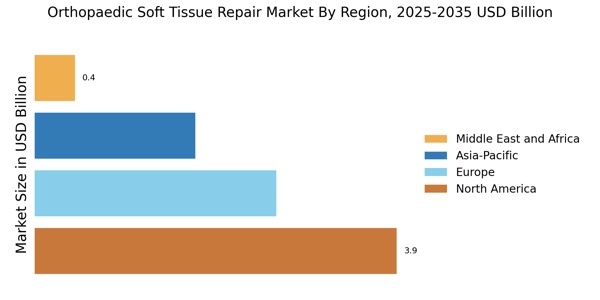

Based on region, the Orthopaedic Soft Tissue Repair Market has been segmented into North America, Europe, Asia-Pacific, and the Rest of the World. North America accounted for the largest market share in 2024 and is anticipated to reach during the forecast period. However, Asia-Pacific is projected to grow to the highest CAGR during the forecast period.

The North America’s orthopaedic soft tissue repair market is experiencing robust growth, driven by several key factors including an aging population, increasing sports-related injuries, rising demand for minimally invasive surgeries, and technological advancements in surgical techniques and implants. The U.S. dominates the region, followed by Canada, with Mexico also contributing to the market’s overall expansion. Below is an overview of the key elements shaping this dynamic market. According to an article released by the Osteoarthritis Research Society International, 700,000 of the 1 million knee arthroscopies performed each year in the United States involve the meniscus.

Furthermore, the National Safety Council of the United States reports that sports and leisure injuries will rise by 20% in 2021 and 12% in 2022, respectively. Rising healthcare expenditure and infrastructure investments are another significant driver of regional prosperity. Increasing healthcare spending can make costly soft tissue repair operations more affordable. In 2023, US had the biggest share of the market in North America for orthopedic soft tissue products.

Because of the existence of numerous important market participants in the country focused on fresh developments and product launches, as well as the growing senior population and the increasing prevalence of sports-related injuries.

Furthermore, the orthopedic soft tissue repair market in Europe is expected to increase significantly over the forecast period. The market is driven by the existence of important players who rely on innovation, strategic collaborations, and product advancements to preserve their position. Furthermore, factors such as an aging population, higher occurrence of sports-related injuries, and developments in surgical procedures and materials such as Tissue Patch, xenograft, and biological mesh drive the market expansion. The UK orthopedic soft tissue repair market is expected to develop at the quickest rate in Europe throughout the forecast period.

Because of the increasing amount of soft tissue injuries, a bioengineered, synthetic patch is expected to drive market expansion in the country. Manufacturers and government groups frequently collaborate to introduce novel treatment settings to the country. For example, in February 2023, James Lind Alliance formed a partnership with the British Association for Surgery of the Knee (BASK), the British Orthopaedic Association (BOA), and the British Orthopaedic Sports Trauma and Arthroscopy Association (BOSTAA) to manage patients with soft tissue knee injuries in the country. Furthermore, the increasing senior population is expected to fuel the country's demand for soft tissue repair products.

The orthopedic soft tissue repair market in Asia Pacific is expected to develop at the fastest CAGR over the forecast period, owing to rising musculoskeletal problems and disposable income. The increased penetration of local medical equipment makers is creating considerable potential opportunities for the region's orthopedic soft tissue repair market. Other significant factors boosting the market include continuous research in sports medicine and advanced wound management, notably in Japan and India, which are emerging as medical tourism hubs. This is owing to the reduced cost of medical operations in these nations compared to developed countries in Europe.

The orthopedic soft tissue repair market is predicted to rise significantly throughout the forecast period, driven by an increase in the occurrence of traumatic and accidental injuries, as well as a growing demand for effective surgical solutions. The market is backed by a competitive landscape, with leading companies employing a variety of methods, such as product launches, to increase market presence. For example, in January 2022, Smith+Nephew announced the expansion of its Next-Gen portable robotics platform, CORI Surgical System, in Japan.

This extension seeks to provide robotic-assisted surgery with low set-up time and portability for a variety of procedures, including knee surgery.

The orthopedic soft tissue repair market in MEA is expected to increase significantly during the forecast period. The expanding number of sports medicine centers in developing and established countries is largely concerned with early detection and prevention of sports-related injuries. In addition, numerous worldwide firms have expanded their distribution routes into the region. For example, in May 2019, CollPlant worked with Arthrex to renew their distribution deal. Arthrex continues to provide CE Marked Vergenix STR, a treatment for tendinopathy, in Europe, the Middle East, India, and a few African countries.

This collaboration seeks to increase the accessibility and availability of new regenerative medicine treatments for patients in the region. According to recent studies published in June 2023, the prevalence of ACL tears in the UAE is estimated at 31 percent. Various prevention training programs (PTPs) are being coordinated to reduce the burden throughout the country. In March 2024, Lifespan Sports Medicine Center Clinic LLC launched a collaborative partnership with Digital Inc. of Canada. This alliance aims to create a membership-based and comprehensive longevity program called 'Health Span' in Dubai.

This collaboration intends to rethink the concept of healthy living and promote preventive measures through a personalized program that will help patients with rehabilitation and diagnostic solutions.