Innovations in Material Science

The Oxygen Barrier Films Coatings for Dry Food Market is significantly impacted by ongoing innovations in material science. Advances in polymer technology and the development of new composite materials are enhancing the performance of oxygen barrier films. These innovations allow for the creation of thinner, lighter, and more effective coatings that can provide superior protection against oxygen and moisture. As manufacturers seek to improve the functionality of their packaging, the integration of these advanced materials is likely to become more prevalent. The market for oxygen barrier films is expected to expand as these innovations lead to more efficient and sustainable packaging solutions for dry food products.

Rising Demand for Extended Shelf Life

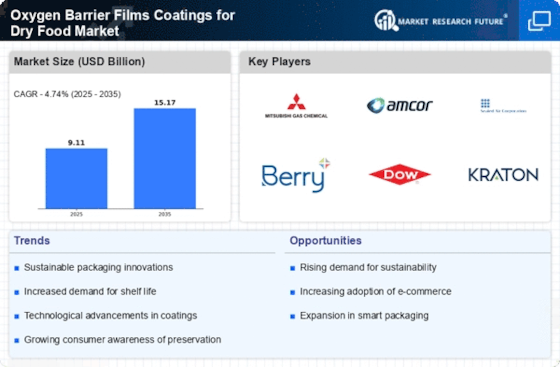

The Oxygen Barrier Films Coatings for Dry Food Market experiences a notable increase in demand for products that offer extended shelf life. As consumers become more conscious of food waste, manufacturers are seeking innovative packaging solutions that can prolong the freshness of dry food items. This trend is supported by data indicating that approximately 30 to 40% of food produced globally is wasted, primarily due to spoilage. Consequently, the adoption of oxygen barrier films is likely to rise, as these coatings effectively minimize oxygen permeability, thereby enhancing the longevity of dry food products. The market for oxygen barrier films is projected to grow significantly, driven by this increasing consumer preference for sustainable and long-lasting food packaging solutions.

Growth in E-commerce and Online Food Sales

The Oxygen Barrier Films Coatings for Dry Food Market is poised to benefit from the rapid growth of e-commerce and online food sales. As more consumers turn to online platforms for their grocery needs, the demand for packaging that ensures product integrity during transit becomes paramount. Research indicates that the e-commerce food market is expected to expand at a compound annual growth rate of over 15% in the coming years. This shift necessitates the use of advanced packaging solutions, such as oxygen barrier films, which can protect dry food items from oxidation and moisture during shipping. Thus, the increasing reliance on online food sales is likely to drive the adoption of oxygen barrier films in the packaging sector.

Regulatory Support for Food Safety Standards

The Oxygen Barrier Films Coatings for Dry Food Market is influenced by stringent regulatory frameworks aimed at enhancing food safety standards. Governments and regulatory bodies are increasingly implementing guidelines that require manufacturers to adopt packaging solutions that ensure the safety and quality of food products. For instance, regulations concerning food packaging materials are becoming more rigorous, emphasizing the need for materials that can effectively prevent contamination and spoilage. This regulatory environment is likely to propel the demand for oxygen barrier films, as these coatings provide a reliable solution for maintaining the quality of dry food items. The market is expected to see growth as compliance with these regulations becomes a priority for food manufacturers.

Consumer Preference for Eco-friendly Packaging

The Oxygen Barrier Films Coatings for Dry Food Market is increasingly shaped by consumer preferences for eco-friendly packaging solutions. As awareness of environmental issues grows, consumers are actively seeking products that utilize sustainable materials. This trend is reflected in the packaging industry, where there is a marked shift towards biodegradable and recyclable options. Data suggests that nearly 70% of consumers are willing to pay more for products that come in environmentally friendly packaging. Consequently, manufacturers are likely to invest in oxygen barrier films that not only preserve the quality of dry food but also align with consumer values regarding sustainability. This shift is expected to drive the growth of the oxygen barrier films market as companies respond to the demand for greener packaging alternatives.