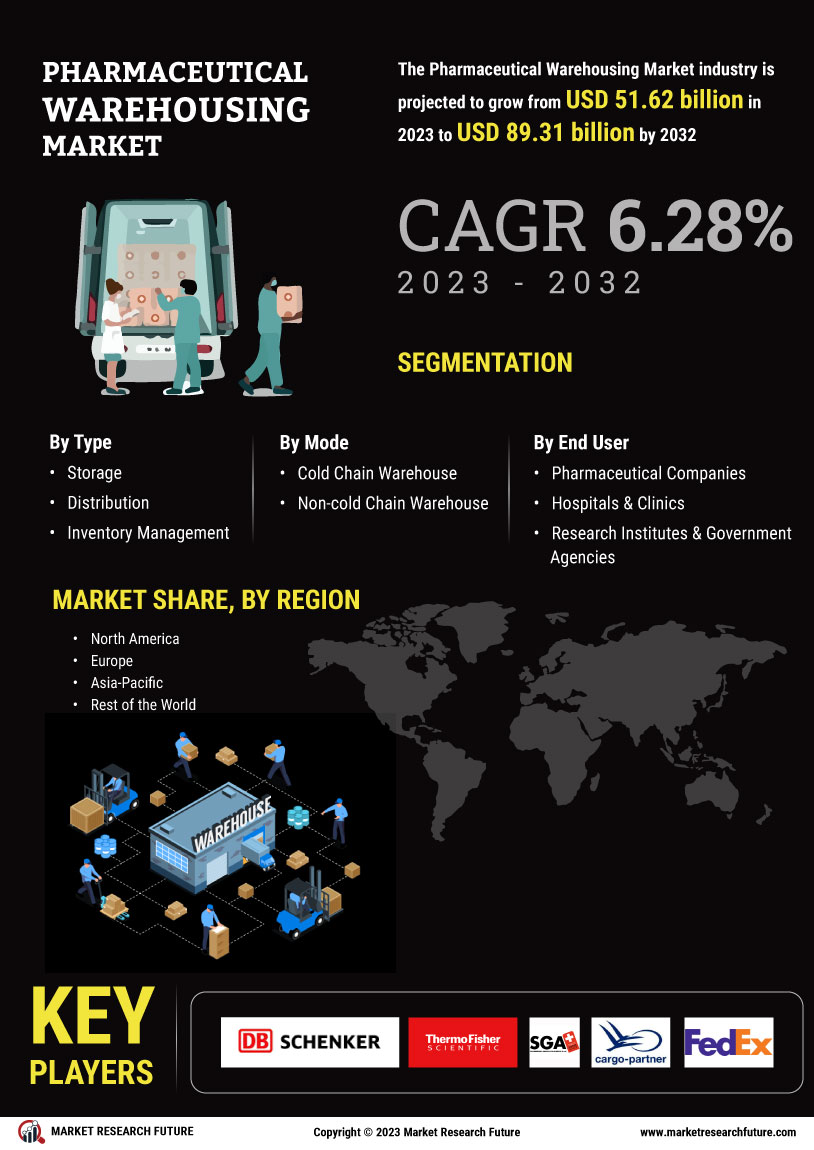

Market Growth Projections

The Global Pharmaceutical Warehousing Market Industry is poised for substantial growth, with projections indicating a market value of 54.9 USD Billion in 2024 and an expected increase to 107.3 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate (CAGR) of 6.28% from 2025 to 2035. Such figures highlight the increasing importance of efficient warehousing solutions in the pharmaceutical sector, driven by factors such as technological advancements, regulatory compliance, and the expansion of e-commerce. Companies are likely to focus on enhancing their warehousing capabilities to capitalize on this growth, ensuring they remain competitive in a rapidly evolving market.

Growing Demand for Biopharmaceuticals

The increasing prevalence of chronic diseases and the rising demand for biopharmaceuticals are driving the Global Pharmaceutical Warehousing Market Industry. As biopharmaceuticals often require specialized storage conditions, the need for advanced warehousing solutions is paramount. In 2024, the market is valued at approximately 54.9 USD Billion, reflecting the industry's adaptation to these complex storage requirements. Furthermore, the biopharmaceutical sector is projected to expand significantly, necessitating enhanced warehousing capabilities to manage the distribution of these products effectively. This trend indicates a robust growth trajectory for the warehousing sector, as it aligns with the evolving landscape of pharmaceutical manufacturing.

Technological Advancements in Warehousing

Technological innovations, such as automation and real-time tracking systems, are transforming the Global Pharmaceutical Warehousing Market Industry. These advancements enhance operational efficiency, reduce human error, and ensure compliance with stringent regulatory standards. For instance, the integration of Internet of Things (IoT) devices allows for continuous monitoring of storage conditions, which is critical for temperature-sensitive pharmaceuticals. As the industry embraces these technologies, it is likely to see a surge in demand, contributing to the market's growth. The anticipated CAGR of 6.28% from 2025 to 2035 underscores the potential for technological enhancements to reshape warehousing practices in the pharmaceutical sector.

Expansion of E-commerce in Pharmaceuticals

The rise of e-commerce in the pharmaceutical sector is significantly influencing the Global Pharmaceutical Warehousing Market Industry. As consumers increasingly turn to online platforms for medication purchases, the demand for efficient warehousing solutions that can support rapid order fulfillment is growing. This trend necessitates the establishment of strategically located distribution centers to ensure timely delivery. The market's projected growth to 107.3 USD Billion by 2035 highlights the importance of adapting warehousing strategies to meet the evolving needs of e-commerce. Companies that invest in modern warehousing capabilities are likely to gain a competitive edge in this expanding market, as they can better serve the needs of online consumers.

Regulatory Compliance and Quality Assurance

Regulatory compliance remains a crucial driver for the Global Pharmaceutical Warehousing Market Industry. Stringent regulations imposed by health authorities necessitate that warehousing facilities adhere to high standards of quality assurance. This compliance ensures the safety and efficacy of pharmaceutical products throughout the supply chain. Facilities must implement rigorous protocols for inventory management, temperature control, and documentation to meet these requirements. As the industry continues to evolve, the emphasis on compliance is expected to intensify, thereby driving investment in advanced warehousing solutions. This focus on quality assurance is likely to contribute to the overall growth of the market, as companies seek to mitigate risks associated with non-compliance.

Globalization of Pharmaceutical Supply Chains

The globalization of pharmaceutical supply chains is a significant driver of the Global Pharmaceutical Warehousing Market Industry. As companies expand their operations internationally, the need for efficient warehousing solutions that can accommodate diverse regulatory environments becomes critical. This globalization trend necessitates the establishment of warehouses that can manage the complexities of international logistics, including customs regulations and varying storage requirements. The anticipated growth of the market, alongside the increasing interconnectedness of global supply chains, suggests that companies will need to invest in adaptable warehousing strategies. This investment is essential for ensuring the seamless distribution of pharmaceutical products across borders.