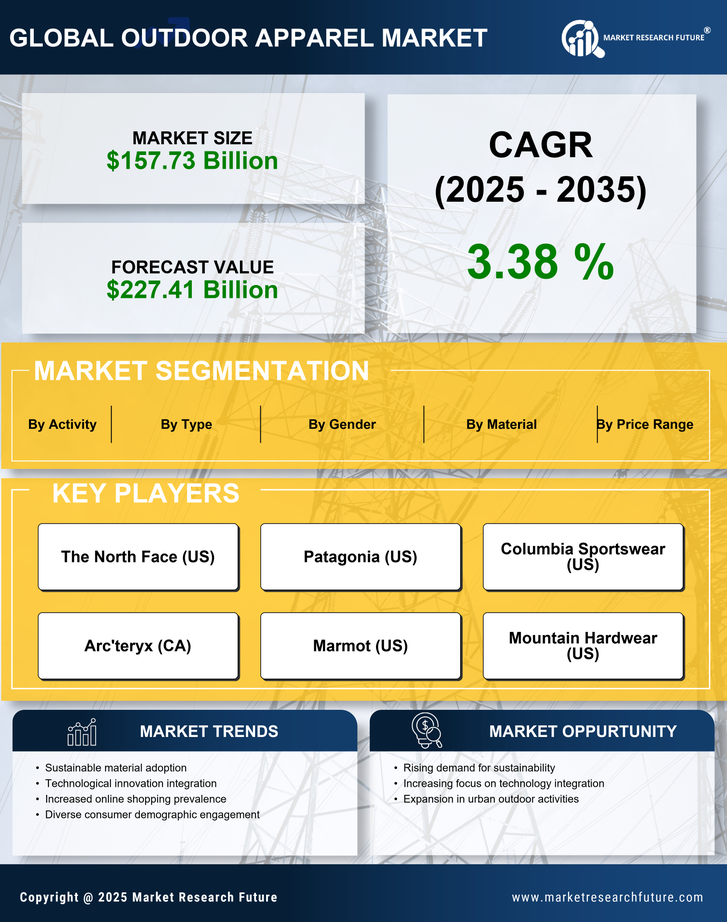

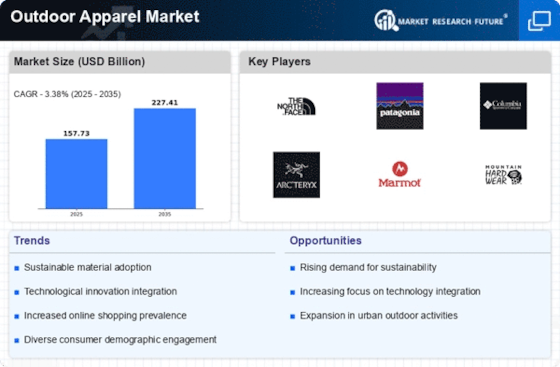

The Outdoor Apparel Market is currently characterized by a dynamic competitive landscape, driven by a confluence of innovation, sustainability, and consumer demand for high-performance gear. Major players such as The North Face (US), Patagonia (US), and Columbia Sportswear (US) are strategically positioned to leverage these trends. The North Face (US) emphasizes technological advancements in fabric and design, while Patagonia (US) focuses on environmental sustainability and ethical sourcing. Columbia Sportswear (US) adopts a multifaceted approach, integrating digital transformation with a strong emphasis on outdoor performance. Collectively, these strategies not only enhance brand loyalty but also intensify competition, as companies vie for market share in an increasingly eco-conscious consumer environment. Key business tactics within the Outdoor Apparel Market include localized manufacturing and supply chain optimization, which are essential for meeting the growing demand for sustainable products. The market structure appears moderately fragmented, with a mix of established brands and emerging players. This fragmentation allows for diverse consumer choices but also necessitates that key players continuously innovate to maintain their competitive edge. The influence of major companies is palpable, as they set industry standards and drive trends that smaller brands often follow. In August 2025, Patagonia (US) announced a partnership with a leading renewable energy firm to power its manufacturing facilities entirely with solar energy. This strategic move underscores Patagonia's commitment to sustainability and positions the company as a leader in environmentally responsible practices. By reducing its carbon footprint, Patagonia not only enhances its brand image but also appeals to a growing segment of eco-conscious consumers, potentially increasing market share in a competitive landscape. In September 2025, The North Face (US) launched a new line of eco-friendly outdoor gear made from recycled materials, further solidifying its commitment to sustainability. This initiative not only aligns with consumer preferences for environmentally friendly products but also showcases The North Face's innovative capabilities. By integrating sustainability into its product offerings, the company is likely to attract a broader customer base, thereby enhancing its competitive positioning. In July 2025, Columbia Sportswear (US) unveiled a digital platform that utilizes AI to personalize shopping experiences for consumers. This strategic initiative reflects the growing importance of digitalization in the retail sector. By leveraging technology to enhance customer engagement, Columbia Sportswear aims to differentiate itself in a crowded market, potentially leading to increased sales and customer loyalty. As of October 2025, the Outdoor Apparel Market is witnessing a pronounced shift towards digitalization, sustainability, and technological integration. Strategic alliances among companies are increasingly shaping the competitive landscape, fostering innovation and collaboration. The evolution of competitive differentiation appears to be moving away from traditional price-based competition towards a focus on innovation, technology, and supply chain reliability. This trend suggests that companies that prioritize these elements are likely to thrive in the future, as consumers increasingly seek brands that align with their values and lifestyle.