Advancements in Robotics Technology

Technological advancements play a pivotal role in shaping the Pharmaceutical Collaborative Robot Market. Innovations in artificial intelligence, machine learning, and sensor technology have significantly enhanced the capabilities of collaborative robots. These advancements enable robots to work alongside human operators safely and efficiently, adapting to various tasks in real-time. For instance, the latest models can now perform complex tasks such as drug dispensing and inventory management with minimal human intervention. This evolution in robotics technology not only improves productivity but also reduces operational costs. As a result, the Pharmaceutical Collaborative Robot Market is poised for growth, driven by the continuous development of smarter and more versatile robotic solutions.

Growing Interest in Personalized Medicine

The trend towards personalized medicine is significantly impacting the Pharmaceutical Collaborative Robot Market. As the demand for tailored therapies increases, pharmaceutical companies are exploring innovative production methods to accommodate this shift. Collaborative robots can facilitate the efficient production of small batches of customized medications, allowing for greater flexibility in manufacturing processes. This capability is particularly important in the context of precision medicine, where specific patient needs must be met. The ability of collaborative robots to adapt to various production requirements positions them as valuable assets in the pharmaceutical sector. As personalized medicine continues to gain traction, the Pharmaceutical Collaborative Robot Market is expected to grow in response to these evolving demands.

Increasing Regulatory Pressure for Quality Assurance

The Pharmaceutical Collaborative Robot Market is influenced by the increasing regulatory pressure for quality assurance in drug manufacturing. Regulatory bodies are imposing stringent guidelines to ensure the safety and efficacy of pharmaceutical products. Collaborative robots can assist in maintaining compliance by providing consistent and accurate results in various processes, such as testing and packaging. The ability of these robots to operate in controlled environments minimizes the risk of contamination and human error, which is crucial in meeting regulatory standards. As pharmaceutical companies seek to adhere to these regulations, the demand for collaborative robots is expected to rise, further propelling the growth of the Pharmaceutical Collaborative Robot Market.

Focus on Cost Reduction in Pharmaceutical Manufacturing

Cost reduction remains a primary focus for companies within the Pharmaceutical Collaborative Robot Market. The rising costs associated with labor, materials, and compliance necessitate innovative solutions to maintain profitability. Collaborative robots offer a viable solution by automating labor-intensive tasks, thereby reducing the need for a large workforce. This automation not only lowers labor costs but also enhances production speed and accuracy. Recent studies indicate that companies implementing collaborative robots can achieve a return on investment within a year due to the significant savings generated. Consequently, the Pharmaceutical Collaborative Robot Market is likely to expand as more organizations recognize the financial benefits of integrating robotic solutions into their manufacturing processes.

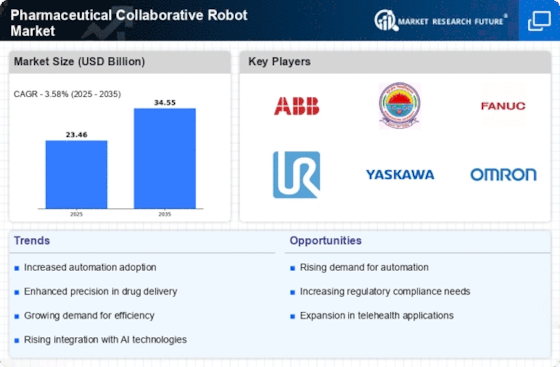

Rising Demand for Efficiency in Pharmaceutical Operations

The Pharmaceutical Collaborative Robot Market is experiencing a notable surge in demand for efficiency within pharmaceutical operations. As companies strive to optimize their production processes, collaborative robots are increasingly viewed as essential tools. These robots can perform repetitive tasks with precision, thereby reducing human error and increasing throughput. According to recent data, the integration of collaborative robots can enhance operational efficiency by up to 30%. This trend is particularly evident in areas such as packaging and quality control, where speed and accuracy are paramount. Consequently, the Pharmaceutical Collaborative Robot Market is likely to witness substantial growth as organizations seek to streamline their operations and meet the rising expectations of consumers and regulatory bodies.