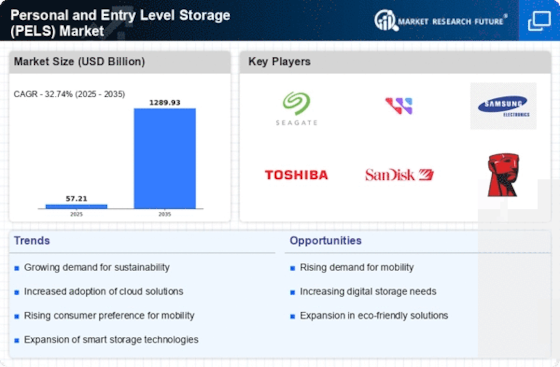

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the Personal and Entry Level Storage (PELS) Market, grow even more. Market participants are also undertaking a variety of strategic activities to expand their footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, Personal and Entry Level Storage (PELS)industry must offer cost-effective items. Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the Personal and Entry Level Storage (PELS) industry to benefit clients and increase the market sector. In recent years, the Personal and Entry Level Storage (PELS) industry has offered some of the most significant advantages to medicine. Major players in the Personal and Entry Level Storage (PELS) Market, including Tintri, Inc. (US), Simplivity Corp. (US), Scality, Inc. (US), Cisco Systems, Inc. (US), Western Digital Corporation (US), Seagate Technology (US) and Symantec Corporation (US) and others, are attempting to increase market demand by investing in research and development operations. Toshiba Corporation is a Japanese multinational enterprise based in Minato, Tokyo. Its diverse products and services include power, industrial and social infrastructure systems, elevators and escalators, electronic components, semiconductors, hard disc drives (HDD), printers, batteries, lighting, and IT solutions such as quantum cryptography, which was developed at Toshiba Europe's Cambridge Research Laboratory and is now commercialized. In 2020, Toshiba announced a 16TB hard disc drive, the biggest capacity hard drive available at the time. This drive is intended for usage in data centres and other business applications. It features Toshiba's helium-sealed technology with a spindle speed of 7200RPM. SanDisk is a Western Digital brand for flash memory goods such as memory cards and readers, USB flash drives, solid-state drives, and digital audio players. Western Digital purchased the original company, SanDisk Corporation. SanDisk was founded in 1988 by Eli Harari, Sanjay Mehrotra, and Jack Yuan, and was incorporated as SunDisk at the time. Eli Harari, a co-founder of SanDisk, created the Floating Gate EEPROM, which demonstrated the practicality, dependability, and endurance of semiconductor-based data storage. In 2020, SanDisk introduced the world's highest capacity microSD card, a 400GB microSD card. This card is intended for usage in smartphones and other mobile devices requiring large amounts of storage. The card supports read and write rates of up to 100MB/s and 90MB/s, respectively.