Regulatory Compliance and Safety Standards

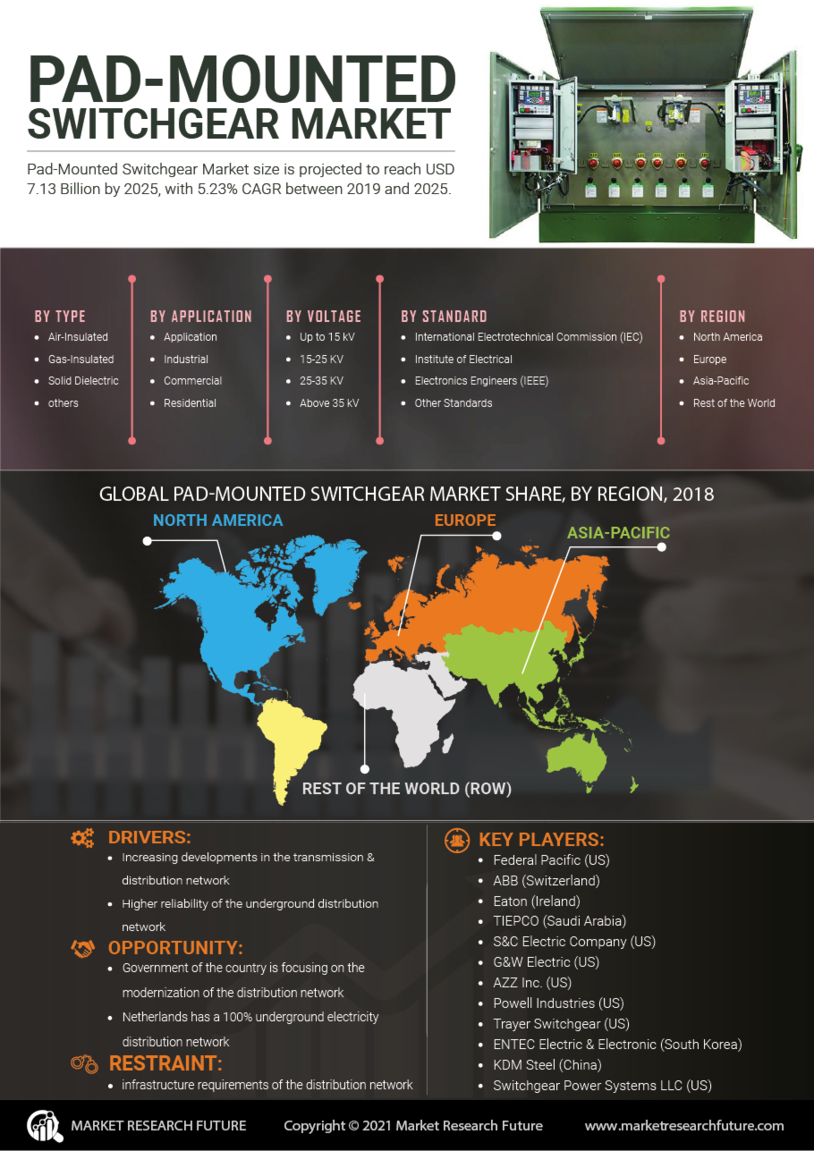

Regulatory compliance and safety standards are increasingly shaping the Pad-Mounted Switchgear Market. As safety regulations become more stringent, manufacturers are compelled to innovate and enhance the safety features of their products. Compliance with international standards, such as IEC and ANSI, is essential for market acceptance and operational reliability. The emphasis on safety not only protects personnel and equipment but also minimizes the risk of outages and failures. Market analysis indicates that the demand for safety-compliant switchgear is expected to rise, driven by both regulatory requirements and the growing awareness of safety among end-users. This trend is likely to propel the adoption of pad-mounted switchgear that meets or exceeds these safety standards, ensuring a secure and reliable power distribution system.

Growing Focus on Infrastructure Development

The growing focus on infrastructure development is driving the Pad-Mounted Switchgear Market. Governments and private sectors are increasingly investing in modernizing electrical infrastructure to support economic growth and improve service reliability. This trend is particularly pronounced in emerging economies, where the need for upgraded power distribution systems is critical. Recent reports indicate that infrastructure spending is projected to reach USD 4 trillion annually by 2025, with a significant portion allocated to electrical grid enhancements. Pad-mounted switchgear plays a vital role in these developments, offering a compact and efficient solution for urban and suburban areas. The emphasis on building resilient infrastructure further underscores the importance of reliable switchgear in ensuring consistent power delivery.

Rising Demand for Reliable Power Distribution

The increasing demand for reliable power distribution systems is a primary driver for the Pad-Mounted Switchgear Market. As urbanization accelerates, the need for efficient and dependable electrical infrastructure becomes paramount. This trend is particularly evident in developing regions, where investments in power generation and distribution are surging. According to recent data, the demand for electricity is projected to rise by approximately 3% annually, necessitating the deployment of advanced switchgear solutions. Pad-mounted switchgear, known for its compact design and ease of installation, is well-suited to meet these demands. Furthermore, the shift towards decentralized energy systems, including renewable sources, further propels the need for robust switchgear solutions that can handle variable loads and ensure uninterrupted service.

Technological Advancements in Switchgear Design

Technological advancements in switchgear design are significantly influencing the Pad-Mounted Switchgear Market. Innovations such as digital monitoring systems, enhanced insulation materials, and improved circuit protection mechanisms are enhancing the performance and reliability of pad-mounted switchgear. These advancements not only improve operational efficiency but also reduce maintenance costs, making them attractive to utility companies and industrial users. The integration of smart technologies, such as IoT capabilities, allows for real-time monitoring and predictive maintenance, which can lead to a reduction in downtime. Market data indicates that the adoption of smart switchgear is expected to grow at a compound annual growth rate of over 10% in the coming years, reflecting the industry's shift towards more intelligent and automated solutions.

Increased Investment in Renewable Energy Projects

The surge in investment in renewable energy projects is a crucial driver for the Pad-Mounted Switchgear Market. As countries strive to meet their sustainability goals, there is a marked increase in the deployment of solar, wind, and other renewable energy sources. This transition necessitates the use of reliable switchgear to manage the integration of these energy sources into existing grids. Data suggests that investments in renewable energy are expected to exceed USD 1 trillion annually by 2025, creating a substantial demand for pad-mounted switchgear that can efficiently handle the complexities of renewable energy distribution. The ability of pad-mounted switchgear to facilitate the connection of distributed energy resources makes it an essential component in the evolving energy landscape.