Market Share

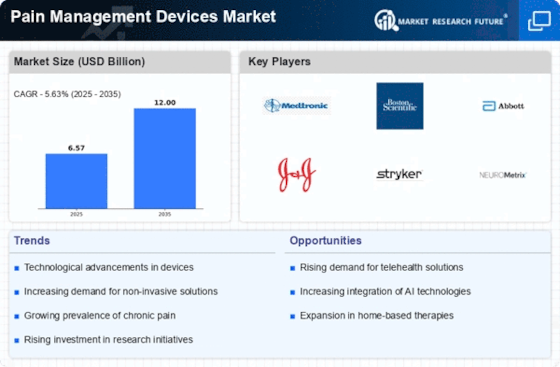

Pain management devices Market Share Analysis

Acquiring Business sector Experiences: Getting a great situation on the lookout for pain management devices requires a broad understanding of market complexities, enveloping administrative commitments, the serious climate, and the consistently changing examples in torment the executives.

Focusing on and Division: It is basic to distinguish specific agony conditions and patient socioeconomics. By redoing pain management devices to take care of explicit sections, one can accomplish a more thoughtful and productive market methodology.

Setting techniques should focus on the exhibit of adequacy relating pain management devices. Gaining exact proof and useful outcomes that exhibit help with discomfort really supports one's validity and accumulates more prominent market adequacy.

Personalization to Address Patient Necessities: Recognizing the heterogeneous idea of agony experiences, adjustable gadgets might act as a strategic part of situating. By accentuating gadgets that can be modified to suit the particular prerequisites of every patient, one can improve their market separation.

Putting accentuation on the harmless qualities of pain management devices can present a significant advantage. Advancing these gadgets as an alternative for obtrusive strategies might speak to patients looking for treatment options that require less interruption.

The consolidation of availability and information observing functionalities into pain management devices can demonstrate profitable in the ongoing period of advanced wellbeing. The essential position of gadgets that are viable with advanced wellbeing stages increases patient commitment while outfitting medical care experts with priceless information.

Patient Schooling Drives: Patient and medical services supplier centered instructive projects are absolutely critical. It is suggested that these drives focus on the scattering of information in regards to the upsides of pain management devices, their fitting use, and the potential improvements they might bring to one's personal satisfaction.

Joint effort with Medical services Suppliers: For market situating, it is fundamental to lay out associations with medical care suppliers. Encouraging cooperative organizations with medical services experts like actual advisors, torment trained professionals, and others might possibly bring about increased gadget supports and solutions.

Effectively Exploring Repayment Deterrents, It is crucial to appreciate repayment systems and actually explore repayment obstructions. A great repayment profile for a gadget can work with its reception and market section.

Global Market Development: considering the overall interest for pain management devices, associations should devise intends to enter worldwide business sectors. Achievement depends on the capacity to conform to shifted administrative conditions and redo gadgets to line up with provincial inclinations.

Propositioning gadgets as imaginative, sans drug choices are reliable with the rising tendency towards non-pharmacological pain management devices. Putting accentuation on the chance of decreasing dependence on pain relieving meds might interest the two patients and medical services experts.

Easy to understand Configuration: Market situating is affected by plans that are instinctive and appropriate for patients. Patient adherence is expanded, and the general client experience is improved by gadgets that are compact, advantageous, and require little upkeep.

Ongoing Agony Observing: A favorable component of these gadgets is their capacity to screen torment progressively. Cultivating the impression of these gadgets as instruments that empower patients to effectively manage their aggravation might engage medical services experts as well as patients.

Altering Gadgets to Target Specific Agony Types: Creating gadgets that explicitly target neuropathic torment or outer muscle torment empowers the execution of designated advertising procedures. By stressing the viability of gadgets in treating specific agony conditions, one can speak to a more unambiguous customer.

The execution of measurements to gauge patient results is absolutely critical. Observing agony lightning, improved usefulness, and by and large quiet satisfaction yields critical information that can be used to prove the adequacy of pain management devices.

Leave a Comment