Research Methodology on Organic Feed Additives Market

This research report investigates the market forces influencing the organic feed additives market. It aids in understanding the key market drivers, restraints, opportunities, and trends influencing the market growth. It also looks at the market attractiveness and competitive landscape in the organic feed additives market. This market research report provides a comprehensive analysis using a bottom-up and a top-down approach. This report further presents the competitive analysis and detailed profiling of major players operating in the organic feed additives market, which includes their business overview, financials, strategies, and product offerings for the estimated forecast period 2023 to 2030.

Information Procurement Process

The information procurement process adopted for the market research report is based on two approaches: primary and secondary. The primary research approach includes interviews and surveys with company representatives, industry personnel, C-level professionals, and industry bodies across the value chain. The information includes estimations and forecasts for the market, assumptions, and in-depth market knowledge gained from the opinion of experts in the industry.

The secondary research approach involves the collation of data from industry-specific databases, press releases, investor presentations, annual reports, white papers, third-party databases, published articles, industry bodies, and data compilations by the company. It also includes research studies and reports, intelligence reports, industry publications, market intelligence reports, and sourced credit ratings.

Approaches Used

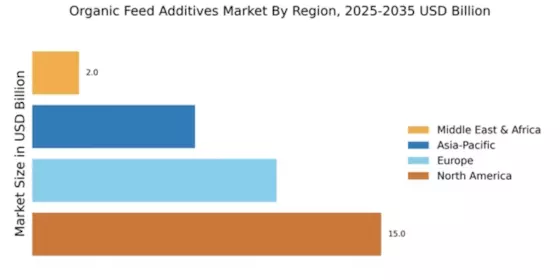

The bottom-up approach was used in this research project to estimate the total size of the organic feed additives market, which includes organic feed preservatives, organic dietary supplements, organic anticoccidials, organic enzymes and nutritive additives, organic acidifiers, and organic essential oils. The bottom-up approach was based on individual market sizes of the organic feed additives product segments, product types, species, and regions.

Besides, a top-down approach was used to validate the bottom-up approach with estimates derived from regional market size, by species, product type, and organic feed additives product segment. Further, the market figures were validated through primary and secondary research. Additionally, demand-side and supply-side data triangulation ensured the precision of estimations and accuracy of forecasts in the report.

Finally, the market figures were validated through several interviews with key opinion leaders of the organic feed additives market. Factors driving the growth, constraints, opportunities, and trends were corroborated by several stakeholders. Factor analysis, time-series analysis, and regression analysis were some of the major tools used in the research methodology.