Growing Awareness and Advocacy

Growing awareness and advocacy for Parkinson's Disease are significantly influencing the Parkinson's Disease Drug Market. Non-profit organizations and patient advocacy groups are actively working to educate the public and healthcare providers about the disease, its symptoms, and the importance of early intervention. This heightened awareness is likely to lead to increased diagnosis rates and, consequently, a larger patient population seeking treatment. In 2025, it is estimated that advocacy efforts will contribute to a 15% increase in diagnosed cases compared to previous years. As more individuals seek treatment, the demand for effective drugs will rise, further driving growth in the Parkinson's Disease Drug Market.

Advancements in Research and Development

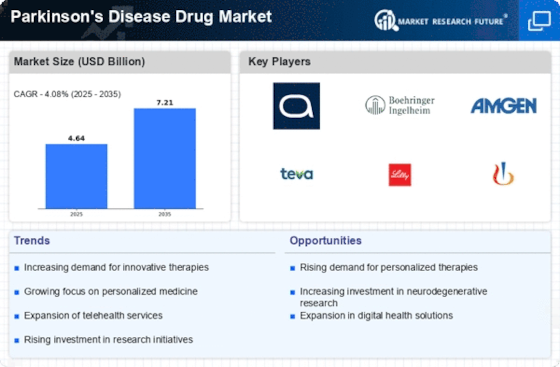

Ongoing advancements in research and development are propelling the Parkinson's Disease Drug Market forward. Innovative approaches, such as gene therapy and stem cell research, are being explored to create more effective treatments. Recent studies have indicated that targeted therapies may improve patient outcomes significantly. The investment in R&D has surged, with pharmaceutical companies allocating substantial resources to discover new drug candidates. In 2023, the global expenditure on R&D in the neurology sector reached approximately 20 billion USD, highlighting the commitment to addressing unmet needs in the Parkinson's Disease Drug Market. These advancements not only promise to enhance treatment efficacy but also to expand the therapeutic options available to patients.

Rising Prevalence of Parkinson's Disease

The increasing prevalence of Parkinson's Disease is a primary driver of the Parkinson's Disease Drug Market. As the population ages, the incidence of this neurodegenerative disorder is expected to rise significantly. Current estimates suggest that approximately 1% of individuals over the age of 60 are affected by Parkinson's Disease, with projections indicating that this number could double by 2040. This growing patient population necessitates the development and availability of effective pharmacological treatments, thereby stimulating demand within the Parkinson's Disease Drug Market. Furthermore, the rising awareness of the disease and its symptoms among healthcare professionals and the general public is likely to lead to earlier diagnoses, further increasing the market's potential.

Regulatory Support for Innovative Therapies

Regulatory support for innovative therapies is a crucial driver of the Parkinson's Disease Drug Market. Regulatory agencies are increasingly recognizing the need for expedited approval processes for breakthrough therapies that address unmet medical needs. Initiatives such as the FDA's Breakthrough Therapy Designation have been instrumental in facilitating faster access to new treatments for Parkinson's Disease. In 2025, it is anticipated that several new drugs will receive accelerated approval, significantly impacting the market landscape. This supportive regulatory environment encourages pharmaceutical companies to invest in the development of novel therapies, thereby enhancing the treatment options available to patients and driving growth within the Parkinson's Disease Drug Market.

Increased Investment from Pharmaceutical Companies

The Parkinson's Disease Drug Market is witnessing increased investment from pharmaceutical companies, driven by the potential for lucrative returns. As the demand for effective treatments rises, companies are eager to capitalize on this opportunity. In recent years, several major pharmaceutical firms have announced multi-million dollar investments aimed at developing new therapies for Parkinson's Disease. For instance, in 2024, a leading pharmaceutical company invested over 500 million USD in a clinical trial for a novel drug targeting motor symptoms. This influx of capital is likely to accelerate the pace of innovation and bring new therapies to market, thereby enhancing the overall landscape of the Parkinson's Disease Drug Market.