Research Methodology on Chronic Disease Management Market

Introduction

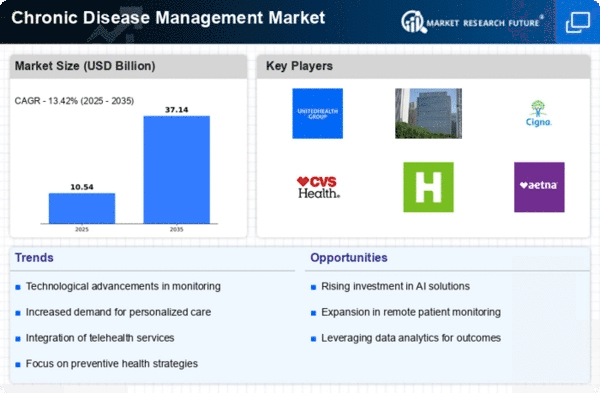

Chronic Disease Management (CDM) is an emerging trend in healthcare and is a set of integrated patient-oriented techniques and interventions that focus on critical health issues such as diabetes, heart disease, asthma, depression, and cancer. CDM strives to improve the quality of care for individuals with chronic diseases through active collaboration with healthcare providers, personalized care plans, and preventive care advocacy. The objective of this research project is to conduct a thorough analysis of the CDM market and provide a comprehensive overview of the various trends, challenges and opportunities in the global CDM market.

Research Objectives

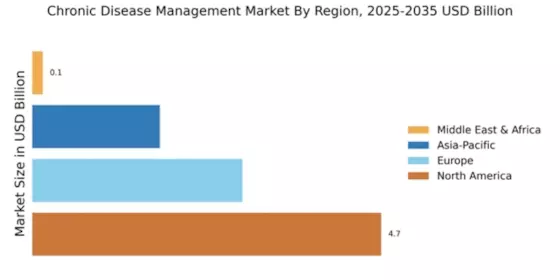

- To establish a comprehensive understanding of the global market for chronic disease management

- To ascertain market segmentation and its impact on the growth of the CDM market

- To analyze the current and emerging trends and their impact on the growth of the CDM market.

- To identify and analyze key growth drivers and challenges in the CDM market

- To scrutinize Porter’s Five Forces model of the CDM market and its impact on the growth of the CDM market.

- To assess the competitive landscape of the CDM market by analyzing major players

Data Collection Methods

Two methods of data collection are planned for this research project – secondary research and primary research.

Secondary Research

Secondary research involves collecting external data from existing works such as research papers, and reports published by industry bodies, Government organizations, and other online sources. Secondary research datasets from reliable sources like Market Research Future (MRFR), Datamonitor, Research and Markets, and various industry journals. The sources cover multiple domains in the healthcare domain such as patient care, health technology and health administration.

Primary Research

Primary research comprises surveys, interviews, and focus group discussions. Data from primary research is obtained through both qualitative and quantitative research. A structured questionnaire is used to collect survey responses from actors in the CDM market. In addition, interviews with industry experts, analysts, and opinion leaders are conducted. Furthermore, focus group discussions with patients and healthcare professionals will be used to collect further information on the current CDM trends and challenges.

Sampling Method

A sampling process based on the survey respondents’ profiles is employed. The selection criteria are based on the knowledge and expertise of the survey participants in the areas of chronic disease management, healthcare delivery, and other related fields. The key criteria include their role in the CDM market, geographical location, ownership, type of organization and other requirements.

Sampling Size

The sample size is estimated to be 100. It is expected that the survey response rate will be approximately 50%. The sample size is adjusted based on the survey response rate after each round of the survey.

Data Analysis

Quantitative and qualitative analysis is used to analyze the primary research data. Coding and content analysis is used for open-ended survey questions. Frequency analysis is used to analyze quantitative survey responses.

Statistical Methods

Data analysis is conducted using advanced statistical techniques such as regression analysis, Hypothesis testing, ANOVA and Factor Analysis. These techniques are used to understand the market dynamics and uncover the various trends and challenges in the CDM market.

Reporting

The report is presented in an executive summary format and comprises key findings and recommendations. The report includes data and insights on the global market for Chronic Disease Management, trends and influences, and competitive outlook. In addition, the report includes a summary of the primary research findings and recommendations for further research.

Conclusion

The research project aims to explore the current trends in the global Chronic Disease Management Market. The report provides comprehensive insights into the drivers and challenges, market dynamics, and competitive landscape of the CDM market. The planned data collection and statistical analysis methods detailed in this research methodology are expected to provide a thorough understanding of the CDM market and its competitive environment.