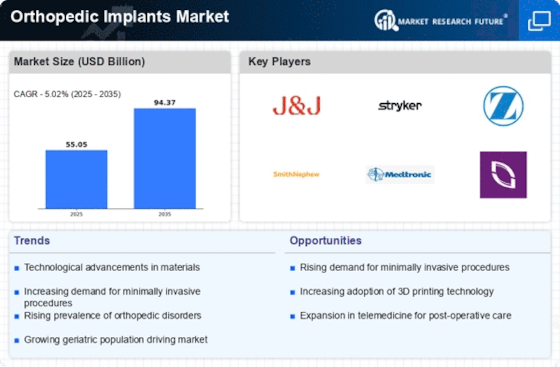

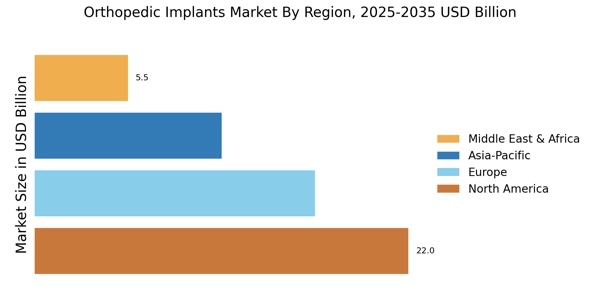

DEC 2025: The orthopedic implants market is experiencing strong momentum as demand rises for joint reconstruction, trauma fixation, and spine implants driven by aging populations and elective-surgery recovery. Manufacturers are accelerating R&D in 3D-printed implants and robotic-assisted surgical systems, with several companies expanding production capacity to meet post-pandemic surgical backlogs. Regulatory agencies in major markets are also issuing updated guidelines for implant safety and tracking, prompting digitalization across supply chains. Analysts expect continued investment in bioactive coatings and personalized implants as hospitals shift toward value-based orthopedic care.

March 2022: Zimmer Biomet announced the debut of WalkAI. The Artificial Intelligence (AI) algorithm identifies patients whose post-hip replacement walking pace is expected to be slower. The company's ZBEdge Connected Intelligence Suite, which incorporates the WalkAI further, gives it a competitive edge in the bone implants market.

January 2022: Announcing the purchase of Engage Surgical, Smith & Nephew The investment is purchasing the cementless partial knee system from Engage. The latest implant can be used with the exclusive CORI robotic surgical system from Smith & Nephew.

