Urbanization and Population Growth

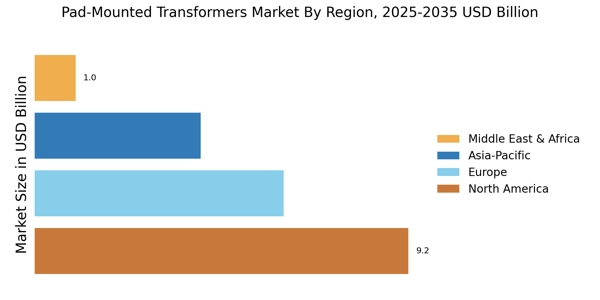

Urbanization and population growth are significant factors driving the Pad-Mounted Transformers Market Industry. As more people migrate to urban centers, the demand for electricity surges, necessitating the expansion of power distribution networks. According to the United Nations, urban areas are expected to house 68% of the world population by 2050, leading to increased energy consumption. Pad-mounted transformers are particularly suited for urban environments due to their compact design and ability to be installed in limited spaces. This adaptability makes them a preferred choice for utilities looking to enhance their infrastructure. Therefore, urbanization and population growth are likely to continue fueling the demand for pad-mounted transformers.

Rising Demand for Reliable Power Supply

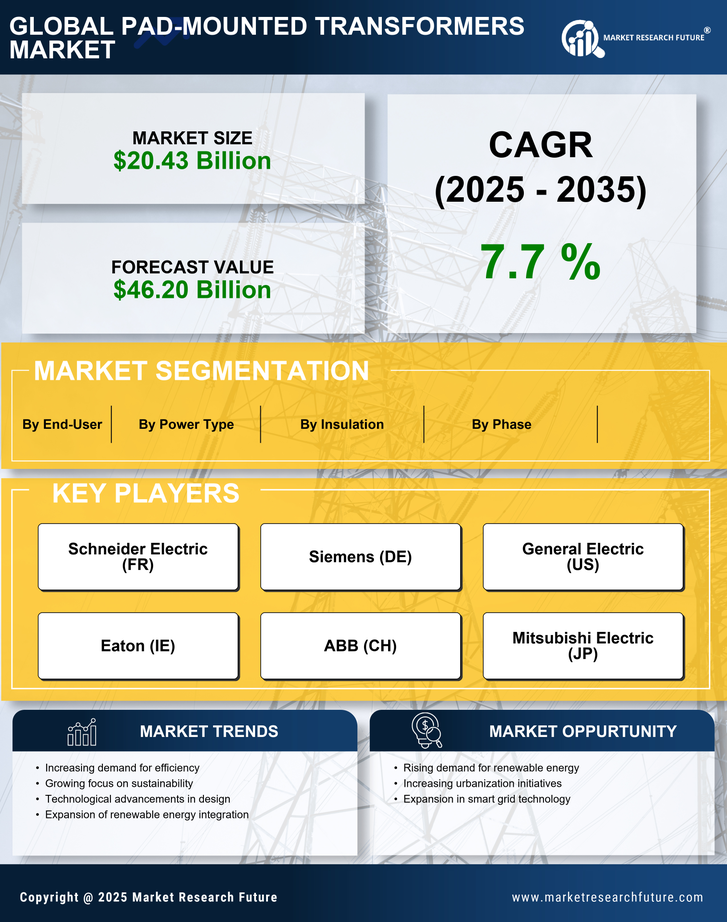

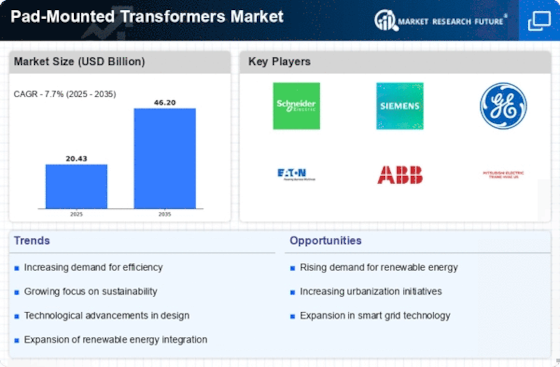

The increasing demand for a reliable power supply is a primary driver for the Pad-Mounted Transformers Market Industry. As urban areas expand and industrial activities intensify, the need for efficient power distribution systems becomes critical. This demand is reflected in the projected growth of the transformer market, which is expected to reach USD 20 billion by 2026. The reliability of pad-mounted transformers, which are designed for outdoor use and can withstand harsh environmental conditions, makes them particularly appealing to utility companies. Furthermore, the shift towards renewable energy sources necessitates robust transformers to manage the variable output from these systems. Thus, the rising demand for a reliable power supply is likely to propel the Pad-Mounted Transformers Market Industry forward.

Increased Investment in Renewable Energy

The transition towards renewable energy sources is significantly influencing the Pad-Mounted Transformers Market Industry. Governments and private sectors are investing heavily in solar, wind, and other renewable energy projects, which require efficient power distribution systems. The International Energy Agency indicates that investments in renewable energy are expected to exceed USD 1 trillion annually by 2025. Pad-mounted transformers play a crucial role in integrating these renewable sources into the existing grid, ensuring that energy is distributed effectively. This trend not only supports sustainability goals but also enhances the resilience of power systems. Consequently, the increased investment in renewable energy is anticipated to drive growth in the Pad-Mounted Transformers Market Industry.

Technological Innovations in Transformer Design

Technological innovations are reshaping the Pad-Mounted Transformers Market Industry, leading to enhanced efficiency and performance. Recent advancements in materials and design have resulted in transformers that are lighter, more compact, and capable of handling higher loads. For instance, the introduction of amorphous steel cores has improved energy efficiency by reducing losses during operation. Additionally, smart grid technologies are being integrated into pad-mounted transformers, allowing for real-time monitoring and management of power distribution. This evolution in transformer design not only meets the growing energy demands but also aligns with the global push for smarter, more efficient energy systems. As a result, technological innovations are likely to be a key driver in the Pad-Mounted Transformers Market Industry.

Regulatory Support for Infrastructure Development

Regulatory support for infrastructure development is a crucial driver for the Pad-Mounted Transformers Market Industry. Governments worldwide are implementing policies aimed at modernizing and expanding electrical infrastructure to meet growing energy demands. This includes incentives for upgrading existing systems and investing in new technologies. The U.S. Department of Energy has outlined initiatives to enhance grid reliability and resilience, which directly impacts the demand for pad-mounted transformers. As regulations evolve to support cleaner and more efficient energy solutions, the market for pad-mounted transformers is expected to expand. This regulatory environment fosters investment in infrastructure, thereby driving growth in the Pad-Mounted Transformers Market Industry.