Top Industry Leaders in the Pad Mounted Transformer Market

*Disclaimer: List of key companies in no particular order

Introduction:

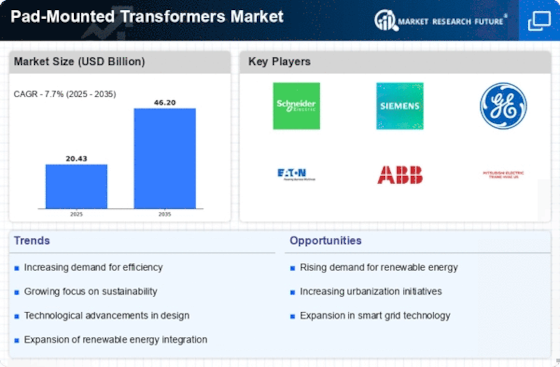

The Global Pad Mounted Transformer (PMT) Market is poised for sustained growth in the foreseeable future, driven by factors such as increasing urbanization, electrification initiatives in developing economies, and a growing emphasis on safety and aesthetics in power distribution. However, this growth is set against a dynamic and vibrant competitive landscape, where established industry leaders contend with emerging trends and disruptive forces.

Key Players and Strategic Approaches:

Major players in the industry include Schneider Electric (France), ABB Ltd. (Switzerland), Siemens AG (Germany), Eaton Co. Plc. (Ireland), General Electric (U.S.), Crompton Graves Ltd. (India), Olsun Electrics (U.S.), Pacific Crest Transformers (U.S.), Pearl Electric Co. Ltd. (China), ERMCO (U.S.), Federal Pacific (U.S.), Hitachi Ltd. (Japan), Vantran Industries Inc. (U.S.), Sunbelt Transformer, Ltd (U.S.), and Wenzhou Rockwell Transformers Co. (China), among others.

- Established Giants:

Global industry leaders like ABB, Siemens, Schneider Electric, and Eaton wield considerable influence, driven by strong brand recognition, expansive distribution networks, and diversified product portfolios. These companies focus on continuous innovation, technological advancements, and strategic partnerships, such as ABB's collaboration with the State Grid Corporation of China for developing next-generation PMTs tailored for smart grids.

- Regional Champions:

Regional players like WEG (Brazil), TBEA (China), and Elind (India) command significant market share in their respective regions due to factors like cost-competitiveness, robust customer relationships, and a deep understanding of local regulations. These entities are increasingly investing in research and development (R&D) to cater to region-specific needs, including the development of PMTs suitable for extreme weather conditions.

- Emerging Challengers:

New entrants with niche offerings or disruptive technologies are gaining traction. Startups like GridBeyond and Grid++ focus on smart PMTs integrated with the Internet of Things (IoT) and artificial intelligence (AI) for real-time monitoring and grid optimization. Others, like Schneider Electric's EVOLVE platform, offer modular and pre-assembled PMTs for expedited installation and enhanced safety.

Factors Influencing Market Share:

Several factors contribute to market share analysis:

-

Product Portfolio: The breadth and depth of a company's product offerings across different kVA ratings, insulation types (oil-filled or dry-type), and environmental adaptations significantly impact market share.

-

Geographical Presence: A robust presence in high-growth regions, coupled with effective distribution networks, is crucial for capturing market share.

-

Technological Innovation: Companies investing in R&D to develop PMTs with enhanced efficiency, lower environmental impact, and smart grid functionalities gain a competitive edge.

-

Price Competitiveness: Maintaining a competitive price point, particularly in cost-sensitive markets, is essential for securing contracts and building market share.

-

Customer Relationships and After-sales Service: Establishing strong ties with utilities and distribution companies, along with prompt and reliable after-sales service, fosters customer loyalty and facilitates market share growth.

Emerging Trends Shaping the Market:

-

Smart PMTs: The integration of IoT, sensors, and AI into PMTs for real-time monitoring, condition assessment, and automated grid management is gaining momentum. Companies with expertise in smart grid technologies and data analytics stand to benefit from this trend.

-

Environmental Focus: The increasing demand for sustainable solutions is propelling the adoption of dry-type PMTs with reduced environmental impact and bio-degradable insulating fluids. Companies investing in eco-friendly technologies are likely to gain traction.

-

Modular and Prefabricated Solutions: Prefabricated and modular PMTs offer faster installation, reduced downtime, and improved safety. Companies with innovative solutions in this segment are positioned to benefit from this trend.

-

Digitalization and Online Platforms: Online platforms for product selection, configuration, and ordering are streamlining the purchasing process for utilities. Companies embracing digitalization gain a competitive advantage.

Overall Competitive Scenario:

The Pad Mounted Transformer Market is fiercely competitive, with established players facing pressure from regional champions and emerging challengers. While traditional factors like product portfolio and geographical presence remain crucial, innovation and technological advancements in smart grid functionalities, environmental sustainability, and prefabrication solutions are emerging as differentiators. Companies that adapt to these trends and build robust customer relationships are well-positioned to capture market share and navigate the dynamic competitive landscape in the years to come.

Key Takeaways:

- The competitive landscape of the PMT market is characterized by a mix of established and emerging players, each with unique strengths and strategies.

- Factors like product portfolio, geographical presence, technological innovation, and customer relationships play a crucial role in market share analysis.

- New and emerging trends like smart PMTs, environmental focus, modular solutions, and digitalization are shaping the future of the market.

- Companies that adapt to these trends and build strong customer relationships will be well-positioned for success in the competitive PMT market.

Industry Developments and Latest Updates:

-

Schneider Electric:

- October 2023: Launched the Green X EcoDesign Pad-Mounted Transformer, focusing on reduced environmental impact and improved efficiency. (Source: Schneider Electric press release)

-

ABB Ltd.:

- September 2023: Unveiled the ABB Ability™ PQE-C pad-mounted transformer, designed for enhanced smart grid integration and digital monitoring. (Source: ABB website)

-

Siemens AG:

- June 2023: Announced a partnership with a local distributor to expand pad-mounted transformer offerings in South America. (Source: Siemens press release)

-

Eaton Co. Plc.:

- May 2023: Introduced a new line of compact pad-mounted transformers for space-constrained applications. (Source: Eaton website)