Emergence of Smart Cities

The development of smart cities is emerging as a pivotal driver for the Passive Optical Network Equipment Market. As urban areas evolve to incorporate advanced technologies for improved efficiency and sustainability, the demand for reliable and high-speed communication networks becomes paramount. Smart city initiatives often rely on robust data networks to support applications such as traffic management, public safety, and energy efficiency. Consequently, the deployment of Passive Optical Network equipment is essential to facilitate the connectivity required for these applications. The trend towards smart cities is likely to accelerate investments in optical network infrastructure, thereby enhancing the growth prospects of the Passive Optical Network Equipment Market.

Increased Data Consumption

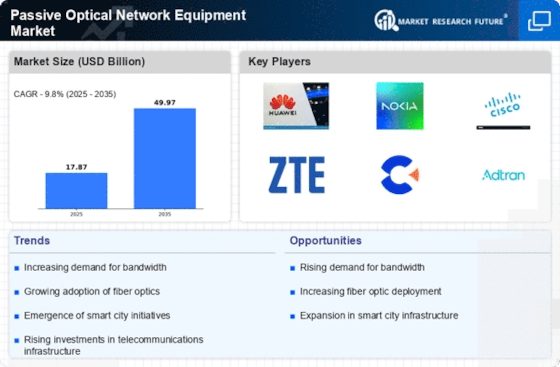

The exponential growth in data consumption is a significant factor propelling the Passive Optical Network Equipment Market. With the proliferation of streaming services, online gaming, and cloud computing, users are demanding higher bandwidth and faster internet speeds. Recent statistics indicate that data traffic is expected to increase by over 25% annually, necessitating the upgrade of existing network infrastructures. This surge in data consumption compels service providers to invest in Passive Optical Network equipment, which can efficiently handle large volumes of data traffic. As a result, the market for these solutions is likely to expand, driven by the need for robust and scalable network architectures that can accommodate future data demands.

Rising Internet Penetration

The increasing penetration of the internet across various regions appears to be a primary driver for the Passive Optical Network Equipment Market. As more individuals gain access to the internet, the demand for high-speed connectivity intensifies. Reports indicate that internet penetration rates have surged, with estimates suggesting that over 60% of the population in many areas now has access. This trend necessitates the deployment of advanced optical networks to support the growing data traffic. Consequently, service providers are investing in Passive Optical Network equipment to enhance their infrastructure, ensuring they can meet the escalating bandwidth requirements of consumers and businesses alike. This shift not only fosters competition among service providers but also propels the Passive Optical Network Equipment Market forward, as companies strive to offer superior connectivity solutions.

Government Initiatives and Funding

Government initiatives aimed at enhancing telecommunications infrastructure are playing a crucial role in the growth of the Passive Optical Network Equipment Market. Various governments are recognizing the importance of high-speed internet access as a vital component of economic development. Funding programs and incentives are being introduced to encourage the deployment of optical networks, particularly in underserved areas. For instance, several countries have allocated substantial budgets to improve broadband access, which directly benefits the Passive Optical Network Equipment Market. These initiatives not only stimulate demand for optical network solutions but also foster partnerships between public and private sectors, further driving innovation and investment in the market.

Shift Towards Fiber Optic Technology

The transition from traditional copper-based networks to fiber optic technology is a notable trend influencing the Passive Optical Network Equipment Market. Fiber optics offer superior speed and bandwidth capabilities compared to their copper counterparts, making them increasingly attractive for telecommunications providers. Data suggests that fiber optic installations have grown significantly, with many regions reporting a doubling of fiber deployments in recent years. This shift is driven by the need for faster internet services and the ability to support emerging technologies such as 5G and IoT. As a result, the demand for Passive Optical Network equipment is likely to rise, as these systems are integral to the deployment of fiber optic networks. The ongoing investment in fiber infrastructure indicates a robust future for the Passive Optical Network Equipment Market.