Emergence of Smart Cities Initiatives

The Aerial Photogrammetry Software Market is poised for growth due to the emergence of smart cities initiatives. Urban planners and local governments are increasingly adopting aerial photogrammetry to support the development of smart infrastructure. This technology facilitates the collection of real-time data, which is essential for effective urban management and planning. As cities strive to become more efficient and sustainable, the demand for advanced aerial photogrammetry software is likely to rise. The ability to integrate various data sources and provide comprehensive spatial analysis is becoming a key component in the planning of smart cities, thereby driving the market forward.

Rising Interest in Environmental Monitoring

The Aerial Photogrammetry Software Market is increasingly relevant in the context of environmental monitoring and management. As concerns about climate change and natural resource management grow, organizations are turning to aerial photogrammetry for effective data collection and analysis. This software enables the monitoring of land use changes, deforestation, and habitat loss, providing essential insights for conservation efforts. The market is likely to expand as more entities recognize the value of aerial photogrammetry in supporting sustainable practices and informed decision-making. The integration of this technology into environmental assessments is expected to enhance the accuracy and efficiency of data collection, further driving market growth.

Growing Adoption in Infrastructure Development

The Aerial Photogrammetry Software Market is witnessing increased adoption in infrastructure development projects. Governments and private entities are utilizing aerial photogrammetry to streamline the planning and execution of large-scale infrastructure initiatives. This trend is particularly evident in transportation, where accurate mapping is essential for road and bridge construction. The market is projected to see a significant uptick, with infrastructure spending expected to rise, leading to a greater reliance on aerial photogrammetry software for efficient project management. The ability to quickly gather and analyze geographical data is becoming a critical factor in the successful delivery of infrastructure projects, thus driving demand for these software solutions.

Increasing Demand for Accurate Mapping Solutions

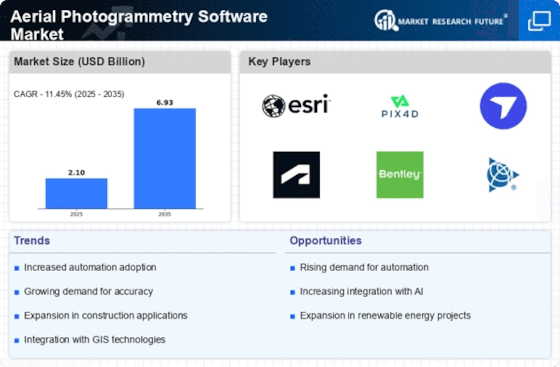

The Aerial Photogrammetry Software Market is experiencing a surge in demand for precise mapping solutions across various sectors, including construction, agriculture, and urban planning. As industries increasingly rely on accurate geographical data for decision-making, the need for advanced photogrammetry software becomes evident. According to recent estimates, the market for aerial mapping solutions is projected to grow at a compound annual growth rate of approximately 15% over the next five years. This growth is driven by the necessity for high-resolution imagery and detailed topographical data, which are essential for effective project planning and execution. Consequently, companies are investing in sophisticated aerial photogrammetry software to enhance their operational efficiency and improve project outcomes.

Technological Advancements in Imaging Techniques

The Aerial Photogrammetry Software Market is significantly influenced by rapid advancements in imaging technologies. Innovations such as high-resolution cameras, LiDAR, and multispectral sensors are enhancing the capabilities of aerial photogrammetry software. These technologies allow for the capture of detailed and accurate data, which is crucial for various applications, including environmental monitoring and infrastructure development. The integration of these advanced imaging techniques is expected to propel the market forward, as organizations seek to leverage improved data quality for better analysis and decision-making. Furthermore, the increasing availability of affordable drone technology is likely to expand the user base for aerial photogrammetry software, thereby driving market growth.