E-commerce Growth

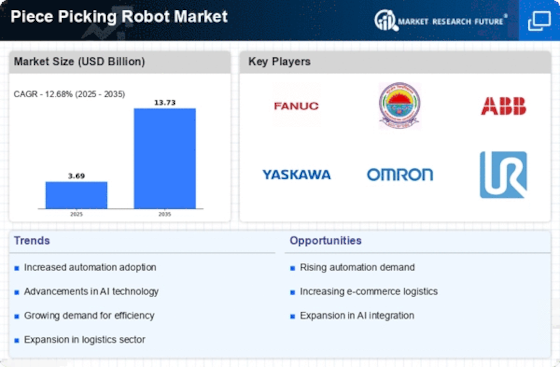

The Piece Picking Robot Market is significantly influenced by the rapid growth of e-commerce. As online shopping becomes increasingly prevalent, the demand for efficient order fulfillment solutions has surged. E-commerce companies are investing heavily in automation technologies, including piece picking robots, to streamline their operations and meet consumer expectations for fast delivery. In 2025, e-commerce sales are projected to reach over 6 trillion dollars, further driving the need for advanced robotic systems in warehouses. This growth necessitates the implementation of automated solutions that can handle high volumes of orders with precision and speed. Thus, the piece picking robot market is poised for substantial expansion as businesses adapt to the evolving landscape of retail.

Rising Labor Costs

The Piece Picking Robot Market is experiencing a notable surge due to the rising labor costs across various sectors. As wages increase, companies are compelled to seek automation solutions to maintain profitability. The integration of piece picking robots allows businesses to reduce dependency on manual labor, thereby mitigating the impact of escalating labor expenses. In recent years, labor costs have risen by approximately 3-5% annually in many regions, prompting organizations to invest in robotic solutions. This trend is particularly evident in warehousing and logistics, where operational efficiency is paramount. Consequently, the demand for piece picking robots is likely to continue its upward trajectory as companies strive to optimize their workforce and enhance productivity.

Increased Focus on Safety

The Piece Picking Robot Market is also influenced by an increased focus on workplace safety. As companies strive to create safer working environments, the integration of piece picking robots can significantly reduce the risk of workplace injuries associated with manual handling. Robots can perform repetitive and physically demanding tasks, thereby minimizing the strain on human workers. This shift not only enhances employee safety but also contributes to higher productivity levels. In 2025, organizations that implement robotic solutions are likely to report a decrease in workplace accidents by as much as 30%. Consequently, the emphasis on safety is expected to drive the adoption of piece picking robots across various industries.

Supply Chain Optimization

The Piece Picking Robot Market is driven by the need for supply chain optimization. Companies are increasingly recognizing the importance of efficient logistics and inventory management in maintaining competitiveness. Piece picking robots offer a solution to streamline operations, reduce lead times, and enhance order accuracy. By automating the picking process, businesses can achieve significant improvements in their supply chain efficiency. In 2025, it is estimated that companies utilizing robotic solutions in their supply chains could see a reduction in operational costs by up to 20%. This potential for cost savings, coupled with the ability to respond swiftly to market demands, positions piece picking robots as a vital component in modern supply chain strategies.

Technological Innovations

Technological innovations play a crucial role in shaping the Piece Picking Robot Market. Advancements in artificial intelligence, machine learning, and computer vision have enhanced the capabilities of piece picking robots, making them more efficient and versatile. These innovations enable robots to identify, pick, and place items with greater accuracy, thereby reducing errors and improving overall productivity. The market is witnessing the introduction of collaborative robots that can work alongside human workers, further enhancing operational efficiency. As technology continues to evolve, the piece picking robot market is expected to benefit from increased adoption rates, as companies seek to leverage these advancements to optimize their supply chain processes.