Rising Healthcare Expenditure

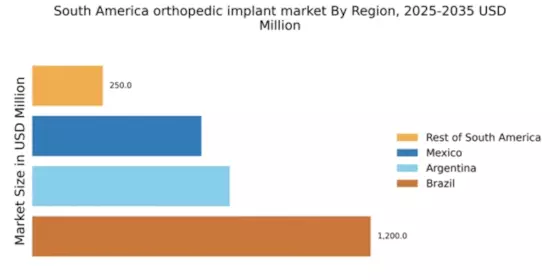

In South America, rising healthcare expenditure is a significant driver of the orthopedic implant market. Governments and private sectors are increasingly investing in healthcare infrastructure, which includes the procurement of advanced medical technologies. For instance, healthcare spending in countries like Brazil and Argentina has seen a steady increase, with projections indicating a growth rate of around 5% annually. This investment is likely to enhance the availability of orthopedic services and improve access to innovative implant technologies. As healthcare systems evolve, the orthopedic implant market is expected to benefit from enhanced funding, leading to improved patient outcomes and increased adoption of orthopedic implants.

Increased Incidence of Sports-Related Injuries

The increased incidence of sports-related injuries in South America is another significant driver for the orthopedic implant market. With a growing interest in sports and physical activities, particularly among the youth, the number of injuries requiring surgical intervention is on the rise. Reports indicate that sports injuries account for a substantial portion of orthopedic surgeries, leading to a higher demand for implants. This trend is likely to continue as more individuals engage in competitive sports and recreational activities. Consequently, the orthopedic implant market is expected to expand to meet the needs of this active population, providing innovative solutions for injury management.

Technological Innovations in Implant Materials

Technological innovations in implant materials are playing a pivotal role in shaping the orthopedic implant market in South America. The development of biocompatible materials and advanced manufacturing techniques has led to the creation of implants that offer improved durability and reduced risk of complications. For example, the introduction of 3D printing technology has enabled the production of customized implants tailored to individual patient anatomies. This innovation is likely to enhance surgical outcomes and patient satisfaction, thereby driving the growth of the orthopedic implant market. As these technologies become more widely adopted, the market is expected to witness a surge in demand for high-quality orthopedic implants.

Growing Awareness of Advanced Treatment Options

There is a growing awareness among patients and healthcare providers in South America regarding advanced treatment options for orthopedic conditions. Educational initiatives and outreach programs are helping to inform the public about the benefits of orthopedic implants, including improved quality of life and mobility. This heightened awareness is likely to drive demand for orthopedic surgeries and, consequently, the orthopedic implant market. As patients become more informed about their treatment options, they are more inclined to seek surgical interventions, thereby increasing the market potential for orthopedic implants. This trend is particularly evident in urban areas where access to information is more prevalent.

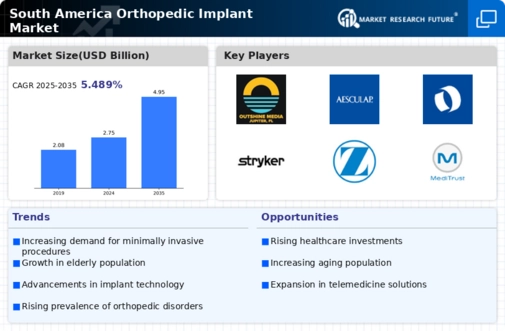

Aging Population and Increased Incidence of Orthopedic Conditions

The aging population in South America is a crucial driver for the orthopedic implant market. As individuals age, they often experience a higher incidence of orthopedic conditions such as osteoarthritis and fractures. This demographic shift is expected to lead to an increased demand for joint replacement surgeries and other orthopedic interventions. According to recent estimates, the population aged 65 and older in South America is projected to reach approximately 10% by 2030. This demographic trend suggests a growing need for orthopedic implants, as older adults are more likely to require surgical solutions for mobility issues. Consequently, the orthopedic implant market is likely to expand significantly to accommodate this rising demand.