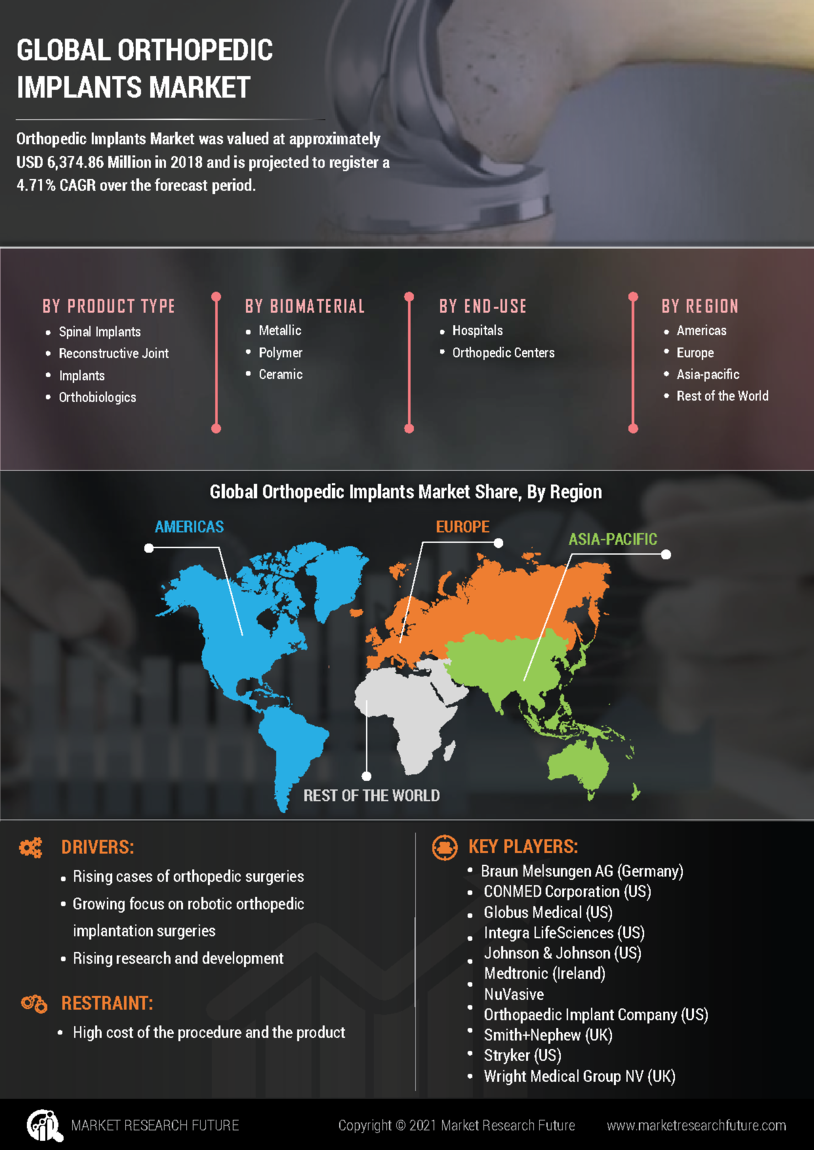

The development of sophisticated implants and other technical advances in the field of orthopedics are also anticipated to contribute to the expansion of the orthopedic implants market. In addition, some major businesses are using effective techniques, like innovation and collaboration, to further develop and supply cutting-edge implant technologies for orthopedic surgery.

The use of 3D printing in the fabrication of speciality implants to create a multi-layered composite implant is also a major development in the orthopedic implant market. This is because numerous significant parties have invested, and the technology permits individualized approaches. Additionally, the increasing prevalence of arthritic conditions among the elderly is anticipated to fuel the market expansion. Additionally, the increasing prevalence of musculoskeletal ailments is expected to fuel market expansion.

Acelus, a medical technology company in the field of expandable spinal implant technologies, launched a linesider modular-cortical system for spinal implant surgeries among patients in January 2024.

For instance, Stryker launched the Ortho Q Guidance System with ortho guidance software by May 2023, which offers advanced surgical planning to doctors and gives guidance on hip and knee procedures. The surgeon easily controls this software from the sterile field.In March 2023, Invibio Biomaterial Solutions unveiled Peek-Optima Am filament, which is an implantable polyetheretherketone polymer designed for the manufacture of 3D-printed medical devices.

Consequently, these filaments will help increase the production of such products in the market.Curiteva Inc., for instance, obtained FDA 510(k) approval in March 2023 on its Inspire 3D Porous PEEK HAFUSE Cervical Interbody System in March of that year; it is a 3D printed PEEK-implant produced by their Fused Filament Fabrication (FFF) printer.Enovis Corporation is an innovation-driven medical technology company that announced the introduction of DynaClip DeltaTM and DynaClip QuattroTM bone staples into the Company’s growing foot and ankle portfolio as well as the DynaClip® family of bone fixation systems in January 2023.

A seed investment and research fund worth around USD 1.4 million was announced by Trabtech – a medtech firm - in January 2023.

This funding was meant to facilitate the development of new implants within the orthopedic and pediatric fields.Stryker, one of the world’s leading global medical technology companies, recently, in October 2022, introduced the Monterey AL Interbody System, which is a stand-alone interbody fusion device specifically designed for anterior lumbar interbody fusion (ALIF).In March 2022, Johnson & Johnson MedTech revealed two other innovations from DePuy Synthes Johnson & Johnson’s orthopedic company: ATTUNE™ Knee portfolio, consisting of ATTUNE™ Cementless Fixed Bearing Knee with AFFIXIUM™ 3DP Technology and the ATTUNE™ Medial Stabilized Knee System.

Alongside the government, various organizations have been advising patients and physicians about orthopedic implants.