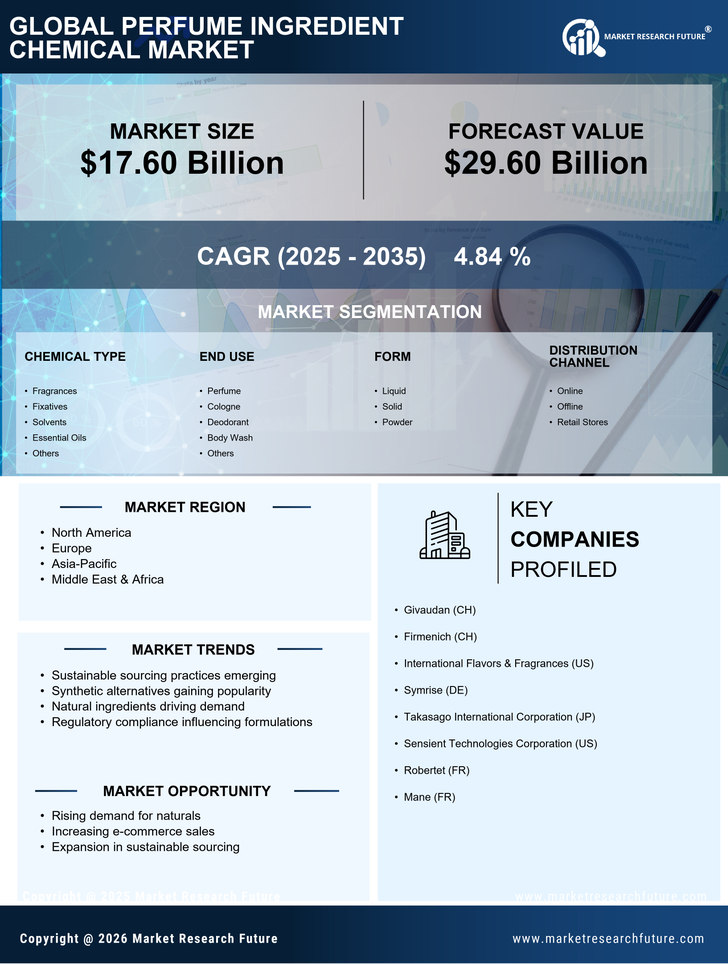

The Perfume Ingredient Chemical Market is characterized by a dynamic competitive landscape, driven by innovation, sustainability, and strategic partnerships. Major players such as Givaudan (Switzerland), Firmenich (Switzerland), and International Flavors & Fragrances (US) are at the forefront, leveraging their extensive portfolios and R&D capabilities to enhance product offerings. Givaudan, for instance, emphasizes its commitment to sustainability, which is increasingly becoming a key differentiator in the market. Firmenich, on the other hand, focuses on digital transformation and consumer-centric innovations, while International Flavors & Fragrances is actively pursuing strategic acquisitions to bolster its market position. Collectively, these strategies not only enhance their competitive edge but also shape the overall market dynamics, fostering a culture of continuous improvement and adaptation.

In terms of business tactics, companies are increasingly localizing manufacturing and optimizing supply chains to enhance efficiency and responsiveness to market demands. The competitive structure of the market appears moderately fragmented, with several key players exerting significant influence. This fragmentation allows for niche players to thrive, while larger companies leverage their scale to optimize operations and expand their market reach. The interplay between these dynamics creates a complex environment where innovation and operational excellence are paramount.

In August 2025, Givaudan (Switzerland) announced the launch of a new line of sustainable fragrance ingredients derived from renewable sources. This strategic move underscores the company's commitment to sustainability and aligns with the growing consumer demand for eco-friendly products. By investing in sustainable sourcing, Givaudan not only enhances its product portfolio but also positions itself as a leader in the sustainability movement within the fragrance industry.

In September 2025, Firmenich (Switzerland) unveiled a cutting-edge digital platform designed to enhance customer engagement and streamline the fragrance creation process. This initiative reflects the company's focus on digital transformation, enabling clients to collaborate more effectively and access a broader range of fragrance options. The platform's introduction is likely to strengthen Firmenich's market position by fostering innovation and improving customer satisfaction.

In July 2025, International Flavors & Fragrances (US) completed the acquisition of a niche fragrance company specializing in natural ingredients. This acquisition is strategically significant as it allows IFF to expand its portfolio in the growing segment of natural fragrances, catering to the increasing consumer preference for organic and sustainable products. This move not only enhances IFF's competitive positioning but also aligns with broader market trends towards natural and clean-label products.

As of October 2025, the competitive trends in the Perfume Ingredient Chemical Market are increasingly defined by digitalization, sustainability, and the integration of artificial intelligence in product development. Strategic alliances are becoming more prevalent, as companies seek to pool resources and expertise to drive innovation. Looking ahead, competitive differentiation is likely to evolve from traditional price-based competition to a focus on innovation, technological advancements, and supply chain reliability. This shift indicates a transformative phase in the market, where companies that prioritize sustainability and digital capabilities will likely emerge as leaders.