Oxo Alcohol Market Summary

As per Market Research Future analysis, the Oxo Alcohol Market Size was estimated at 15.76 USD Billion in 2024. The Oxo Alcohol industry is projected to grow from 16.58 USD Billion in 2025 to 27.52 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 5.2% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Oxo Alcohol Market is poised for growth driven by sustainability and diverse applications.

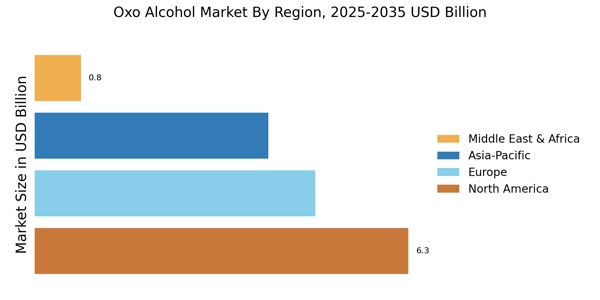

- North America remains the largest market for oxo alcohols, reflecting robust industrial demand.

- The Asia-Pacific region is the fastest-growing market, fueled by increasing production capacities and consumption.

- N-butanol continues to dominate as the largest segment, while 2-ethyl hexanol is emerging as the fastest-growing segment.

- Key market drivers include rising demand for solvents and the growth in the automotive sector, supporting the expansion of industrial applications.

Market Size & Forecast

| 2024 Market Size | 15.76 (USD Billion) |

| 2035 Market Size | 27.52 (USD Billion) |

| CAGR (2025 - 2035) | 5.2% |

Major Players

BASF SE (DE), ExxonMobil Chemical (US), SABIC (SA), Eastman Chemical Company (US), Oxea GmbH (DE), LG Chem (KR), Mitsubishi Chemical Corporation (JP), Huntsman Corporation (US), Dow Inc. (US)