Photogrammetry Software Size

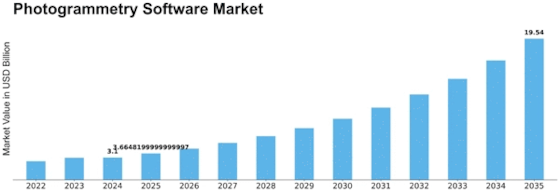

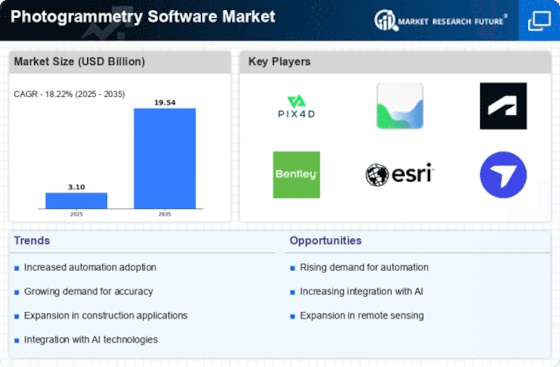

Photogrammetry Software Market Growth Projections and Opportunities

The market for photogrammetry software is expanding due to the worldwide push for digital transformation and smart city projects. The importance of geospatial data in planning and decision-making processes is becoming more and more apparent to governments and businesses. Photogrammetry software makes it possible to create intricate maps and three-dimensional (3D) models, which makes urban planning, infrastructure construction, and disaster management more efficient. Numerous market drivers have a substantial impact on the photogrammetry software industry, shaping its dynamics and growth trajectory.

The rising need for precise and comprehensive spatial data across industries including construction, agriculture, forestry, and urban planning is one of the main factors propelling this market. In order to convert satellite and aerial photos into accurate 3D models and support experts in making judgments, photogrammetry software is essential. Photogrammetry software is in high demand since it provides a time and money-saving substitute for conventional surveying techniques, which is driving up the cost of mapping and surveying solutions. In addition, technical developments in the photogrammetry industry are fostering market growth. Photogrammetry software can analyze data quicker and more accurately when artificial intelligence and machine learning algorithms are integrated into it. Users searching for advanced solutions capable of managing huge datasets and delivering useful insights are therefore drawn to this. The key to maintaining market growth is the ongoing development of software with enhanced features and functions. Consequently, there is an increase in demand for the product from organizations looking to use geospatial intelligence for sustainable development.

On the other hand, obstacles like high upfront expenditures and the difficulty of photogrammetry software function as barriers to industry expansion. Potential users may be deterred by the requirement for specialist knowledge in order to use the program and understand the data that is produced. However, these difficulties should become less of an issue as technology advances and becomes more user-friendly. A tendency toward cloud-based photogrammetry systems is also seen in market trends. Cloud computing is a desirable alternative for companies looking for affordable and cooperative photogrammetry solutions since it provides scalability, flexibility, and accessibility. The ability to process and share geospatial data in real-time through cloud platforms enhances the efficiency of workflows and supports collaborative projects, thus contributing to the market's expansion.

Leave a Comment