military and medical devices. Trends such as the push for sustainable manufacturing practices and the integration of smart technologies in optics are accelerating growth. Additionally, advancements in fabrication techniques, such as additive manufacturing, are shaping the evolution of this segment, enabling more complex designs and improved performance.

Future Outlook

The Optical Ceramics market is poised for significant growth from 2024 to 2032, with a projected market value increase from $0.37 billion to $0.85 billion, reflecting a robust compound annual growth rate (CAGR) of 10.92%. This growth trajectory is underpinned by the increasing demand for advanced optical materials in various applications, including telecommunications, defense, and consumer electronics. As industries continue to prioritize high-performance materials that offer superior optical properties, the penetration of optical ceramics is expected to rise, with usage rates potentially reaching 25% in key sectors by 2032.

Key technological advancements, such as the development of new fabrication techniques and the integration of optical ceramics in next-generation photonic devices, are expected to drive market expansion. Additionally, supportive government policies aimed at fostering innovation in materials science and manufacturing processes will further enhance the market landscape. Emerging trends, including the growing emphasis on miniaturization and energy efficiency in electronic devices, will also contribute to the increasing adoption of optical ceramics. As a result, stakeholders in the optical ceramics market should prepare for a dynamic environment characterized by rapid technological evolution and expanding application horizons.

Leave a Comment